Canalys expects Mainland China's PC market to grow from Q2 2024

Thursday, 21 December 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

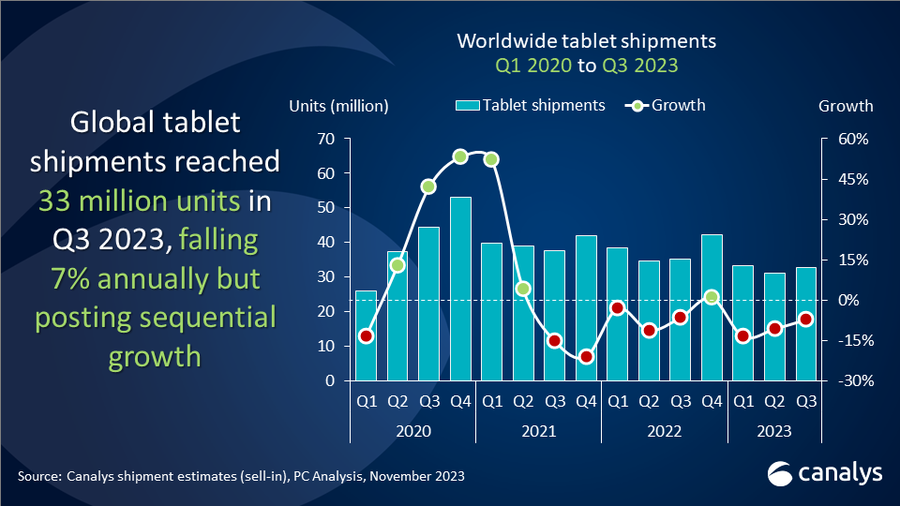

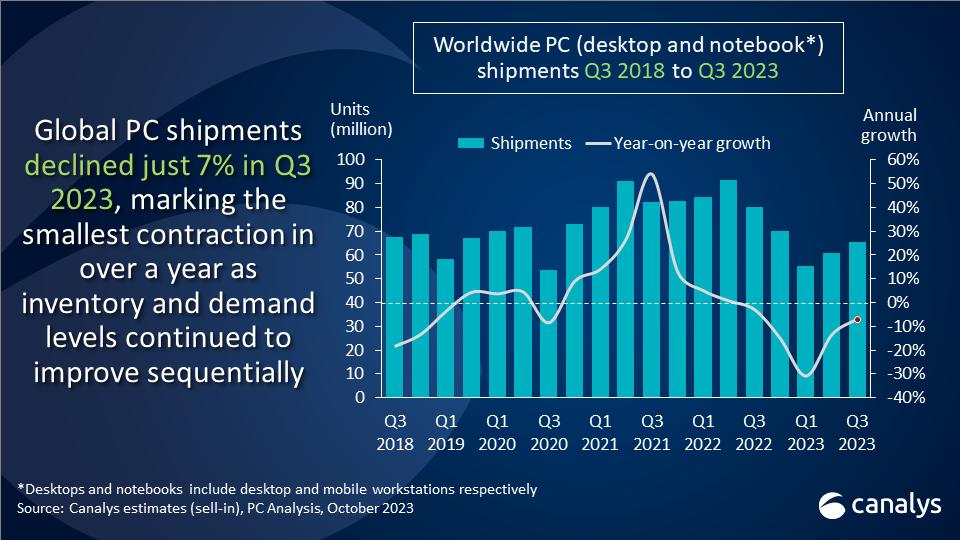

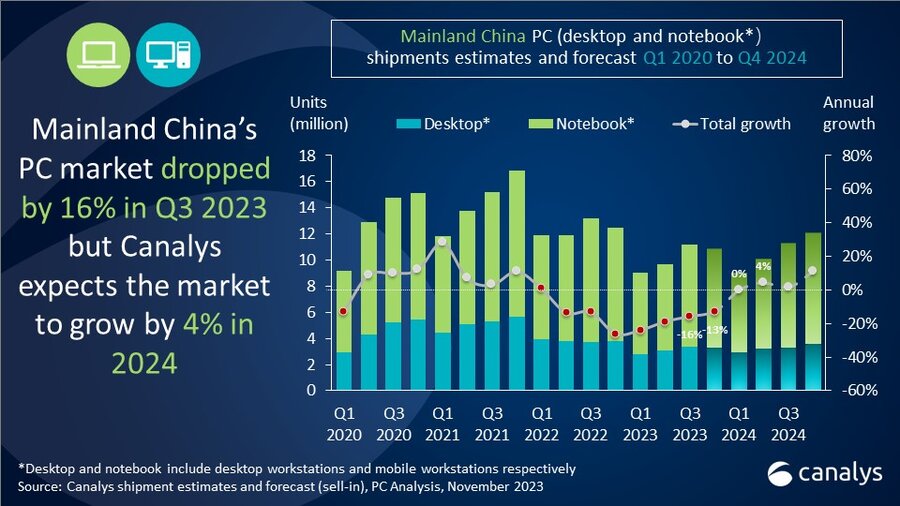

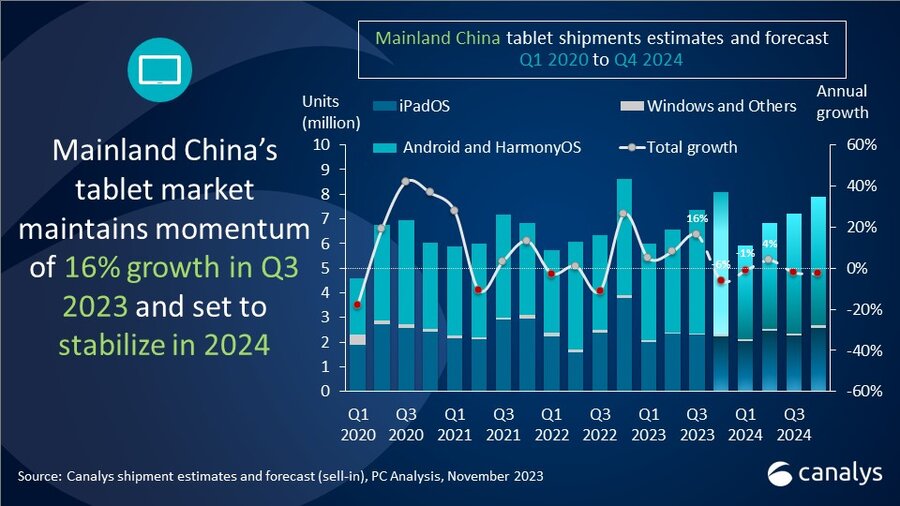

In Q3 2023, the PC (desktops, notebooks and workstations) market in Mainland China gradually recovered, with shipments experiencing a 16% year-on-year decline but undergoing a promising 15% sequential increase to reach 11 million units. Desktops (including desktop workstations) spearheaded the rebound with a marginal 9% decrease to 3.4 million units, while notebook (including mobile workstations) shipments dropped by 18% year-on-year to 7.8 million units, reflecting lingering weakness in end-consumer demand. In contrast, the tablet market sustained positive momentum, recording a 16% year-on-year growth to 7.4 million units, fueled by seasonal promotions and digitalization in education and entertainment.

