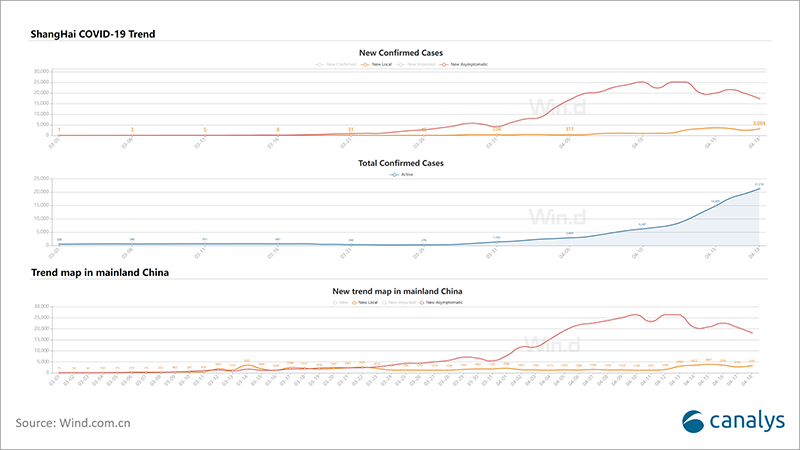

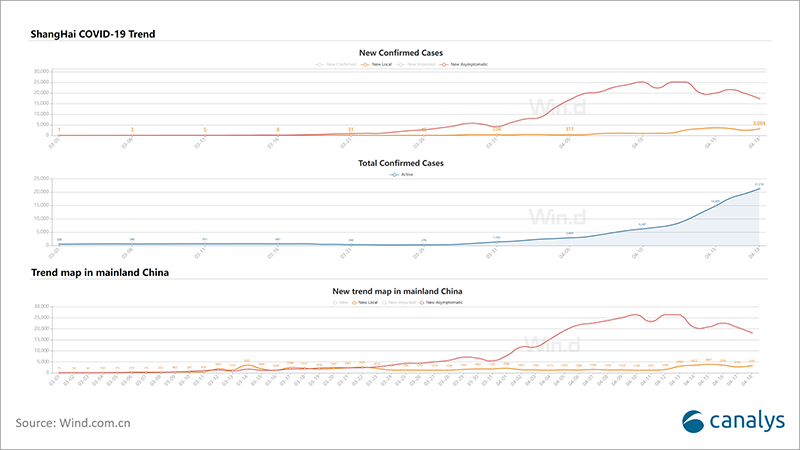

On 27 March 2022, Shanghai, the largest city in China by population and GDP, went into its first large-scale lockdown on the east side of the river. Three days later, the city’s entire 25 million population was barred from leaving their homes. Twenty-three days on, the daily new cases (including asymptomatic cases) continue to hover above the 20,000 mark, a critical level from the government’s point of view. The lifting of lockdown is not a possibility while daily mass testing continues. The Shanghai lockdown is just a glimpse into China’s current COVID policy and its multifaceted impacts. Since March, more than 10 provinces and 22 cities with more than 110 million residents went into “static management”. This new term means schools and shops are shut, all transport inside and between cities is suspended and all residents within the “control areas” are not allowed to leave home unless there is an “absolute emergency”.

As we have told clients since mid-February, China’s COVID policy is the biggest known risk to the global technology industry so far this year. The probability and severity are very high, and the scale and scope can be challenging to address and mitigate for any entity, public or private. China is still the primary manufacturing hub for many technology hardware companies. The complexity of accessing and quantifying the multi-layer supply chain risk is almost impossible, not to mention the inconsistent measures that different local governments are deploying. For global companies, it is vital to look for answers to the following questions rather than focusing on China’s COVID policy itself.

