Apple’s WWDC 2021: Focus and Control

8 June 2021

A look at the most popular smartphones in Spain and their features.

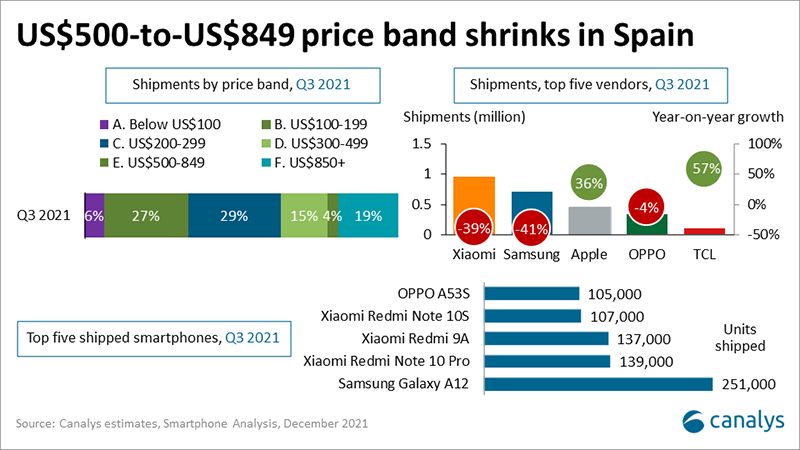

In a previous blog post we discussed opportunities in the Spanish market, the decline of shipments by the two market leaders (Samsung and Xiaomi), the channel mix evolution and changes in the telco industry. In this follow-up, we’re going to find out what sort of devices Spanish consumers are after. We will look at the most popular price ranges, the top five best-selling smartphones and their common features.

Spain is mainly mid-range, but also high-end

Approximately 70% of smartphones shipped in Spain were priced between US$100 and US$499, which can be considered a combination of entry level/mid-range and pure mid-range. The US$500-to-US$849 price band has been shrinking as Spain either favors models priced under US$500 or those priced over US$850. It is becoming a more polarized market. Apple accounted for 69% of phones in the US$850-plus price bracket in Q3 2021, but there is still room for Android smartphone vendors. In fact, OPPO grew its shipments by 286% year on year in Q3 2021 in that price bracket, as Apple cannot currently cope with demand for its new series, especially for the Pro and Pro Max models, and will only be able to do so toward the end of Q1 2021.

When looking at the top five smartphones shipped in Q3 2021, two of them (Samsung’s Galaxy A12 and Xiaomi’s Redmi 9A) can be considered entry level and the other three mid-range, but the Galaxy A12’s features are more comparable with other mid-range devices from Xiaomi and OPPO. Let’s take a closer look.

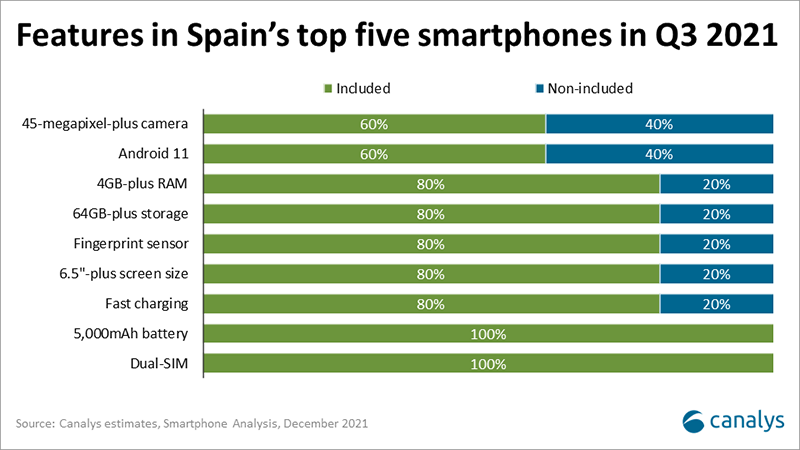

When looking at the most common features of the top five smartphones shipped in Spain in Q3 2021, we notice some key points.

The above-mentioned variables are just some of the 60-plus that are monitored by Canalys on an ongoing basis that help our clients to benchmark against competitors and identity trends in specific markets.