Wasabi Technologies: new expansion targets APAC growth

1 July 2022

As the number of competitors in the IoT space continues to grow, the role channels play in consumer decision-making has become increasingly important. With the IoT market still expanding, this has meant retailers and brands compete for consumer attention, and retailers currently have greater momentum.

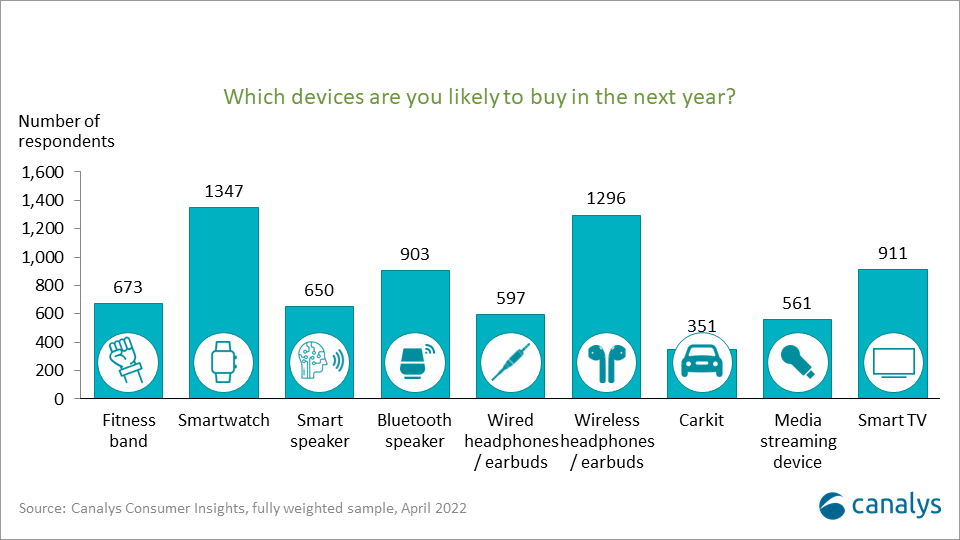

The IoT market’s popularity with consumers and vendors is growing. Vendors are increasingly looking to integrate multiple products into their ecosystems to create user stickiness and loyalty. On the customer side, Canalys consumer research shows an increasing interest in buying companion devices. Canalys recently conducted a survey across Western Europe, with 1000 participants from each country, looking at which IoT devices they were likely to buy next. Our survey showed some of the most popular products were smartwatches, wireless headphones/earbuds, and Bluetooth speakers.

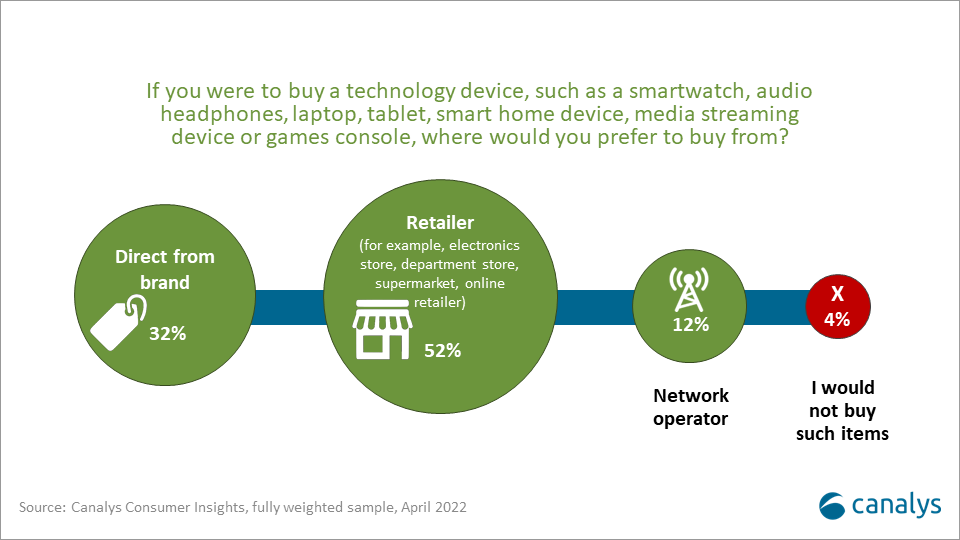

The IoT space is incredibly competitive and sees constant innovation as a result. The consequence of this is a variety of products consumers can choose from. Even looking at wireless headphones/earbuds, the number of options has increased drastically as specialist brands such as Sennheiser and Jabra now compete with the likes of Apple and Samsung. This is why retailers are currently consumers’ preferred point of sale for IoT products. They are able to leverage the flexibility of choice retailers provide in selecting the product that best suits their needs.

With the rise in direct-to-consumer sales, brands have been able to reach their customer base without third-party intermediaries. While retail channels continue to be important for brands looking to build awareness, established brands can operate their own offline and online channels effectively. Loyalty is also becoming more “brand” focused rather than merchant. Within the IoT space, many are likely to have found a specific branded product or brand that serves their needs best. A consumer who has their needs met perfectly by Bose headphones, for example, is likely to buy a newer Bose model over a cheaper alternative. Similarly, positive experiences with Bose devices could lead to further engagement with their product portfolio. In both cases, the “stickiness” between the consumer and the brand creates a relationship retailers are unable to emulate.

We asked participants where would they prefer to purchase their IoT devices from (if at all)? Most respondents (52%) identified retailers as their preferred method of purchasing. This is in keeping with the scale and reach retailers have, and their ability to guide customers through the plethora of choices.

The second-most popular method was direct from the brand (32%). Loyalty and trust between the brand and consumer will continue to exist irrespective of the various enticing retail offerings. While they might not be as cheap as retailers, the authenticity the brand conveys is an important aspect for consumers when purchasing devices. This is especially true when buying expensive, high-end products such as smart TVs.

Network operators were third with 12% of responses. And finally, 4% of the 4000 strong sample, identified that they were not interested in purchasing any IoT devices.

The battle for consumer attention between retailers and brands is likely to continue evolving as online shopping becomes increasingly popular, and the rise in data collection practices makes tracking consumer behavior a priority. Perhaps as IoT matures and customers become accustomed to the products and their capabilities, brands will be able to leverage direct-to-consumer practices to a greater degree. However, for now, retailers retain the edge in the developing IoT market.