Analysis of carmakers’ strategies in making smartphones

4 October 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

With a global increase in the number of individuals experiencing hearing loss, smart personal audio vendors are venturing into the over-the-counter hearing aid market. This strategic move aims to diversify their strategies and revenue streams, enabling them to compete more effectively with smartphone ecosystem vendors in the highly competitive smart personal audio market.

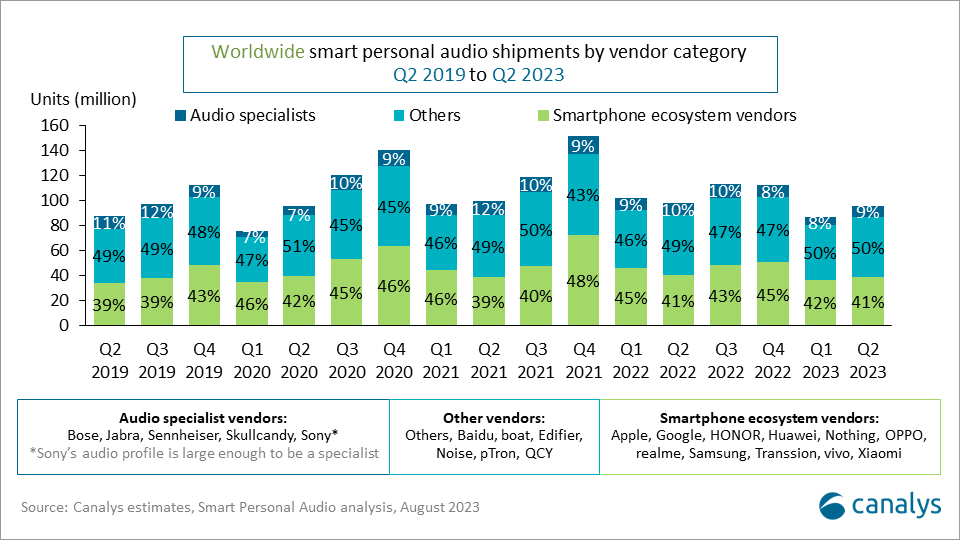

Differentiation in the smart personal audio market is challenging due to the simplistic nature of personal audio devices, leading to standardized products where consumers increasingly prioritize value, convenience, price and brand image. As the smart personal audio market developed, smartphone and IoT ecosystem vendors outperformed specialist audio counterparts, offering lower-priced products driven by scale economies. The continuing preference of smartphone ecosystem vendors is further fuelled by convenient purchasing, bundling and ecosystem interoperability.

In recent years, "audio specialist" vendors have entered the over-the-counter (OTC) hearing aid market, following FDA initiatives in 2017 to open the market (available since 2022). The OTC hearing aid market was valued at US$1.06 billion in 2022, with significant growth potential due to:

Notable smart personal audio vendors who produce OTC hearing aids include:

Rumors swirl of JLab developing two of their own OTC hearing aids.

Specialized audio vendors facing continuous competition need alternative strategies. Embracing OTC hearing aids provides a distinct and revenue-diversifying approach, offering substantial long-term growth prospects. A top-performing OTC hearing aid can set vendors apart, expanding their device ecosystem, enhancing revenues, attracting new consumers and fostering brand loyalty by showcasing their technical expertise. Audio specialists can target the growing number of those with mild to moderate impairment.

Ecosystem vendors have taken a different approach to combatting this hearing health issue. Instead of developing OTC hearing aids, leading vendors like Apple and Samsung have recently integrated hearing health features into their flagship devices.

Samsung:

Apple:

Integrating these features into flagship TWS devices targets consumers with low to mild hearing damage. With a rising prevalence of low-level hearing issues, these consumers are likely to prioritize TWS devices over OTC and prescription aids, finding sufficient improvement from the enhancement features. This will become an important factor in the purchasing decisions of individuals with mild hearing impairments. As the prevalence of hearing damage increases, the effectiveness of these features will be a crucial differentiation, essential for long-term success in the premium TWS market.

These devices would substitute OTC and medical hearing aids for moderate to severe hearing damage. Short-term purchasing decisions are limited by current awareness, the prevalence of hearing health issues and early product capabilities. It is unlikely that these enhancements will substantially boost vendor revenue, given the substantial costs of investment, development and testing required to compete with OTC devices (which is likely to be unachievable, regardless). The considerable product markups (often surpassing 60%) and growth potential in the OTC market seem more appealing.

Ecosystem vendors entering the OTC space currently appear unlikely due to their focus on TWS enhancement integration. Additionally, they would trail competitors with established devices and expertise. Jabra and Sennheiser receive support from sister-brand hearing aid companies and Sony partners with the hearing aid giant W.S. Audiology. If revenues justify, smartphone ecosystem vendors aiming for an OTC share might need to acquire or heavily invest in a partnership with a hearing aid vendor, not established in the current OTC market.

While specialists may not capture significant shipment share from ecosystem vendors, the substantial revenue from OTC hearing aid growth can fund personal audio device development and enable aggressive pricing. This yields a renewed competitive edge, alongside discussed brand benefits and the potential for hearing enhancement that AI brings after being integrated into their personal audio devices.

The OTC hearing aid market is positioned to provide audio specialists the brand, feature and financial means to compete successfully in the challenging smart personal audio market over the long term.