Insights into the personal audio TWS segment

15 June 2023

The results of Canalys’ 2023 sustainability survey are in, revealing the channel’s current outlook on the circular economy, which continues to grow despite a set of persistent challenges.

With sustainability still high on partners’ agendas, much attention is rightfully given to the circular economy, the IT sector’s solution to its alarming e-waste output. In a recent worldwide Canalys survey, 545 partners shared their views on sustainability, providing insights into the state of the circular economy in 2023. While the gradual growth in this area is encouraging, partners still face a range of challenges in shifting towards circular models.

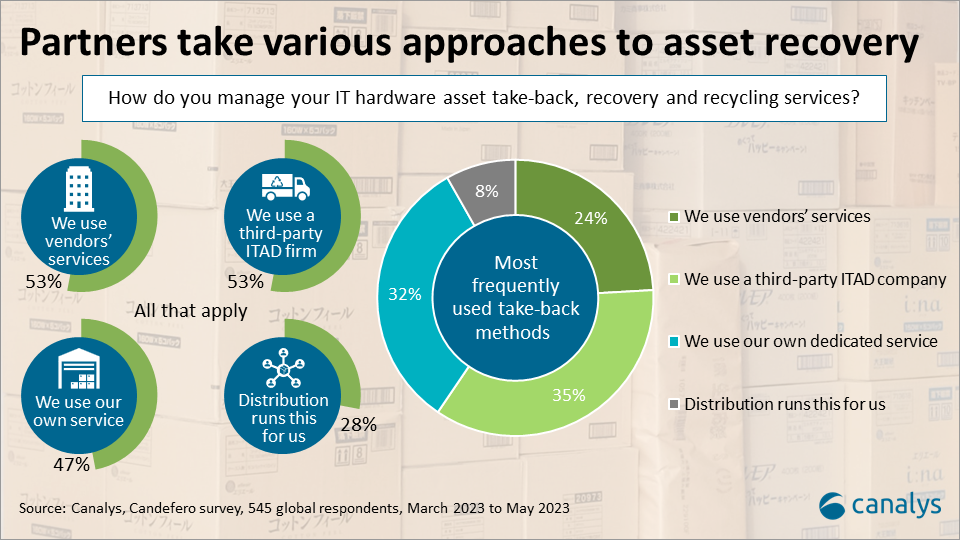

Vendors’ ITAD services are proving popular with the channel, as 53% of partners use them (albeit not exclusively). In recent years, the vendor community has invested in take-back offerings, with the likes of Dell and Cisco incentivizing their asset recovery schemes with rebates or discounts upon the return of discarded IT equipment.

However, vendors’ services are yet to dominate the ITAD scene. The survey found that 53% of partners use third-party ITAD companies to manage their circular services; this approach was also the most frequently used among respondents. Partners still value the role of external ITAD specialists – but these ITAD firms may begin to struggle to compete with some vendors’ take-back incentives and in-house processes.

By avoiding the involvement of external ITAD companies, many vendors are now overcoming perceptions of the take-back sector as a gray market entailing data security risks. Partners ranked data privacy concerns as the second-largest challenge restricting take-back services, behind poor customer awareness, so taking entire ITAD processes in-house will give vendors an advantage here.

This isn’t the only challenge facing ITAD specialists in 2023. Following years of pandemic-linked supply issues, business customers have had to delay hardware refreshes, and now amid inflationary pressures, many are sweating their assets for longer to minimize IT spending. Although this means longer first lives for IT equipment, this hardware is often in poor condition (and therefore of lower value) when ITAD partners collect it.

Moreover, our survey found that just 28% of respondents use distribution to handle ITAD processes, with just 8% listing distribution as the most used method. Given their position between vendors and resellers, distributors have opportunities to grow in this space.

Our survey revealed that just over half (51%) of partners offer take-back and recycling services, but 51% also stated they offer product repair services. Clearly, while the channel works to ensure discarded hardware gets a second chance, or at least gets recycled, prolonging its first life through repair services is also a priority.

This sentiment was echoed in what partners want from vendors on sustainability. One of partners’ top five requests from the vendor community was to ensure hardware can be repaired easily, which could boost the capabilities and efficiencies of partners’ repair services. Addressing this issue could massively support the industry’s efforts to reduce e-waste – but solving it requires manufacturers rethink products at the design stage.

For vendors, improving the repairability of kit – primarily client devices, such as notebooks and smartphones – would contribute to longer device lifespans and, in turn, less frequent hardware refreshes. From this perspective, enhancing repairability is a complicated prospect for vendors, but regulators are beginning to step in on behalf of the consumer with a wave of “right to repair” laws.

The French government acted early on this issue in January 2021, requiring OEMs to display repairability scores out of 10 for devices at the point of sale. Earlier this year, the EU followed with a proposal that will require manufacturers to offer repairs on consumer electronics for up to 10 years post-purchase (where possible). Individual US states are taking action on repairability too, with Minnesota and New York passing right-to-repair legislation as California pursues its own bill.

The channel’s progress towards circular models is reassuring, especially in EMEA, but partners’ progress is dependent on the sustainability efforts of vendors. Some of partners’ top expectations of vendors is for them to offer incentive programs for take-back services, enhance customer awareness of these services, and recognize sustainability-focused partners through specialization badging. Ultimately, progress here will depend on whether vendors are prepared to fully embrace circular models and step back from prioritizing new product sales.

If you are a channel partner keen to learn about the opportunities in sustainability, we encourage you to register for the Canalys Forums 2023. These events will give partners the chance to learn more about the latest trends in developing sustainable business models and address how they can swiftly adapt to meet the changing needs of customers alongside top distributors and channel-committed vendors. See you there.

EMEA: 3 – 5 October | NORTH AMERICA: 13 – 15 November | APAC: 5 – 7 December