Western Europe’s PC market Q1 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Tuesday, 1 June 2021

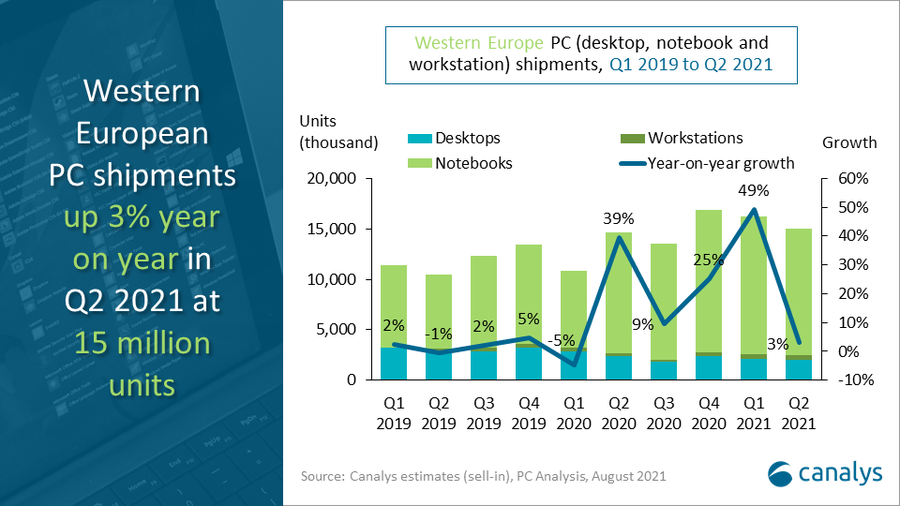

In Q1 2021, Western European PC shipments (desktops, notebooks and workstations) reached 16.1 million units, up 48% year on year. The COVID-19 demand momentum from 2020 has continued into 2021. Ongoing bottlenecks around key components are delaying some orders, but the supply chain is actually in much better shape than in Q1 2020, which saw sudden factory closures amid the first COVID-19 outbreaks. HP regained the top spot, shipping 4.1 million units and taking a 26% share of the market. Lenovo followed closely, shipping 4.0 million units to take a 25% share. Dell, Apple and Acer completed the top five, with 14%, 10% and 9% shares respectively.

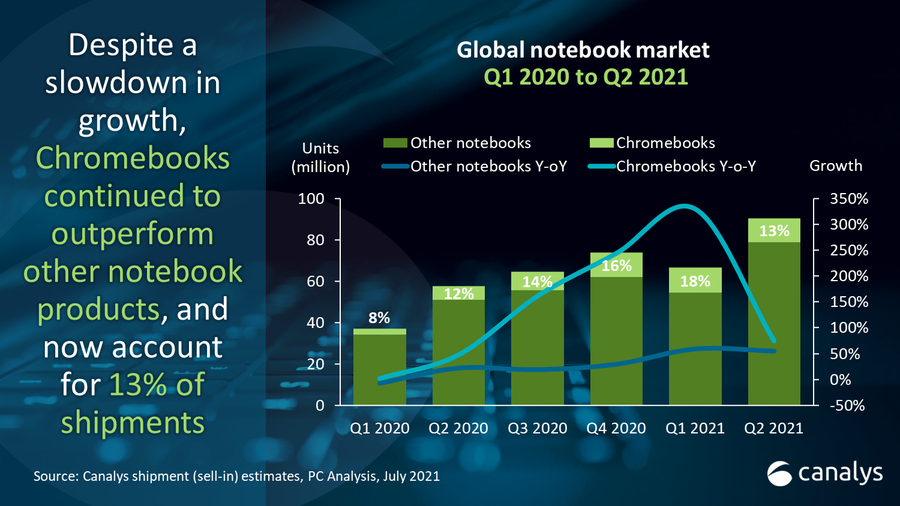

HP and Lenovo have long been the top-selling vendors, but this year the component shortage is a key factor suppressing shipments. “While demand remains sky high, the question is can supply cope? Right now, the vendors that can fulfil orders the quickest will win,” said Canalys Research Analyst Trang Pham. “In Q1, several PC distributors and resellers reported strong supply of HP devices, especially for AMD models. And in cases where shipment delays were inevitable, HP managed its channel well, being transparent about shipment timings and giving assurances to customers, which discouraged them from seeking alternatives. Lenovo also had an exceptional quarter, with particular success in Chromebook sales as Google continues to spend big to push its platform with enterprise customers. Its new manufacturing facility in Hungary will also speed up order fulfilment in Europe.”