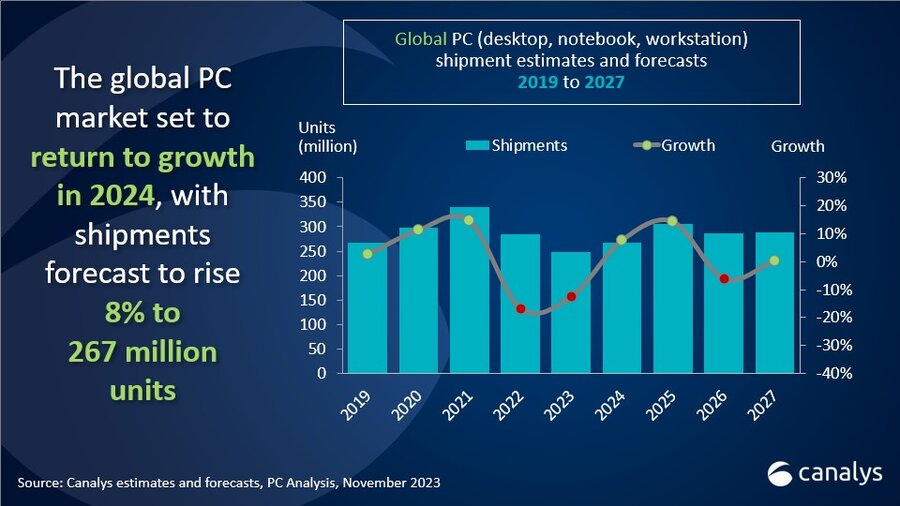

Canalys projects a year-end decline of 18% in Mainland China's PC market (excluding tablets) in 2023 and a modest 4% growth in 2024. The growth is expected to materialize in Q2 2024 and beyond, benefiting from the further recovery of the commercial sector, driven by significant IT investments from large enterprises in strategic industries.

“IT investment from enterprises is only improving marginally alongside the overall Chinese economy recovery, while SMBs still face many operational challenges,” said Emma Xu, Analyst at Canalys. “There are signs of growth in public sectors and frontier industries with IT upgrade demands set for AI solutions. According to the latest central government economic discussion panel, as the primary economic focus of 2024 is shifting to encouraging industrial upgrades from domestic consumption, advanced IT investment is expected to be a beneficial factor for tech industries and vendors.”

In Q3 2023, Lenovo maintained its top position despite a 15% year-on-year decline in the PC shipments. HP took the second position with an 11% market share as the vendor strengthened its commercial product portfolio offerings with its acquisition of Poly. Huawei increased its market share despite a 5% unit drop year-on-year. Dell and Asus secured the fourth and fifth positions, respectively, though both encountered a substantial 36% year-on-year decline.

In the tablet market, Canalys anticipates a 5% growth for the full year 2023, reaching 28 million units before it stabilizes in 2024. The continuous digitalization trends in learning and working are a driving force for tablet expansion, enabling usage in various life scenarios, including home, school and business environments. “The demand for smart products that make life more convenient and efficient will continue to be strong in Mainland China as leading vendors are anchoring their growth in driving upgrades in specific user scenarios such as parental education or creative work and investing in constructing entire product ecosystems with embedded interoperable functionalities,” added Xu.

Apple and Huawei maintained their dominance, with Apple's market share contracting to 31% from 38%. Huawei's market share increased to 24%, driven by proactive product marketing and channel promotion. Xiaomi experienced growth, with its tablet market share expanding from 7% in Q3 2022 to 11%. HONOR and Lenovo completed the top five, although both experienced declines in both market share and shipments.

|

People’s Republic of China (mainland) desktop and notebook shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2023 |

|||||

|

Vendor |

Q3 2023 shipments |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Lenovo |

4,258 |

38% |

4,998 |

38% |

-15% |

|

HP |

1,221 |

11% |

1,237 |

9% |

-1% |

|

Huawei |

975 |

9% |

1,026 |

8% |

-5% |

|

Dell |

958 |

9% |

1,501 |

11% |

-36% |

|

Asus |

771 |

7% |

1,199 |

9% |

-36% |

|

Other |

2,972 |

27% |

3,264 |

25% |

-9% |

|

Total |

11,155 |

100% |

13,225 |

100% |

-16% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

|

People’s Republic of China (Mainland) tablets shipments (market share and annual growth) Canalys PC Market Pulse: Q3 2023 |

|||||

|

Vendor |

Q3 2023 shipments |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

|

Apple |

2,294 |

31% |

2,406 |

38% |

-5% |

|

Huawei |

1,779 |

24% |

934 |

15% |

90% |

|

Xiaomi |

805 |

11% |

471 |

7% |

71% |

|

HONOR |

521 |

7% |

552 |

9% |

-6% |

|

Lenovo |

435 |

6% |

578 |

9% |

-25% |

|

Other |

1,546 |

21% |

1,410 |

22% |

10% |

|

Total |

7,379 |

100% |

6,351 |

100% |

16% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Emma Xu: emma_xu@canalys.com

Canalys' PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities in the market. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.