Canalys recognizes 2021’s APAC channel leaders

7 December 2021

Canalys’ view of Honor’s highly anticipated product launch event.

Honor hosted its first high-profile product launch event for its latest flagship Honor 50 and 50 Pro in Shanghai, seven months after it divested from a sanction-worn Huawei. In that time, Honor, which is seen as Huawei's successor, was scrambling to plan new products, and set-up organizations while trying to secure its critical component supplies and channel partnerships in China and overseas. This launch event was one of the most anticipated and was watched by industry analysts, component suppliers, channel partners, and its competitors. Expectations of Honor and its new products are high as we hope to see if it can rise from the ashes to recapture Huawei's lost market share. Unexpectedly, the event was rather similar to other domestic launch events and while the 50 series is nicely set-up and feature packed, the hardware and software innovations are underwhelming. The series will certainly not be enough to make a big splash in such a competitive mainland market.

Honor is playing it safe with this domestic launch, bringing two above-average smartphones with affordable price tags. There are no new shiny in-house developed technical features and Honor didn't even mentioned the adoption of the much-hyped Harmony OS developed by Huawei. The first debut of the new Qualcomm Snapdragon 778G 5G processor used in the Honor 50 and 50 pro were not lauded and cheered either. It was unveiled in their press release post-conference. https://www.hihonor.com/global/news/honor-50-series/. This conservative approach is somewhat explainable. Honor might want to monitor domestic consumer response and demand before feeling comfortable announcing the collaboration with US partners, given the patriotism trends in China.

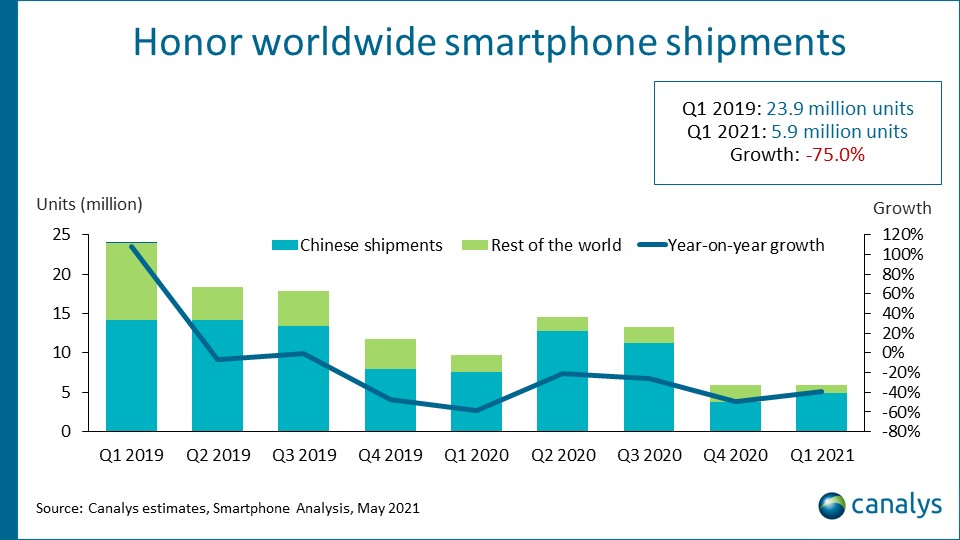

Honor's strategy is to build a strong domestic foundation before aggressive international expansion, to focusing on Huawei's existing user base. However, its competitors have not stopped growing. Over the seven months, Oppo, Xiaomi and Vivo in China, and Samsung in international markets have competed fiercely to capture Huawei's market share. For Honor to show it has the capabilities to fill Huawei's big shoes, it needs to boldly showcase its partnerships and results in R&D for future global launches to win the mindshare of early adopters and industry stakeholders. Despite Honor being in the early stages, the market landscape has already shifted dramatically, and this leaves very little space for smaller scale players.