Apple saw the highest growth of the top five, up 127% year on year. Its new devices, powered by Apple’s own M1 chips, have been the driving force behind its commercial success. “Apple’s success makes sense, as Western Europe has a base of existing Mac users, high disposable income, and a strong community of tech enthusiasts and early adopters,” said Pham. “Apple’s recent move to design its own processors shows its ambition. It also reflects Intel’s lagging SoC process with 5nm and 3nm chips. By working with TSMC directly, Apple has been able to bring 5nm to Mac much sooner. But the move is about more than specifications. It shows absolute commitment to Apple’s ethos, that hardware, software and services work best when created together. That said, enterprise IT managers may look at M1-based Macs as a complex addition to their estate, and Apple must now ensure clear communication about the ease of device management and optimization of bespoke apps.”

The vaccine program in Western Europe did not significantly improve business and social activity in Q1 2021, due to limited supply, diplomatic incidents, and medical authority hesitancy over the AstraZeneca vaccine in some countries. In Q1, many countries, such as France, Germany and Italy, were hit with new waves of COVID cases, and were forced to re-impose strict measures.

“The picture is certainly improving, but we are not out of the woods yet,” said Canalys Research Manager Ben Stanton. “As vaccinations progress, restrictions have started to ease, which will pave the way for economic recovery. Schools, for example, were re-opened between March and May in different countries. And business activities are resuming, as employees return to their offices. But the world that emerges will not be the same as the one we left behind. Digital transformation has accelerated, apps and workloads are increasingly cloud-based, and employees will now expect remote and hybrid working options. It is extremely unlikely that PC supply will match this sustained demand surge over the next 12 months. If a vendor can supply, the product will fly.”

|

Western Europe PC (workstation, desktop, notebook) shipments and growth |

|||||

|

Vendor |

Q1 2021 shipments (thousand) |

Q1 2021 Market share |

Q1 2020 shipments (thousand) |

Q1 2020 Market share |

Annual |

|

HP |

4,106 |

26% |

3,113 |

29% |

+32% |

|

Lenovo |

4,029 |

25% |

3,117 |

29% |

+29% |

|

Dell |

2,322 |

14% |

1,773 |

16% |

+31% |

|

Apple |

1,552 |

10% |

684 |

6% |

+127% |

|

Acer |

1,466 |

9% |

727 |

7% |

+102% |

|

Others |

2,574 |

16% |

1,457 |

13% |

+77% |

|

Total |

16,050 |

100.0% |

10,871 |

100.0% |

+48% |

|

Note: percentages may not add up to 100% due to rounding Source: Canalys estimates (sell-in shipments), PC Analysis, May 2021 |

|||||

For more information, please contact:

Canalys China

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Emma Xu: emma_xu@canalys.com

Canalys India

Rushabh Doshi: rushabh_doshi@canalys.com +91 99728 54174

Sanyam Chaurasia: sanyam_chaurasia@canalys.com +91 89820 33054

Canalys Singapore

Ishan Dutt: ishan_dutt@canalys.com +65 8399 0487

Himani Mukka: himani_mukka@canalys.com +65 8223 4730

Canalys UK

Ben Stanton: ben_stanton@canalys.com +44 7824 114 350

Trang Pham: trang_pham@canalys.com +44 7881 934784

Canalys USA

Marcy Ryan: marcy_ryan@canalys.com +1 650 862 4299

Brian Lynch: brian_lynch@canalys.com +1 650 927 5489

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.