Channel sustainability in 2023

13 February 2023

Each element of the PC supply chain is facing different challenges and timelines.

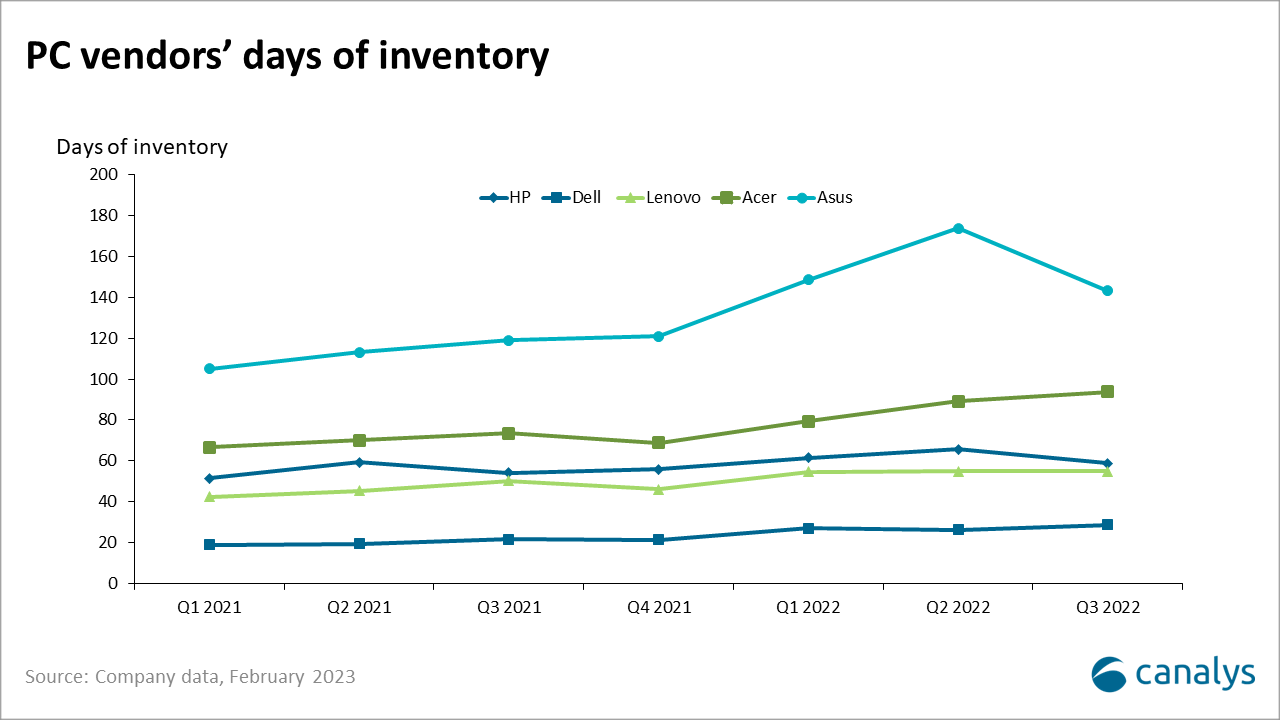

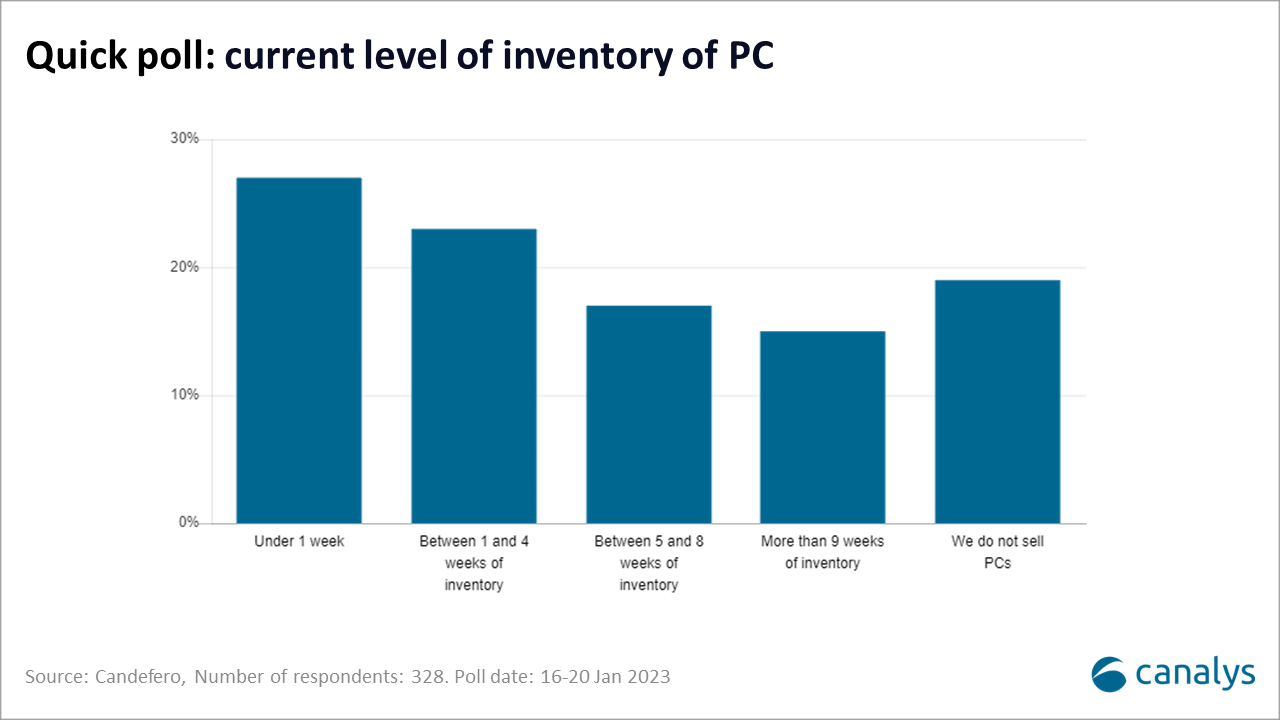

Canalys data shows that global shipments of desktops and notebooks were down by 29% to 65.4 million units in Q4 2022 (Canalys Newsroom). Weak macro environment and inventory correction are commonly mentioned in the recent earning conference calls, especially for key component vendors like Samsung, Intel, LGD, and AMD. Different parts of the PC supply chain face different challenges and hence, their recovery timeline varies. Canalys expects that the first company to start its inventory correction shall be the first to walk out of this cycle. The inventory level of channels and PC vendors should return to a normal level earlier than upstream component providers, considering the lengthy order process. Based on the recent financial results of the top PC vendors (Apple excluded), the days of inventory (DoI) of HP and Asus had started to decrease while for the rest of the three vendors (Dell, Lenovo and Acer), it slightly increased. As all vendors already took serious actions to reduce production, the overall DoI is expected to improve further in Q4 2022 and Q1 2023, which is on track to return to normalize inventory level by Q2 2023. Meanwhile, our recent poll on Candefero showed the PC inventory level of over 60% of partners to be below four weeks, while around 20% of the responses hold over nine weeks of inventory, showing that the overall channel inventory level is returning to a healthier level.

|

Company type |

Starting quarter of downcycle |

Recovery timeline |

|

PC OEMs |

Q3 2022 |

Q3 2023 |

|

Display panels |

Q4 2021 |

Q2 2023 |

|

Memory |

Q1 2022 |

Q3 2023 |

|

CPU |

Q3 2022 |

Q3 2023 |

|

Semi foundry |

Q4 2022* |

Q4 2023 |

*The situation varies from node to node.

Among the PC components, memory products and display panels have the highest volatility in terms of price due to the competition dynamic and the higher cost to adjust down capacities. The price dynamic of these two components is giving important signals for future recovery.

The display panel was the first key component with a price decline starting from Q3 2021. After multiple consecutive decreases, the display panel price had already reached the cash cost level in Q3 2022. Almost all suppliers are operating in a very low utilization or had already drastically reduced production capacity. Based on Canalys’ monthly supply chain checks, the price decay has been modest in recent months and is expected to reduce in Q2 2023.

