Canalys Forums 2022 Expert Hubs: Diversity in a time of adversity

29 November 2022

Before the pandemic, the physical retail channel (including telcos’ own stores) was the dominant route to market for mobile devices in volume terms in many European countries. The offline channel was dominated by large retail chains with multiple points of sale, complemented by small and medium-sized retailers with great geographical reach and flexible local logistics. In the aftermath of the pandemic, when consumers were forced to move to online channels, they have returned to physical retail stores, but with increased expectations, demanding the best experiences in a safe, sanitized environment.

Extending reach to demanding customers via an omnichannel approach

As with the telco channel, retailers during the pandemic invested heavily in their online channel capability and ramped up their digital presence, increasing their customer touchpoints to deliver the best possible service to customers. As a result, a highly developed omnichannel approach remains in place today to serve the complex and diverse customer retail journey.

Retail footfall has increased dramatically since the height of COVID-19 but is still below what it was pre-pandemic in most developed European markets. Customer buyer behavior in most countries has permanently changed to a mixed channel sourcing model. But the biggest shift has been the massive growth in online purchasing, a trend that continues to shape the retail landscape. Though online retail varies by country, overall, it represents as much as a 15% share in volume terms in Western Europe. Another outcome of the omnichannel strategies adopted by most large retailers due to the pandemic has been that by forcing retailers to expand their digital offerings, they have benefited by attracting new age groups and expanding their demographic reach.

Having experienced an online retail journey, customers have returned to physical stores expecting the same, if not a better retail journey – and depending on their experience it may have even changed their purchasing habits, leading some to even switch brand loyalties. For leading-edge retailers able to provide a seamless omnichannel journey, such as buy online/pick up in-store, delivery features such as pick and collect from kiosks and trade-in cashback or financing options, it has given them a competitive advantage and raised the barriers to competition for smaller retailers, which have been unable to invest. Consequently, it has also created a market ripe for consolidation, as smaller retailers unable to compete go up for sale – a trend that has started already in some major European countries.

Increased competition and supply chain pressures

Competition has also intensified from vendors’ own branded channels too – either from their direct stores or their online channels. As the pandemic abated and channels opened, the competitive dynamic in the market also changed, with more competition coming from vendors’ own channels, which also slightly distorted availability in the markets as vendors under supply constraints will prioritize their own retail stores over independents.

Component availability issues, exacerbated by post-pandemic-related global supply chain problems, the conflict in Ukraine, inflationary pressures, the ongoing energy crisis and, more recently, iPhone production issues in China, are major factors affecting all retailers. Many products are increasingly unavailable while consumer expectations regarding product delivery and service remain unchanged. As these trends continue, successful retailers will adapt to these challenges using technology to deliver services such as buy and reserve online, pick up in-store, and/or store-to-store product transfers. Winning retailers during this disruption in the supply chain will be those that invest in inventory management tools and those that partner and integrate their back-office systems with vendors’ own supply chain management systems to gain better stock visibility and inventory prediction at a local store level. Deeper partnerships with key vendors will become strategically important for large retail chains.

An enriched digital and physical retail experience to tempt customers

The challenge for retailers going forward will be to continue to deliver experiences that tempt the customer. Transitioning the customer experience from the physical retail space to advanced digital technologies will become an expectation and the new normal for customers in the future. Customers will want to experience retail through tools on their 5G-enabled devices, and/or in-store so they have the ability to interact and experience immersive retail displays and in-store brand experiences.

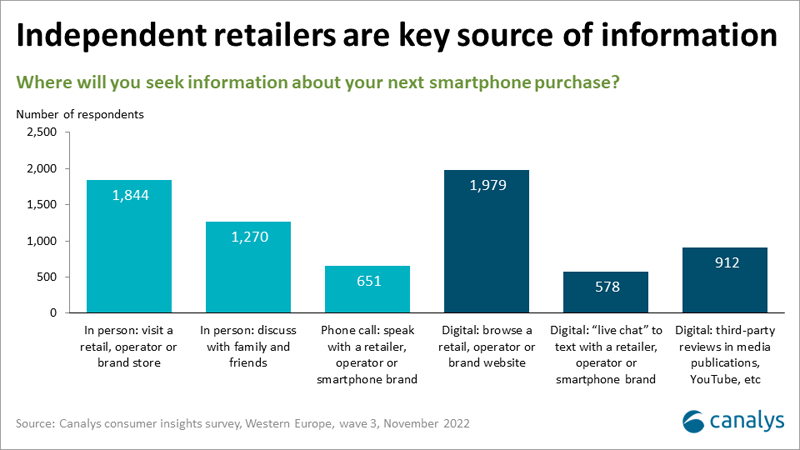

Augmented reality is still in its infancy, but retailers must be prepared to embark on this trend and start testing and rolling it out in stores. For those retailers that are successful, the use of AR could bring a major source of competitive advantage and enable retailers to capitalize on driving purchasing behavior, increasing conversion rates and having access to consumer data in real-time. As proved by Canalys consumer insights research, retailers are the first port of call for consumers when seeking information, and hence where consumers will also look to experience a physical digital retail experience.

Anywhere, anytime

The evolution of the retail channel will be ongoing. From the focus on online, the likelihood is that retailers will experiment with other types of “experience concepts”, such as stores within stores and even mobile “shops” at concerts and large sporting or music events. Aiding this roll-out is 5G, which is the enabling technology needed to make the retail experience happen as opposed to anything available in the past. The other issue will be how to capitalize on social media and start the customer journey on Instagram, TikTok or by using other types of video on social media, which will lead customers to the retailers’ physical or online stores. Retailers know that the key to success is to be available to the customer – anywhere, anytime – but, critically, at the start of their retail customer journey, offering an end-to-end shopping experience all the way to post-purchase customer service. Customers expect brands and retailers to know and understand them and their needs, and be there for them.

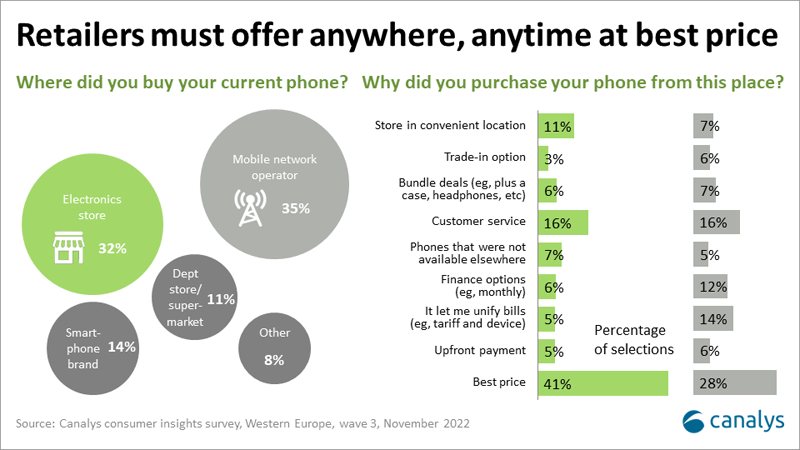

Today, retailers are exploring how to bring products to customers most effectively. The seamless integration of multiple retail channels and inventory visibility is at the core of enabling all omnichannel strategies – it is not possible to effectively serve the customer without that transparency, but fundamentally price is always the main reason customers buy products from retailers.