Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

NinjaOne acquires Dropsuite to drive its platform evolution

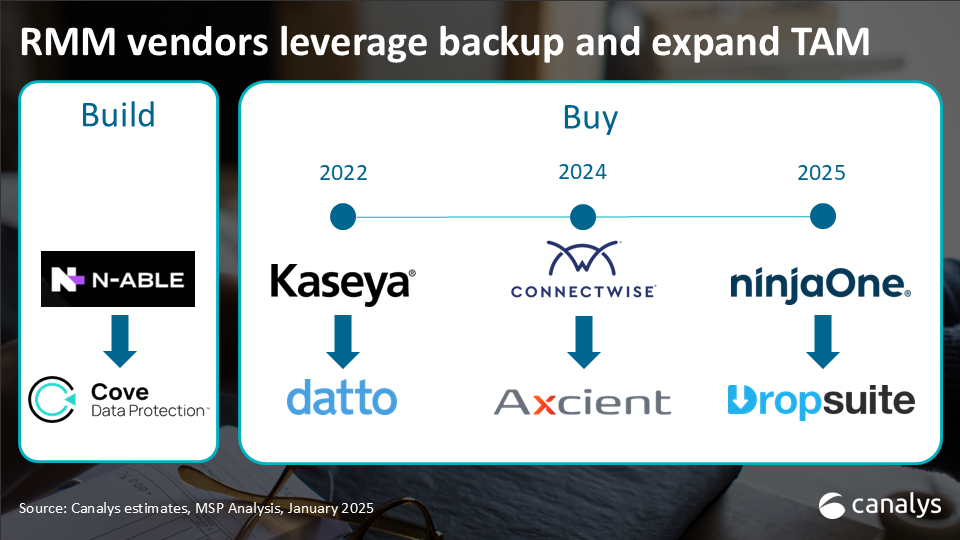

NinjaOne announced its intent to acquire backup and disaster recovery vendor Dropsuite in a deal worth approximately US$252m. This is the latest in a series of moves by RMM vendors to develop platform plays for channel partners building managed services offerings.

NinjaOne drives towards its platform future

NinjaOne, a vendor best known for providing remote monitoring and management (RMM) software to IT managed services providers (MSPs), has announced its intent to acquire backup and disaster recovery vendor Dropsuite for approximately US$252m. Dropsuite’s latest reported annual revenue showed ARR of around US$32m. Over two thirds of its revenues come from the Americas, and most of its customers are in the SMB space. The company works with over 4,500 MSPs and over 700 IT resellers in its go to market motion, delivering backup and disaster recovery to around 1.7m users.

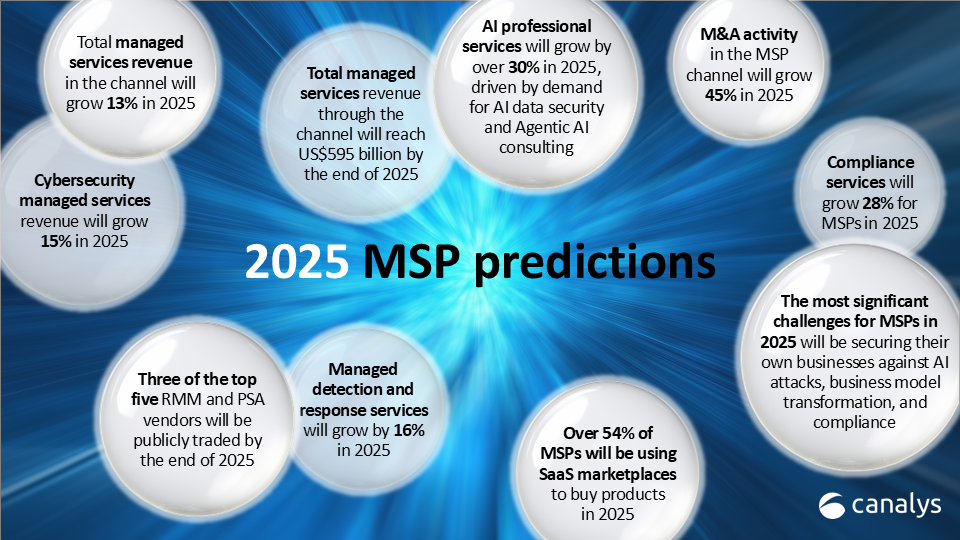

The deal is another step in NinjaOne’s move to becoming a MSP platform player, following its partnership with Halo PSA in 2024. The four largest vendors in the RMM space in recent years have either acquired or built backup and disaster recovery capabilities. ConnectWise acquired Axcient and SkyKick in 2024, Kaseya famously acquired Datto for US$6.2bn in 2022, while N-able has built out its Cove Data Protection suite, which now stands as the largest part of that company’s portfolio by revenue.

