AI-capable PCs forecast to make up 40% of global PC shipments in 2025

Monday, 18 March 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

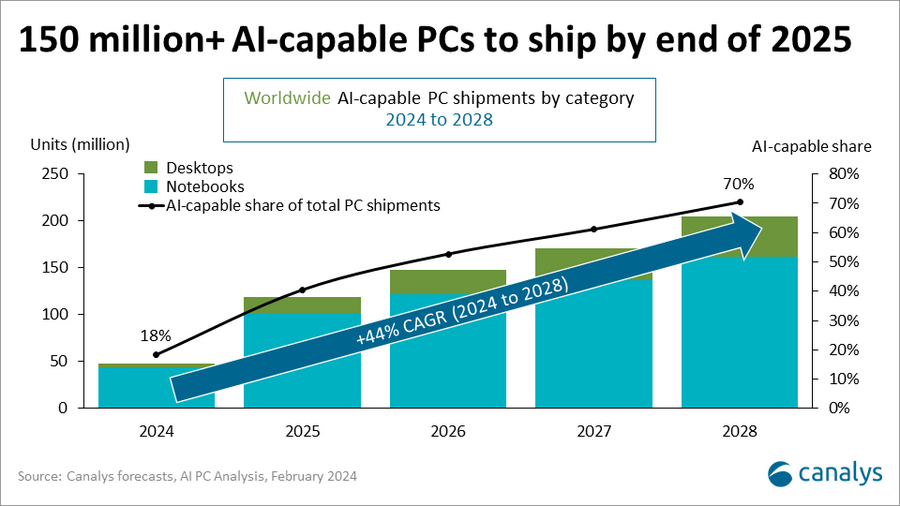

Canalys’ latest forecast predicts that an estimated 48 million AI-capable PCs will ship worldwide in 2024, representing 18% of total PC shipments. But this is just the start of a major market transition, with AI-capable PC shipments projected to surpass 100 million in 2025, 40% of all PC shipments. In 2028, Canalys expects vendors to ship 205 million AI-capable PCs, representing a staggering compound annual growth rate of 44% between 2024 and 2028.

These PCs, integrating dedicated AI accelerators, such as Neural Processing Units (NPUs), will unlock new capabilities for productivity, personalization and power efficiency, disrupting the PC market and delivering significant value gains to vendors and their partners.

“The wider availability of AI-accelerating silicon in personal computing will be transformative, leading to over 150 million AI-capable PCs shipping through to the end of 2025,” said Ishan Dutt, Principal Analyst at Canalys. “PCs with dedicated on-device AI capabilities will enable new and improved user experiences, driving productivity gains and personalizing devices at scale while offering better power efficiency, stronger security and reduced costs associated with running AI workloads. This emerging PC category opens new frontiers for both software developers and hardware vendors to innovate and deliver compelling use cases to customers across consumer, commercial and education scenarios.”

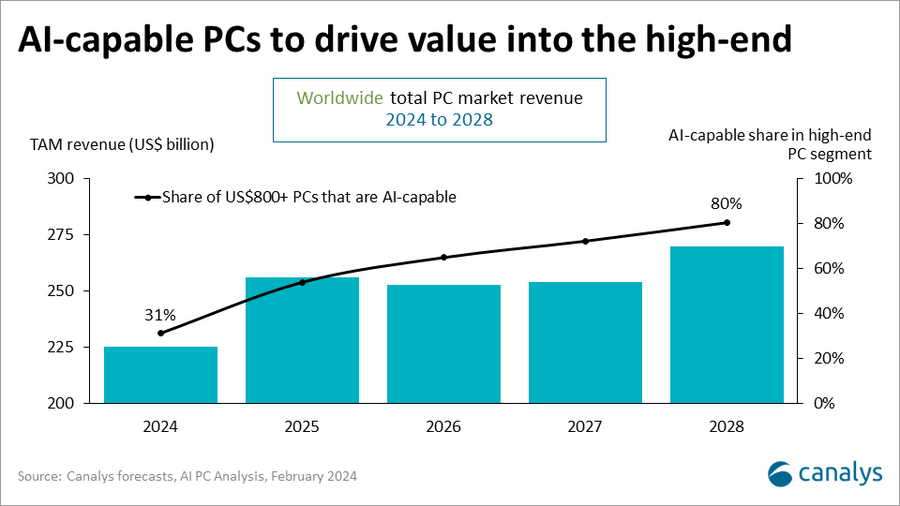

The rapid uptake of AI-capable PCs will drive a moderate increase in the TAM value of the broader PC market. “The enhanced capabilities of this new category will create momentum toward premiumization, particularly in the commercial sector,” said Canalys Analyst Kieren Jessop. “In the short term, Canalys expects a 10% to 15% price premium on AI-capable PCs compared with similarly specified PCs without NPU integration. With the spike in adoption, by the end of 2025, over half of PCs priced at US$800 and above will be AI-capable, with this share increasing to over 80% by 2028. As a result, PC shipments in this price range will grow to account for more than half the market in just four years. This will help boost the overall value of PC shipments from US$225 billion in 2024 to over US$270 billion in 2028.”

Canalys’ latest forecasts underscore the massive potential and wide-ranging impact AI-capable PCs will have on the industry over the next five years and beyond. Vendors that can deliver innovative, differentiated AI-accelerated experiences stand to gain significant advantage as this disruptive new category goes mainstream.

Canalys’ “Now and next for AI-capable PCs” report provides a comprehensive overview of this future computing paradigm. It includes initial category definitions and forecasts, technical considerations, market opportunities and potential industry challenges. For more insights into the transformative effects of AI on other sectors of the technology industry and channel, explore here.

For more information, please contact:

Ishan Dutt (Singapore): ishan_dutt@canalys.com

Kieren Jessop (UK): kieren_jessop@canalys.com

Canalys’ PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology, and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry. With AI rapidly becoming vital to the PC industry, Canalys also provides shipment data, forecasts and market insights for the emerging category of AI-capable PCs.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys 2024. All rights reserved.