Vendors are trying to navigate evolving routes to market

5 October 2022

Google officially released the long-awaited Pixel Watch on 6 October 2022, marking a new milestone as it is Google's first attempt at making a first-party smartwatch.

Google officially released the long-awaited Pixel Watch on 6 October 2022, marking a new milestone as it is Google's first attempt at making a first-party Pixel smartwatch. The Pixel Watch has an attractive circular design and a unique band attach mechanism, giving it a distinctive look. Still, the smaller display and large bezel make the device look dated in an era where smartwatch screen bezels are thinner with a larger display.

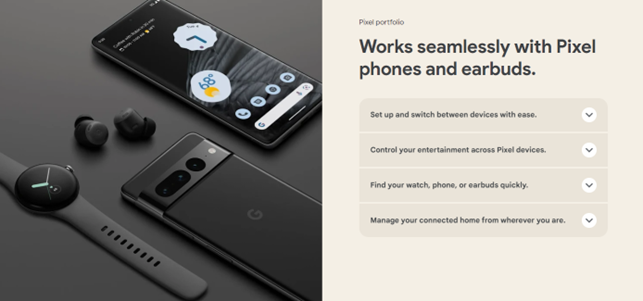

The Pixel Watch release is a boon to the Google ecosystem as the flagship smartwatch completes the Pixel portfolio. The pure Android user experience now extends to the wrist with the latest Wear OS 3.5 supported by Google services and third-party apps. Google highlighted Fitbit's integration as one of the key selling points. Combining Fitbit's robust health, fitness and sleep tracking features and services with Google smarts appeals to mass-market users.

While the Pixel Watch is primarily designed for Pixel and Android smartphone users, it is currently positioned as the most premium offering on Google's entire smartwatch portfolio. This is evident from the pricing strategy adopted for the Pixel Watch, which is priced higher than other Fitbit smartwatches. The Pixel Watch is also ranged in Fitbit's official stores.

Adding Fitbit into the picture, created many strengths and brought challenges for Google. The new Fitbit Sense 2 and Versa 4, with upgrades centered around a new user interface, new sensors, and improved health tracking features, went on Sale on 29 September 2022. Major Fitbit OS changes were made to the Sense 2 and Versa 4, highlighting the shift of Google's smartwatch strategy to create differentiations between Fitbit branded smartwatches against Google's.

Firstly, the support for Fitbit OS App Gallery on both new Fitbit smartwatches was removed, meaning the successors to the Sense and Versa 3 have no third-party app support. Google Assistant integration is missing, although Alexa integration is still available on the latest watches. While Google promises future updates to bring Google Maps and Google Wallet integration, the removal of several smart features from Fitbit OS showed Google's intention to position Fitbit OS as its new lightweight option. This move is similar to what Huawei did years ago when it launched its Watch GT lineup of basic watches for users seeking simpler watches with excellent health and fitness tracking and longer battery life.

The crucial iOS user base is likely the main reason that forces Google to continue developing Fitbit OS alongside Wear OS, so that iOS users do not get alienated. The 'downgrades' introduced to the new Fitbit OS brought inconsistencies in user experience while lessening the appeal of Sense 2 and Versa 4 as viable upgrades for current Fitbit users. Fitbit's loyal Sense and Versa users who use iPhones still lack a clear upgrade path if they wish to attain a more premium user experience. And even worse, they may feel they are being treated as second-class citizens since they are not getting any value-added smart features from ecosystem integration compared to Apple Watch users. This presents an excellent opportunity for Apple to poach Fitbit users with its well-integrated watchOS features.

The success of Google and Fitbit smartwatches hinges upon James Park, Fitbit's co-founder and now Vice President and General Manager for Google's wearables group. He needs to sort out the confusion of the current portfolio and chart a clear growth strategy for Google’s future smartwatches. The launch of the Pixel Watch marks the beginning of a long journey that requires a substantially stronger commitment from Google in multiple areas, including rapid market expansion, platform feature development, and health and fitness technology development. While Fitbit integration is the current Pixel Watch headline feature, the next generation of Pixel Watch will require new wow factors, including new use cases leveraging cellular connectivity and ecosystem integration.

Additionally, Google must avoid repeating the mistake of failing to integrate the target-acquired properties into Google's core team and improve its track record in maintaining and developing software platforms and properties that may not be growing exponentially. Google must uphold Fitbit's user privacy and health data while it allows better integration of Fitbit, allowing Fitbit to thrive and not be overshadowed. Further consolidation of platform and software services, such as Fitbit's platform with Google Fit, is expected and will continue to pose many challenges.

It would be wise if Google would allow Fitbit to explore new opportunities in other health and fitness products and services more freely, leveraging Google's AI software expertise and machine learning capabilities. Google must also remind itself that it still has plenty of interest in developing Wear OS for other Android partners, and boosting the market share of Wear OS to 25% or even 30% next year would be a worthwhile target to pursue. According to Canalys estimates, Wear OS currently takes up 20% market share within smartwatches in Q2 2022, mainly taken up by Samsung.