RMM and PSA (professional services automation) software, along with backup and cybersecurity tools, form the four pillars of most MSP business models today. For vendors in these areas, building a suite of tools to provide a single platform has become the key to gaining a competitive edge over specialists, but there are two ways of doing this. NinjaOne is pursuing an open, or hybrid, platform approach, with its Halo PSA partnership and cybersecurity vendors alliances. This is similar to N-able. Kaseya has pursued a more ‘walled garden’ approach, acquiring vendors in cyber, backup, and PSA (among other areas), to develop its own platform. ConnectWise has a mixed approach, as it has acquired backup with Axcient and built a SOC-aaS offering, but also relies heavily on SentinelOne and other cyber vendors for specific technological capabilities.

The future of RMM platforms is converging

With the top four players in RMM on a clear path forward, questions arise about the next steps in the platform battle. Cybersecurity and AI are obvious capabilities to add, but there are obstacles to this too. Should RMM vendors build, buy, or partner with businesses that provide these capabilities? In cybersecurity, for example, Kaseya, ConnectWise, and N-able have all acquired some capabilities necessary for the delivery of cybersecurity managed services. Most recently N-able acquired Adlumin, a company which provides MDR, XDR, and SIEM. Kaseya has acquired several cybersecurity products, services, and training companies over the years, while ConnectWise has its own SOC-aaS capabilities. But these vendors cannot compete with much larger specialists such as SentinelOne, Bitdefender, Mimecast, or even Microsoft in terms of market share, capital expenditure, or technological strength and so partnerships and alliances will always be necessary in cybersecurity.

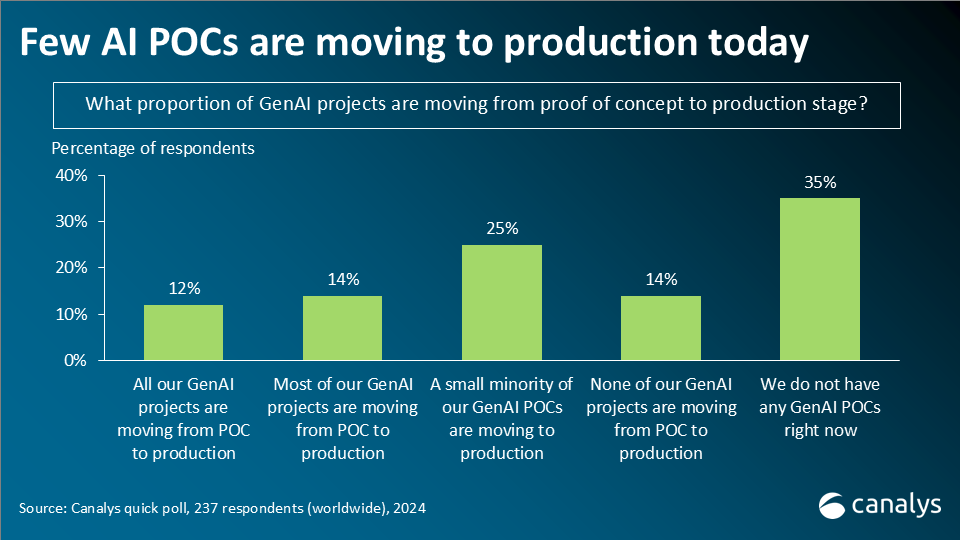

AI is an obvious next step, but here too there are potential obstacles. Some companies, such as Atera, are building AI tools to help automate some service desk actions and ticket resolution for MSPs, with obvious potential cost and time saving benefits. Syncro too is targeting building these kinds of capabilities, and all of the top four vendors are either looking at this or actively investing in what can broadly be termed AI service desk management.

NinjaOne introduced ‘AI for Patch Sentiment’ in 2024, which is designed to reduce some elements of patch-related risk; the tool provides sentiment analysis for Windows KB updates to identify potential risks with patches, helping techs to deploy or delay patching if necessary.

AI software could well be the next wave of acquisitions in the RMM vendor space, after backup, cybersecurity, and Microsoft management tools. Several AI service desk management companies are emerging, and a number are already in use by MSPs to help improve ticket resolution speed, taking pressure off existing technical staff and improving profitability. There is a risk some of these start-up AI specialists could be left behind as the RMM vendors insource AI development, but some will build enough capability to attract interest and may even be acquired in 2025.

In the meantime, the future of RMM is now a four-way battle and while it may be impossible to predict the likely success of any of these companies, NinjaOne has taken a big step forward in its evolution towards becoming a major global MSP platform.