For memory products, the price for both DRAM and NAND flash products dropped dramatically during H2 2022, with a more than 20% decrease for both Q3 and Q4. This has led memory suppliers, including Kioxia and Micron, to lower their production drastically in Q4 2022, which helped the memory price to start stabilizing in Q1 2023. We expect the memory product price to bottom out soon while it has already reached the cash cost level, which will help drive demand from OEMs soon.

The recent earnings of LGD, Samsung and SK Hynix revealed a very weak performance for Q4 2022 and even weaker guidance for Q1 2023, a necessary pain during the inventory correction cycle. Canalys expects the inventory level of component vendors will continue to increase to a peak by Q2 2023, following the inventory correction from PC and smartphone vendors before any uptick in procurement volume.

Semiconductor foundry companies like TSMC and Samsung have not entered a serious downcycle thanks to their client and product exposure, such as automobiles and high-performance computing. However, the utilization of certain node processes, like TSMC’s 6/7 nm node, mainly used in smartphones and PCs, started to decrease in Q4 2022. The under-utilization could last for a few more quarters than other products, like memory and display panels.

Meanwhile, Intel and AMD reported a massive downturn in their client CPU business, which dropped 36% and 51% in revenue respectively. As PC vendors have already drastically cut production volumes, such a level of decline is unlikely to happen. Although PC demand in Q1 2023 is to fall again, we could expect the decline to soften gradually in the following quarters.

Most vendors and component suppliers look forward to a better demand scenario in H2 2023. Canalys expects the component prices in the H2 to bounce a lot if procurement orders squeeze in simultaneously. It is a tough call for the procurement team to increase component orders during the correction cycle amid limited visibility on future demand. The one that is willing to take more risks ordering ahead of its peers in Q2 2023 will be able to react faster to market demand and reduce impacts from the next component price uptrend.