PC shipments in India hit five-year high of 4.1 million in Q2 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 8 September 2021

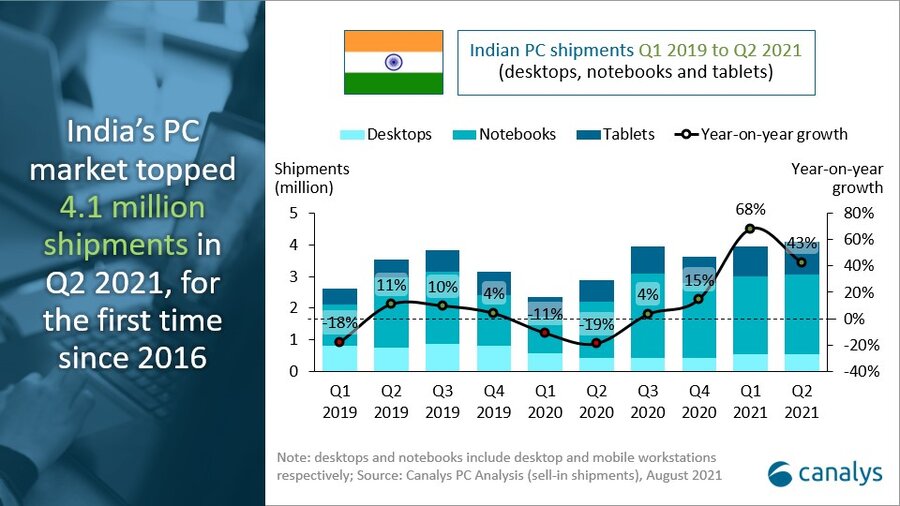

PC shipments in India grew by 43% year on year in Q2 2021 to reach 4.1 million units, comprising half a million desktops, 2.5 million notebooks and 1.0 million tablets. Almost all categories grew by double-digit percentages year on year, mainly due to a lackluster performance in Q2 2020, when the entire country was under lockdown, braving the first wave of COVID-19. Shipments of notebooks, the largest category by volume, grew 43% over Q2 2020. Tablets also had one of their best quarters since 2016, with 52% year-on-year shipment growth. Desktop shipments were up by 23%.

|

Indian total PC (including tablets) shipments (market share and annual growth) |

|||||

|

Product category |

Q2 2021 |

Q2 2021 |

Q2 2020 |

Q2 2020 |

Annual |

|

Desktop |

515 |

12.6% |

419 |

14.6% |

23.0% |

|

Notebook |

2,495 |

60.9% |

1,742 |

60.7% |

43.2% |

|

Tablet |

1,033 |

25.2% |

679 |

23.7% |

52.0% |

|

Workstation |

54 |

1.3% |

31 |

1.1% |

75.2% |

|

Total |

4,097 |

100.0% |

2,871 |

100.0% |

42.7% |

|

Note: shipments in thousands. Percentages may not add up to 100% due to rounding. |

|||||

Vendor performances

|

Indian total PC shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q2 2021 |

Q2 2021 |

Q2 2020 |

Q2 2020 |

Annual |

|

HP |

1,066 |

26.0% |

692 |

24.1% |

54% |

|

Lenovo |

840 |

20.5% |

819 |

28.5% |

3% |

|

Dell |

525 |

12.8% |

376 |

13.1% |

40% |

|

Samsung |

403 |

9.8% |

172 |

6.0% |

134% |

|

Acer |

326 |

8.0% |

168 |

5.8% |

95% |

|

Others |

935 |

22.8% |

646 |

22.5% |

45% |

|

Total |

4,097 |

100.0% |

2,871 |

100.0% |

43% |

|

Note: Shipments in thousands. Percentages may not add up to 100% due to rounding. |

|||||

“The market has finally returned to pre-COVID shipment levels,” said Canalys Research Analyst Ashweej Aithal. “While desktops and notebooks haven’t really seen a major bump in shipments, tablets are in much higher demand than before, resurrecting what was a dying category in India. Due credit for that should be given to remote learning, as well as the accelerated digital transformation of multiple industries and processes. As we look ahead to the second half of the year, Canalys is positive about the Indian PC market, as a major government and educational tenders, which were put on hold due to the COVID-19 Delta variant wave, are now re-tendered.”

“Compared to western markets, long-term demand in India remains low,” added Aithal. “While COVID-19 has helped move the needle slightly when it comes to PC penetration, it has been unable to generate a lot of demand, as vast portions of the population still regard PCs as a luxury, not a must-have. Added to that, India also has some of the poorest broadband penetration rates in the world. While the long-term outlook for PCs in India is still positive, it is not going to outshine the US or Western Europe.”

For more information, please contact:

Ashweej Aithal (India): ashweej_aithal@canalys.com +91 97386 19281

Rushabh Doshi (India): rushabh_doshi@canalys.com +91 99728 54174

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.