Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

Hyperscaler cloud marketplaces are accelerating as a critical route to market for software and SaaS

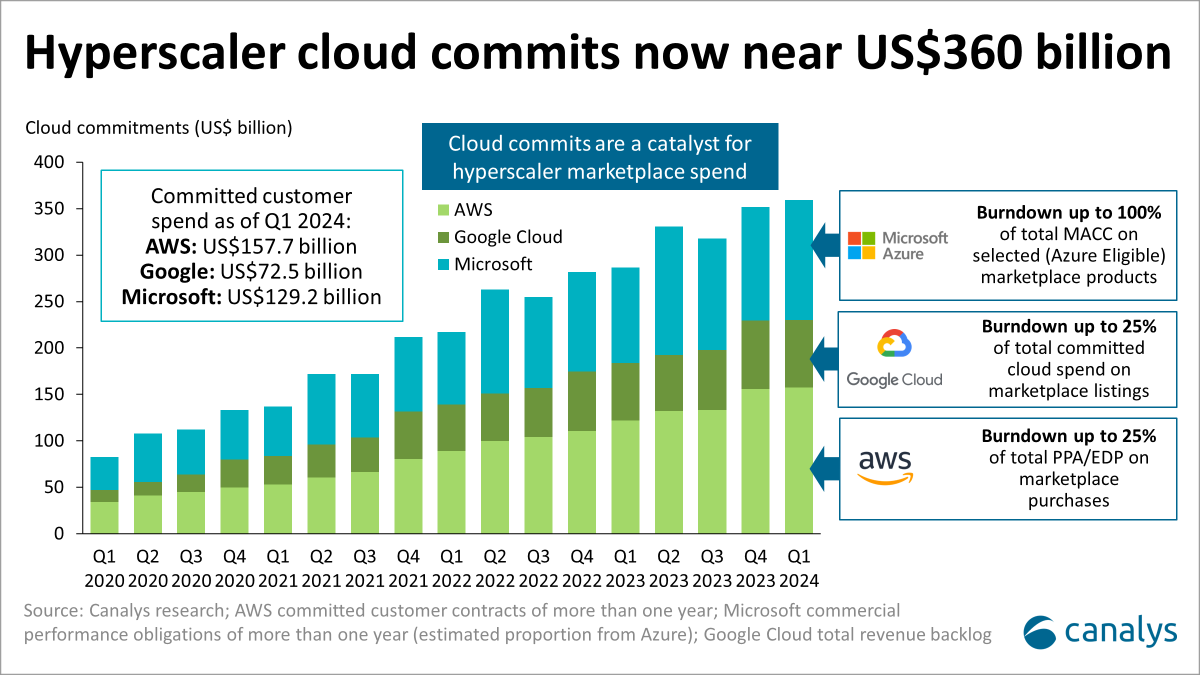

Enterprise software sales through hyperscaler cloud marketplaces are projected to reach $85 billion by 2028. Led by hyperscaler platforms AWS Marketplace, Microsoft Azure Marketplace, and Google Cloud Marketplace this surge is disrupting traditional sales channels for enterprise technology software and cybersecurity. Yet Canalys anticipates that more than 50% of sales are expected to flow through the channel by 2027. Early leaders like Crowdstrike, Palo Alto, Splunk, and Snowflake have already achieved significant milestones, with billion-dollar sales through AWS Marketplace. In the rapidly evolving landscape of cloud marketplaces, enterprise customers have committed over $360 billion to hyperscaler platforms.

