China PC market share Q2 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Friday, 6 August 2021

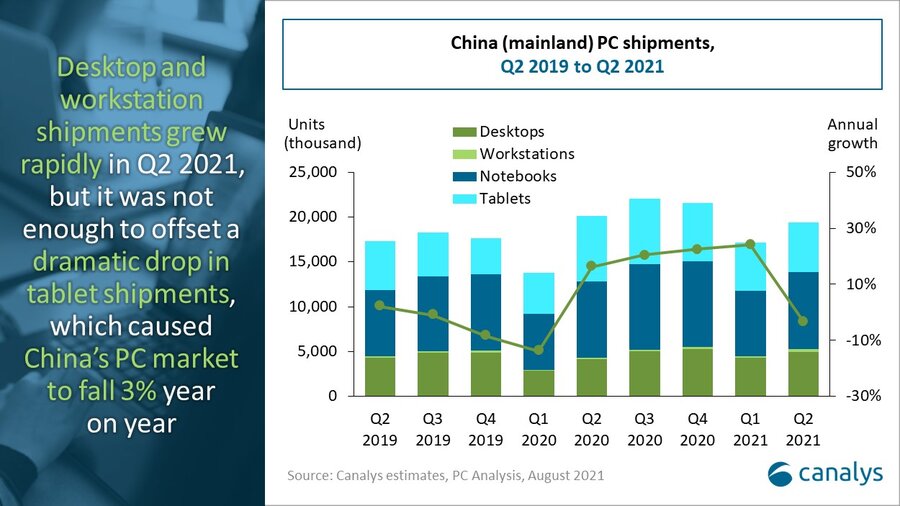

China’s tablet market falls 24% in Q2 2021 as desktop and notebook demand stays strong

Total PC shipments in China fell by 3% year on year in Q2 2021 but increased 13% sequentially, to reach 19.4 million units. Desktop, notebook and tablet shipments all grew against a weak Q1. Compared with last year, desktop and mobile workstation shipments were up 77%, at 270,000 units. Standard desktop shipments recovered to hit 5.0 million units. Notebook shipments were flat, up only 1.4% at 8.6 million units. Tablet shipments, however, plummeted, down 24% year on year in Q2 2021.

“An explosion in commercial demand has triggered a new wave of growth,” said China-based Canalys analyst Emma Xu. “The online ‘618’ promotion festival, hosted by most of the important online retailers, such as JD, Tmall and Suning, boosted purchases by small businesses and consumers alike, especially for desktops and notebooks. China remains one of the few markets where desktop demand remains high, and the category continues to see positive year-on-year growth.”

The PC leaderboard in China saw some changes due to Huawei’s problems and its decision to spin-off Honor. Lenovo solidified its leadership position further with 31% year-on-year growth, to take 40% of the market with shipments of 5.6 million units. Dell enjoyed 32% year-on-year growth, benefiting from strong growth of both desktops and workstations. HP and Asus both moved up a place due to Huawei’s fall, coming third and fourth, though HP’s shipments fell 3% to 1.1 million, while Asus grew 25% year on year with 0.9 million units shipped. Huawei found itself in fifth place after a 64% year-on-year drop in shipments. “Honor’s spin-off has contributed to Huawei’s decline, but its lack of new notebooks is the main cause, and this will create more competition among the other vendors,” said Canalys Research Director Rushabh Doshi.

|

China (mainland) PC shipments (desktops, workstations and notebooks) and annual growth |

|||||

|

Vendor |

Q2 2021 shipments (million) |

Q2 2021 Market share |

Q2 2020 shipments (million) |

Q2 2020 Market share |

Annual |

|

Lenovo |

5.6 |

40% |

4.3 |

33% |

31% |

|

Dell |

1.9 |

14% |

1.4 |

11% |

32% |

|

HP |

1.1 |

8% |

1.1 |

9% |

-3% |

|

Asus |

0.9 |

7% |

0.7 |

6% |

25% |

|

Huawei |

0.5 |

3% |

1.3 |

10% |

-64% |

|

Others |

3.9 |

28% |

3.9 |

31% |

-2% |

|

Total |

13.9 |

100% |

12.8 |

100% |

8% |

|

Note: percentages may not add up to 100% due to rounding |

|||||

In the tablet market, leading vendor Apple saw its share fall from 45% last year to 31% in this quarter, partly due to a strong Q2 2020 rebound post-pandemic lockdown in China, but also due to the resurgence of new vendors, such as Samsung and Lenovo, which have capitalized on renewed demand for tablets in the consumer space. Samsung and Lenovo both enjoyed strong annual growth, of 78% and 299% respectively, to take third and fourth place in Q2 2021. Disrupted by multiple sanctions and the Honor spin-off, Huawei’s shipments fell by more than 60% to just over 1.0 million. Honor came in fifth, shipping 0.6 million units, benefiting greatly from its expansion in offline distribution this year after its spin-off.

“The hybrid classroom and workplace are a global factor behind tablet growth. Vendors see the desire for one device per person as a huge opportunity, and smart classes and the healthcare digitalization as key drivers for expanding their portfolios,” said Xu.

|

China (mainland) tablets shipments and annual growth |

|||||

|

Vendor |

Q2 2021 shipments (thousand) |

Q2 2021 Market share |

Q2 2020 shipments (thousand) |

Q2 2020 Market share |

Annual |

|

Apple |

1,724 |

31% |

3,310 |

45% |

-48% |

|

Huawei |

1,034 |

19% |

2,649 |

36% |

-61% |

|

Samsung |

781 |

14% |

439 |

6% |

78% |

|

Lenovo |

695 |

12% |

174 |

2% |

299% |

|

Honor |

600 |

11% |

- |

0% |

N/A |

|

Others |

740 |

13% |

739 |

10% |

-13% |

|

Total |

5,573 |

100% |

7,311 |

100% |

-24% |

|

Note: percentages may not add up to 100% due to rounding |

|||||

“China’s K12 education market, a core market for tablets, has been hit hard by new policies that forbid out-of-school education, designed to equalize education despite economic disparities in society and minimize parents’ economic burden. But this move will bring potential opportunities of upgrading the digital infrastructure and the embedded functionality of devices such as tablets once the education systems get more streamlined,” said Xu.

“Looking ahead, component shortages will remain a key growth inhibitor for the rest of 2021, and price rises will further hinder tablet growth. But Canalys maintains a positive long-term outlook for tablets, thanks to their increasing application in both the consumer and commercial sectors.”

For more information, please contact:

Emma Xu (Canalys China): emma_xu@canalys.com +86 158 0075 6471

Rushabh Doshi (Canalys India): rushabh_doshi@canalys.com +91 74117 22711

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.