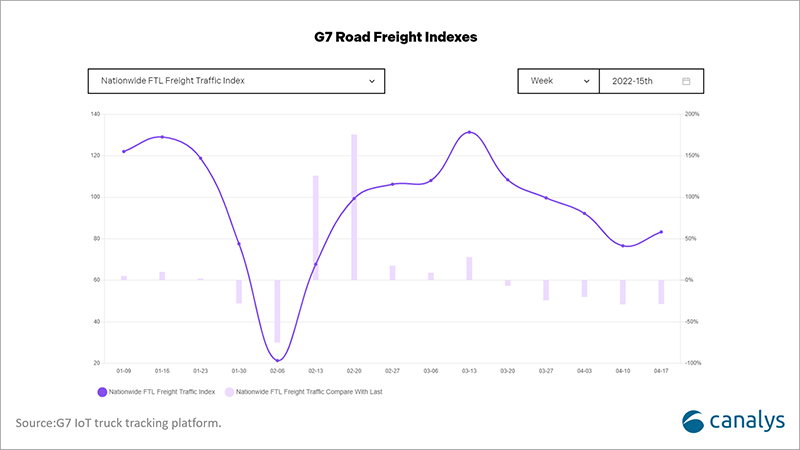

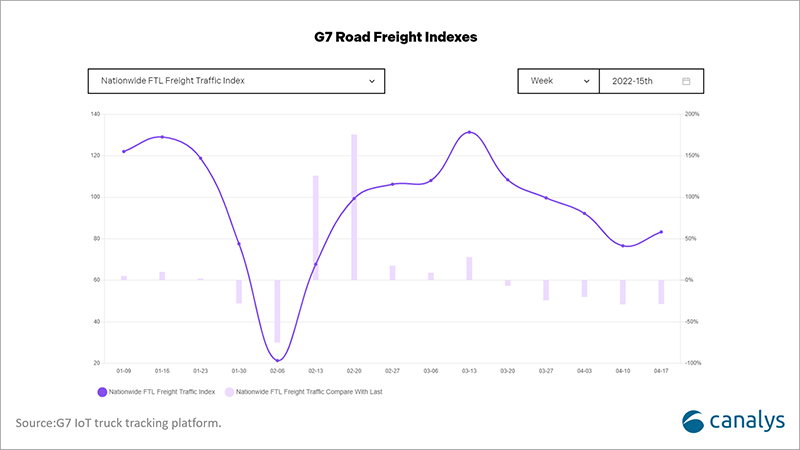

- What is the biggest bottleneck? Unlike in 2020, when the main challenge with resuming factory operations was the severe lack of workers along with health and safety concerns, the most significant headache this time round is the substantial logistics problem as the movement of goods (and drivers) is severely restricted. Each local government has implemented different measures to prevent spill-over from areas classified as medium or high risk. According to the Ministry of Transportation, as of 10 April, 678 highway toll stations remain closed to comply with pandemic control measures. In China’s most developed Yangtze River Delta economic district alone, 129 toll stations in Jiangsu and 64 in Zhejiang are closed, stopping trucks with supplies from entering or leaving. Local media are reporting trucks stranded at different points between suppliers and customers, mainly due to drivers not being able to comply with pandemic control requirements, such as getting special travel permits to be on the road. Even the Shanghai government and major online retailers such as JD.com are struggling to deliver food and other core necessities to affected families, underscoring the gravity of the situation. Supply constraints are detrimental to many technology component suppliers’ and manufacturers’ business continuity. Car manufacturers are the worst affected, while senior executives from Huawei, XPeng and Nio spoke publicly, raising the alarm about the suspension of assembly lines due to delays in delivery of raw materials and key components. Smartphone and PC ODMs, such as Compal and Pegatron, and key component suppliers in the pandemic areas are being forced to cut production or divert activities to other sites in China. But the entry of raw materials and exit of final products is still difficult, given that congestion is spreading from road to sea and air freight.

- How is it being addressed? The blockage is mainly caused by strict pandemic control measures across provincial governments, where the execution of these measures lacks consistency and collaboration. Drivers who work interprovincial routes are often forced to go through lengthy procedures, needing multiple permits and multiple PCR tests and, if unlucky, weeks of quarantine should their travel historys include any pandemic areas. The Shanghai outbreak has led to even lower tolerance of new cases and stricter measures in other provincial governments. To remedy the situation, the State Council has issued multiple directives to local governments to ease logistics and supply bottlenecks, aiming to cut red tape for interprovincial drivers. It has also introduced green lanes to expedite material supply for manufacturing companies on the whitelist in a few industries, including automotive, device ODMs and IC packaging. For example, Foxconn’s Zhengzhou site and Quanta in Shanghai have received special permits to ensure supply and production resumption.

- When will the Shanghai lockdown end? It is unlikely that central and local governments will make a drastic directional change to the COVID policy. Shanghai is likely to continue its large-scale lockdown until the effective reproductive rate of the pandemic (Rt ratio) drops below 1 (according to China’s CDC, the most recent figure is 1.23). The most recent COVID case projections from Nankai University expect this wave to last until the end of May. But the last few days prove this projection to be too optimistic. Outside of Shanghai, other local governments favor faster, stricter measures to prevent a similar event in Shanghai from happening again. China will likely have rolling lockdowns throughout 2022.

- What does this wave of lockdowns mean for technology vendors? The Shanghai lockdown has affected short-term consumer consumption in the area. Meanwhile, consumer confidence in future recovery is also severely affected given the poorly managed supply of food and other necessities. It has also created ripple effects on consumer confidence and spending in other parts of the country as negative news spreads on social media. While the impact of Shanghai’s lockdown on China’s economy, service sectors and SMBs remains to be seen from data, consumer technology sectors are less likely to benefit from this round of monetary easing.

Global technology vendors should prioritize two areas to mitigate the unknown risks. In addition to planning for a short-term sales slowdown in sectors such as automotive, PCs and mobile devices in mainland China, they must first strengthen relationships with local governments and actively engage with industry organizations. Developing a local emergency response team to gain information and react to external changes quickly will help vendors and their key suppliers get ahead. Secondly, vendors should continue to diversify the supply chain outside of China – a talking point during the first pandemic wave two years ago. With current unknown risks being difficult to predict despite the efforts of the government to prioritize manufacturing, supply chains and logistics, a diversification strategy that aligns with a long-term business vision remains the best way to ensure business continuity.