Indian PC shipments grow 34% to a record 5.3 million in Q3 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Wednesday, 15 December 2021

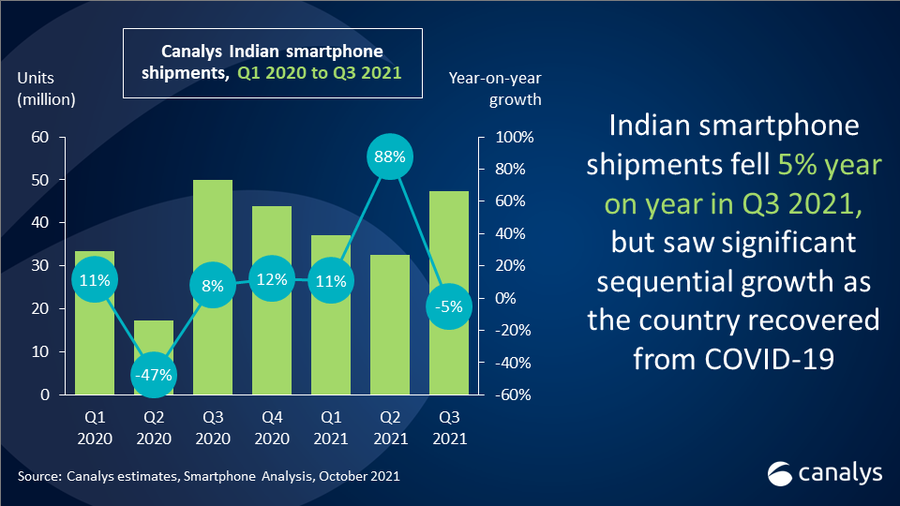

PC shipments in India grew by a solid 34% year on year in Q3 2021 to a record 5.3 million units. These comprised 0.6 million desktops, 3.5 million notebooks and 1.2 million tablets, with all categories growing strongly. Notebook shipments were up by a record 31% year on year, tablets by a massive 41% and desktops by 29%. Growth was aided by overall optimism and accelerated economic recovery in India, especially among SMBs and larger enterprises.

“Despite supply chain challenges, India’s PC market reported its highest shipments ever,” said Canalys Research Analyst Ashweej Aithal. “Vendors have finally prioritized markets outside of North America and Western Europe, focusing more on Asia and Latin America, leading to higher shipments than normal. While the seasonal rise in consumer demand has boosted shipments in consumer channels, a ramp up in enterprise and SMB procurement has ensured strong growth in all segments.”

|

India total PC shipments (market share and annual growth) Canalys PC market pulse: Q3 2021 |

|||||

|

Vendor |

Q3 2021 shipments |

Q3 2021 |

Q3 2020 |

Q3 2020 |

Annual |

|

Lenovo |

1,429 |

27.0% |

1,092 |

27.6% |

+30.9% |

|

HP |

1,268 |

24.0% |

965 |

24.4% |

+31.4% |

|

Dell |

726 |

13.7% |

505 |

12.7% |

+43.6% |

|

Acer |

398 |

7.5% |

203 |

5.1% |

+95.8% |

|

Asus |

376 |

7.1% |

267 |

6.7% |

+40.9% |

|

Others |

1,094 |

20.7% |

930 |

23.5% |

+17.7% |

|

Total |

5,292 |

100.0% |

3,962 |

100.0% |

+33.6% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2021 |

|||||

The pandemic has brought about longer-term changes in the market, especially in education. “Uncertainty about the pandemic is forcing educational establishments to sustain their hybrid learning models and remain agile in the event of a future lockdown,” said Aithal. “Tablet and notebook demand is expected to remain high, as government and education tenders remain solid. At an individual level, however, demand will remain unsatiated. To ensure that every child whose education has been disrupted due to the pandemic gains access to a computer is an ambitious goal but one that must be fulfilled. If not, we risk the future of our workforce.”

|

India desktop, notebook and workstation shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2021 |

|||||

|

Vendor |

Q3 2021 shipments |

Q3 2021 |

Q3 2020 |

Q3 2020 |

Annual |

|

HP |

1,268 |

31.2% |

965 |

31.3% |

+31.4% |

|

Lenovo |

830 |

20.4% |

744 |

24.1% |

+11.5% |

|

Dell |

726 |

17.9% |

505 |

16.4% |

+43.6% |

|

Asus |

376 |

9.2% |

264 |

8.6% |

+42.1% |

|

Acer |

371 |

9.1% |

185 |

6.0% |

+100.0% |

|

Others |

491 |

12.1% |

423 |

13.7% |

+15.9% |

|

Total |

4,061 |

100.0% |

3,088 |

100.0% |

+31.5% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2021 |

|||||

Vendor performances

|

India tablet shipments (market share and annual growth) Canalys PC market pulse: Q3 2021 |

|||||

|

Vendor |

Q3 2021 shipments |

Q3 2021 |

Q3 2020 |

Q3 2020 |

Annual |

|

Lenovo |

599 |

48.7% |

347 |

39.7% |

+72.6% |

|

Samsung |

292 |

23.7% |

193 |

22.1% |

+51.2% |

|

Apple |

153 |

12.4% |

81 |

9.3% |

+88.6% |

|

Acer |

27 |

2.2% |

18 |

2.0% |

+51.9% |

|

Huawei |

10 |

0.8% |

36 |

4.1% |

-72.7% |

|

Others |

150 |

12.2% |

199 |

22.8% |

-25.0% |

|

Total |

1,231 |

100.0% |

874 |

100.0% |

+40.8% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), November 2021 |

|||||

For more information, please contact:

Ashweej Aithal (India): ashweej_aithal@canalys.com +91 97386 19281

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.