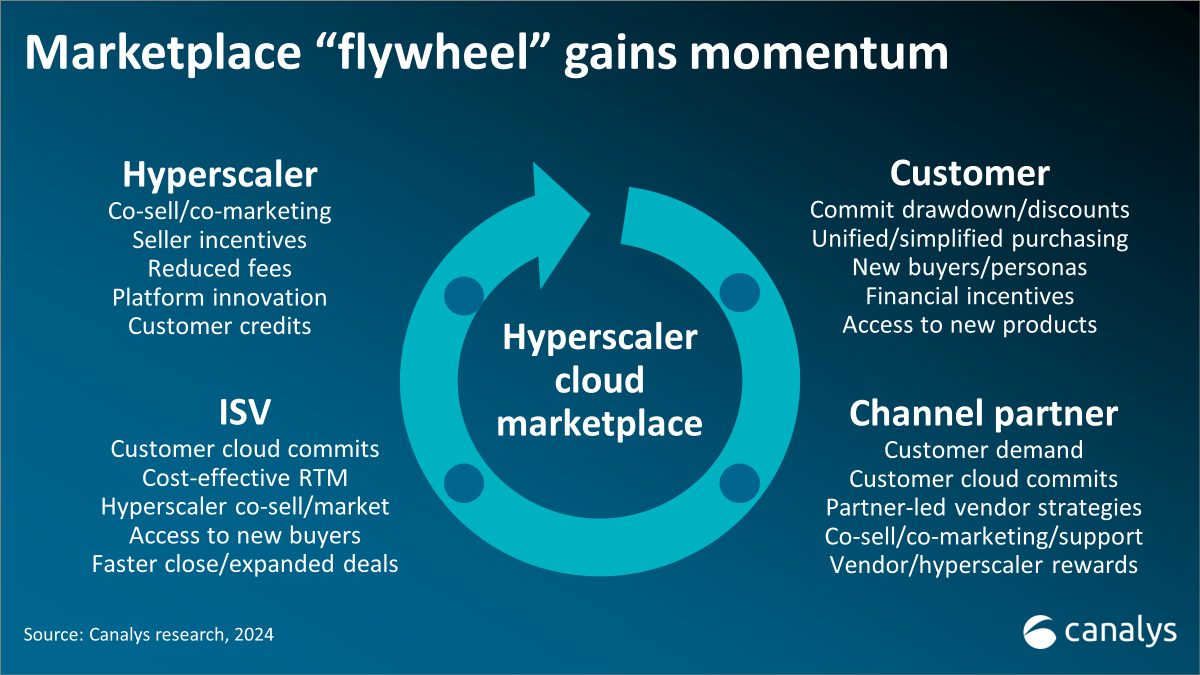

This substantial investment is drastically reshaping enterprise procurement, vendor go-to-market strategies, and channel models as enterprises strategically 'burn down' their pre-committed cloud credits. As the marketplace model matures, the role of channel partners is becoming increasingly critical, highlighted by the introduction of tailored partnership models such as AWS Channel Partner Private Offers, Microsoft Multiparty Private Offers, and Google Cloud Channel Private Offers. These developments underscore a shift towards more complex transactions being managed through indirect channels, promising to accelerate as more vendors adopt partner-first approaches. This latest report from Canalys delves into the transformative role of hyperscaler marketplaces in the global software distribution channel.

This report is crucial for software vendors, channel partners, enterprise IT decision-makers and the financial community. Understand how hyperscaler marketplaces are shaping the future of software sales, driving partner strategies, and influencing enterprise procurement. Gain insights into navigating this evolving landscape to maximize market opportunities and partner engagements.

Key findings

- Hyperscaler marketplaces are rapidly becoming a critical route to market for software and SaaS vendors across numerous technology categories.

- This is changing enterprise procurement behavior, as customers start to build marketplace purchasing strategically into their cloud spending commitments with the hyperscalers.

- Channel partners will become increasingly important to hyperscaler marketplace momentum, as vendors prioritize partner-led strategies, and customers turn to partners to help them manage marketplace procurement.

- More than 50% of hyperscaler marketplace sales will be via channel partners by 2027, as AWS, Microsoft and Google Cloud expand their respective channel partner private offer models.

- Distribution faces a threat from hyperscaler marketplaces, but distributors will define new roles by integrating their own digital platforms with those of the hyperscalers.

Companies mentioned: ALSO, Amazon Web Services (AWS), AppDirect, AppXite (Atea), Arrow, Bechtle, Carahsoft, CDW, Cisco, Citrix, CloudBlue (Ingram Micro subsidiary), Cloudmore, Cloud Software Group, Coca Cola, Computacenter, Crayon, CrowdStrike, Exclusive Networks, Google Cloud, IBM, Ingram Micro, Insight, Interworks, Microsoft, Mirakl, Nerdio, Nutanix, Palo Alto, Pax8, Presidio, Red Hat, SADA (part of Insight), Salesforce, ServiceNow, SHI, Snowflake, Softcat, Solgari, SoftwareONE, Splunk, Tackle, TD Synnex, Westcon, Wiz, Workday, WWT (World Wide Technology), Zoom

Your next steps

Access the report

Gain comprehensive insights into the future of global software channels by accessing the full "Now and Next: Hyperscaler Marketplaces are Redefining Global Software Channels" report. This detailed analysis will provide you with in-depth examinations, market projections, strategic recommendations, and much more.

Connect with Canalys analysts

Reach out to Canalys for personalized insights and to discuss the implications of the report findings for your business. Our experts are available to provide clients with tailored advice, answer your questions, and help you navigate the opportunities and challenges.

Stay updated

Ensure you stay informed about the latest trends and developments in cloud marketplaces and enterprise software by subscribing to Canalys updates. Receive notifications about new reports, industry insights, and exclusive events directly to your inbox

By following these steps, you can leverage the insights from the report to make informed decisions, drive innovation, and maintain a competitive edge in the rapidly changing landscape of software distribution.