Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Decoding the new Indian EV policy: a global stage beckons (Part 1)

Formulated for India's thriving electric vehicle market, the new EV policy is designed to attract global automakers, promote local manufacturing and boost technological innovation. This blog analyzes the policy's key features, implications for major industry players like Tesla and Chinese-owned automakers, and the challenges and opportunities in navigating India's evolving EV landscape.

The latest Canalys research reveals that India’s light vehicle market grew by 26% in 2023 to 4.4 million units, up from 3.5 million in 2022. Electric vehicles (EVs) accounted for 2.2% of the Indian market share, with 96,000 EVs sold in 2023. The market grew by 92% year-on-year, aiming for 30% by 2030. The government wants to accelerate EV adoption and establish India as a top manufacturing destination for automakers, hence introducing a new EV policy in Q1 2024.

This policy has two objectives - attracting foreign investments and allowing new automakers like Tesla and VinFast to establish a local manufacturing base in India. The new EV policy aims to promote India as a manufacturing destination for EVs, boost the supplier ecosystem and establish India as an export hub.

Decoding the details: key features of the new Indian EV policy

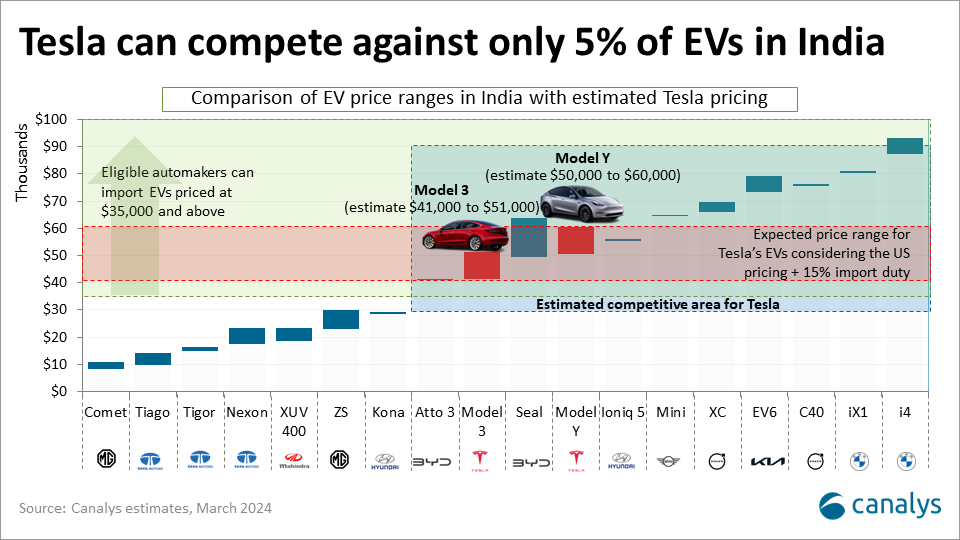

The updated policy mandates automakers to invest a minimum of US$500 million in India within three years, establishing local EV manufacturing facilities with 25% domestically sourced components. Eligible carmakers can import up to 8,000 EVs annually with a 15% reduced import duty for vehicles priced at US$35,000 and above. This aligns with the Indian government’s “Atmanirbhar Bharat” initiative, fostering self-reliance and technological advancement.

A key feature is the emphasis on Domestic Value Addition (DVA), aiming for a minimum of 50% DVA within five years. This reduces reliance on imports, stimulates job growth and promotes technological innovation in the Indian EV sector, supporting indigenous manufacturing. Additionally, the policy ensures accountability by requiring companies to back investment pledges with bank guarantees. Non-compliance with DVA and investment criteria will lead to enforcement of guarantees, enhancing transparency and accountability.

Implications of the strategy: navigating opportunities and challenges

The Indian government aims to create policies that attract all electric vehicle manufacturers globally to establish operations in India, leveraging the country’s expanding economy. The goal is not just to attract these big players but to leverage their presence and create a ripple effect, fostering a network of smaller, specialized domestic suppliers for a robust and self-sustaining industrial ecosystem.

The industry claims this policy is a disguise crafted to the advantage of Tesla, although the Indian government has reportedly clarified that its intention is not to cater to Tesla’s interests specifically. Even so, it is a win-win situation for Tesla, as it holds an advantage in such negotiations. Its focus on vertical integration, with massive “gigafactories” allows for greater control over supply chains and easier localization promises than competitors, but will still require significant efforts in localization of processes and management, especially requiring skilled workers that can match Tesla’s global standards.

On the contrary, there are some limitations specifically faced by Chinese-owned automakers. India has been cautious about approving Chinese automaker investment plans in the recent past. Despite already having a presence in India and having launched its third EV, BYD’s US$1 billion investment plan to establish an EV factory was turned down by the government. This setback is significant for BYD as missing out on the benefits of local manufacturing and substantial import duties will restrain the manufacturer from scaling up in India.

As Chinese EV technologies gain global dominance, many global OEMs, including Volkswagen Group and Stellantis, increasingly rely on them for global EV development. Consequently, India's options for global partnerships may narrow if it fails to act swiftly.

Domestic players such as Tata Motors and Mahindra & Mahindra had expressed concerns about increased competition from globally popular EVs. This policy will disrupt the premium segment vehicle market priced at and above US$35,000 while protecting the volume segments for domestic players. Balancing the interests of domestic manufacturers with the imperative of attracting foreign investments remains a delicate task for policymakers, especially with the sustained commitment needed to drive EV demand domestically.

Continue reading - Decoding the new India EV policy: opportunities for Tesla and Beyond (Part 2)