When indicators stop working

12 July 2021

The South Asian region is one of few that maintained strong smartphone shipments during the pandemic. International brands have started investing in South Asia like never before.

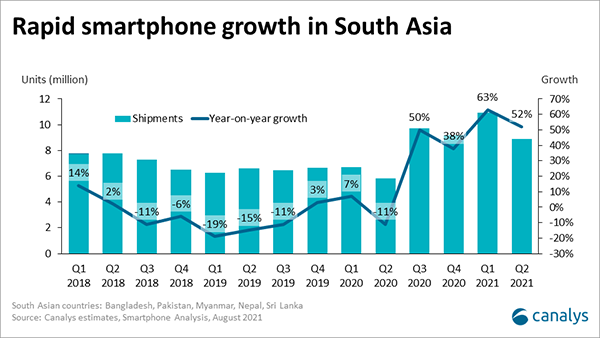

South Asia has seen strong growth in the smartphone market for several quarters. Until mid-2020, the market was growing at a stable rate, in the range of 6 million to 7 million units per quarter, but since Q3 2020, this has increased to 9 million to 10 million units. The South Asian region is one of few that maintained strong smartphone shipments during the pandemic. International brands have started investing in South Asia like never before. There are several reasons for this: large and growing populations, improving purchasing power, and government FDI incentives. But why now? What are the growth drivers behind the South Asia market? And will it be profitable for vendors?

Smartphone markets are growing in South Asia, driven by Bangladesh and Pakistan – the largest markets in the region. This has been due to radical import policy changes and incentives for local manufacturing. While the pandemic has strengthened demand for smartphones for entertainment and education, the governments in South Asia see local production as one of the most effective ways to increase local employment, following in the footsteps of India. Local governments have also started tracking illegal phones to quash the grey market and increase demand for official channels.

These reforms attracted many international investors to manufacture locally. Seeing Transsion’s market growth results improve due to local production, other global manufacturers followed suit. In addition to Samsung and BBK, Xiaomi TCL and Huawei have put forward production plans. In May, Nokia received approval to set up a factory in Bangladesh and manufacture over 85% of its smartphones locally. Vivo also announced it would invest US$10 million in its base in Pakistan with its first mobile production plant set up in August, capable of producing 6 million smartphones. Samsung partnered with Lucky Motor Corporation (LMC) to assemble smartphones in Pakistan to avoid high import duties on its devices.

Vendors are attracted by the numerous benefits of investing in South Asian countries, especially Bangladesh and Pakistan.

Despite strong growth in South Asia, many vendors are unwilling to put local production on their priority lists until tax reforms come into force. The reasons behind this are underdeveloped logistics infrastructure, an incomplete component supply chain, a lack of skilled labor and lower spending power. Vendors also need to invest in their go-to-market channels while ecommerce developments have been slow in the region. Major vendors, such as Samsung, Vivo and Oppo, have started to put resources into their own ecommerce stores or other forms of omnichannel services.

Some markets have also been underperforming due to social and economic factors. Myanmar faces social unrest and vendors face many operational challenges despite the demand still being there. Sri Lanka’s smartphone market is resilient, but currency volatility has adversely affected short-term investment.

Overall, the region still has much room to grow in the next few years, given that 4G penetration is still relatively low. According to Canalys, 4G will still dominate smartphone shipments over the next five years, gradually replacing 3G products due to markets’ organic growth. The leading vendors are likely to increase the level of their local production to include accessories and components. Governments will continue their local manufacturing drive by promoting more tax incentives for device exports. As smartphone penetration increases in these markets, investments from Internet service companies will follow, which will drive demand for smartphones further.