The top 67 associations for MSPs, VARs and tech channel professionals

4 May 2023

This week, Slalom announced that it was the first “Microsoft Partner to have a Microsoft 365 Copilot offering available now in AppSource.” This one sentence beautifully captures three major trends that are manifesting throughout the technology partner ecosystem.

This week, Slalom announced that it was the first “Microsoft Partner to have a Microsoft 365 Copilot offering available now in AppSource.” This one sentence beautifully captures three major trends that are manifesting throughout the technology partner ecosystem.

We are now firmly in the age of artificial intelligence

You don’t need an industry analyst to tell you that ChatGPT has been a transformative technology. It is far from the first artificial intelligence offering available on the market, but it is the one that has truly democratized access for all. Small independent Shopify sellers and large multinational enterprises alike are all trying to establish how ChatGPT (and AI more broadly) can benefit their businesses. Other companies such as Chegg are grappling with AI’s disruptive nature as the online education provider noted that ChatGPT is starting to hurt its business and has seen its share price plummet nearly 50% as a result.

Microsoft moved quickly to embed ChatGPT into new product offerings, such as Microsoft 365 Copilot, and others have followed suit. New Relic this week claimed to have launched the “Industry’s first OpenAI GPT observability integration.” Even those companies that had pioneered their own AI solutions, such as Salesforce’s Einstein, have come to market with versions and offerings underpinned by ChatGPT integrations. AI, as a capability, will become table stakes for any technology company and products will end up competing on the quality, reliability and useability within the solution.

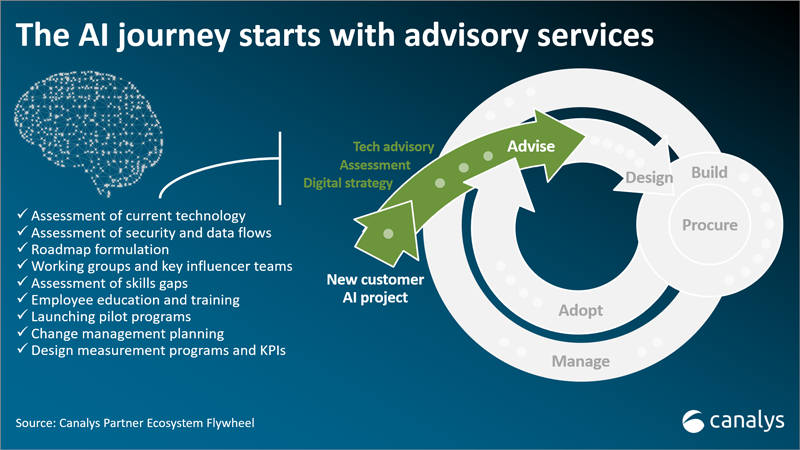

Partners building an AI practice need to start with education and advisory

Interestingly, Slalom’s “Copilot offering” comes before the actual Microsoft 365 Copilot solution is generally available. Currently, Copilot exists in a limited private preview mode. As mentioned, all businesses are in discovery mode to understand how to leverage AI, while providers of the technologies are still working through various kinks and continually improving the software.

But this hasn’t stopped Slalom from capitalizing on this great opportunity that sits in front of the technology ecosystem. An examination of the offering shows that Slalom is focused on helping customers prepare for deploying Copilot within their organizations. It has designed a consultative offering starting with an assessment of existing Microsoft 365 deployments, an assessment of organization setup and preparing individuals to adopt the technology, planning for a pilot deployment of Microsoft 365 Copilot, and finally rolling out the organization-wide deployment. The first assessment part of this approach (which it has cleverly marketed as “Pre-flight Inspection”) is designed to take between four and six weeks to complete.

Canalys defines these offerings as part of the “Advise” stage of the Partner Ecosystem Flywheel, and in these early days of AI exploration these services will be vital to help customers kick-start their journey. For Slalom, these types of offerings are a key part of its playbook. Slalom is a leading partner for the top hyperscalers and has been involved in deploying many complex cloud-based projects. It specializes in migrating customers to the cloud and building customer solutions that reside there. While in some capacity Copilot is more of a transactional sales play for Microsoft (being another subscription for partners to sell), given the potentially disruptive nature of these solutions, many businesses will be looking at how to fully take advantage of their investments, and consulting services such as those from Slalom and other integrators will prove valuable.

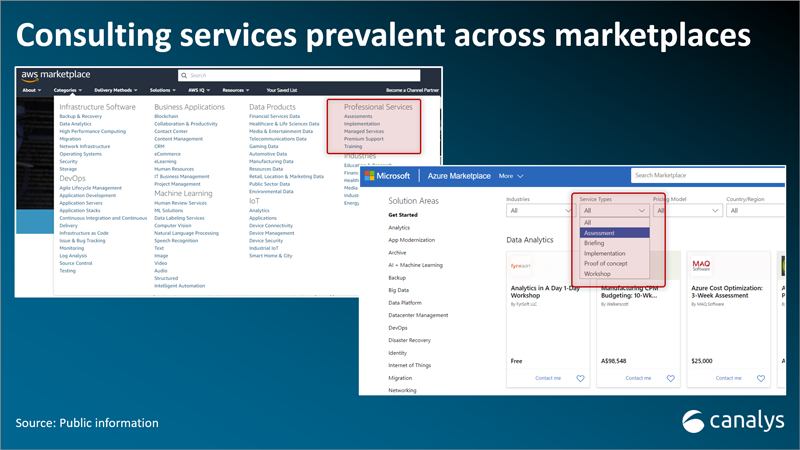

Marketplaces are growing hubs for software and services; AI will accelerate this

It is worth noting that the Slalom announcement highlighted that its offering is the first (and currently only) Copilot offering listed in the AppSource marketplace. Marketplaces have gained significant momentum in recent years due to the rapid acceleration of cloud use, and we expect this growth to continue by as much as 84% annually to 2025. We conventionally think of cloud marketplaces as hubs for software and SaaS deployments, but increasingly partners are offering their own professional services via these marketplaces too. Both of Microsoft’s main marketplaces (Azure and AppSource) have “Consulting Services” and standalone categories. The AWS Marketplace has 4,394 distinct offerings listed in its “Professional Services” category. While Slalom can claim the first Copilot service offering in AppSource, numerous AI-related service offerings already exist across the major marketplaces.

Marketplaces and AI will prove to be a strong intersection for several reasons:

Much still needs to be ironed out in the world of AI, but those vendors that can establish the right technology alliances, SaaS distribution models and the supporting partner services ecosystems will be best positioned to win in this era.

Note: This article was not written by ChatGPT, but after reading it, you might start to wonder if the author should have considered using the AI language model. With ChatGPT’s natural language processing capabilities, who knows, maybe it could have even added a few more jokes to this article!

Note 2: The first note was written by ChatGPT.