Wasabi Technologies: new expansion targets APAC growth

1 July 2022

Sustainability is of growing importance in the smartphone market. With Canalys' latest consumer research study exploring the consumer interest in refurbished devices and what consumers currently prefer to do with their old device, new business models and approaches have to be brought in to grow the industry's sustainability initiatives.

Sustainability is a hot topic. Over the last few years, companies have increasingly invested into ESG schemes and launched new sustainability initiatives as consumer interest gradually increased. In the smartphone market, vendors have promoted their increased ESG focus by, for instance, recycling packaging, committing to net zero, and phasing out chargers. Here, the Western European market lies ahead of the global curve on sustainability-awareness, with consumers being cautious about sustainability credentials. In the market, this can be reflected through network operators' push on the Eco Rating and trade-in schemes as well as the presence of Fairphone.

Although these initiatives are improving the standard of the industry, it is far away from offsetting the environmental footprint of the enormous volumes of devices manufactured every year. Here, both vendors and channel players will look at opportunities over the decade to improve sustainability credentials while connecting more with consumers. In the short term though, the key question for the industry to understand is to what extent consumers value sustainability and what initiatives would they consider contributing to. Insights here are crucial for vendors and channel players to understand what the business models of the future will look like as smartphone related businesses seek to make sustainability profitable and financially viable.

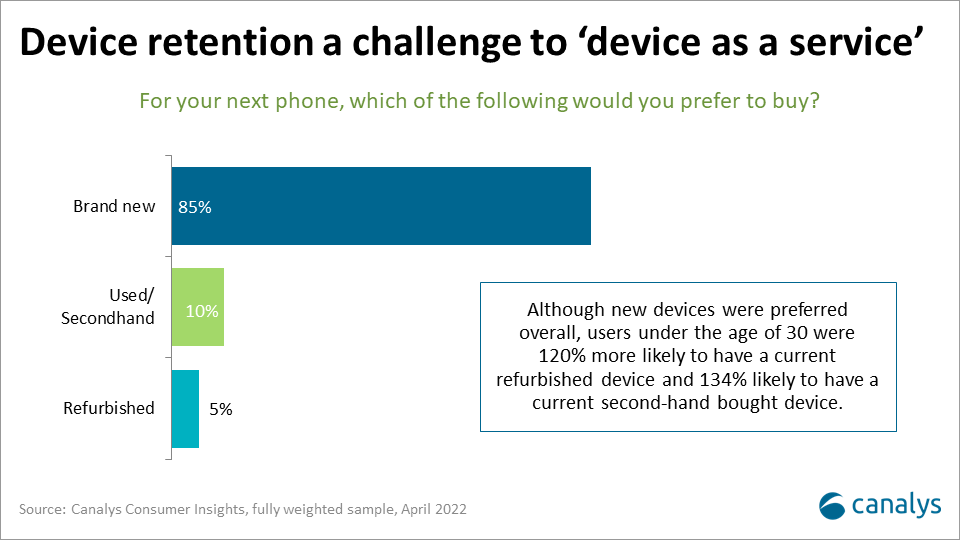

Refurbished devices is the new leading, short-term initiative the industry looks towards to give consumers sustainable options. In Canalys’ latest consumer research study in Western Europe, 5% of the respondents stated they would be interested in buying a refurbished device and 10% showed interest in a secondhand device. Although these shares appear low, a few percent of the European smartphone market can easily add up to several million units annually. Simultaneously, the shares also increase from the current rate of respondents who's current device is refurbished or secondhand. Within this respondent group, users under 30 were much more likely to show an interest in both refurbished and secondhand devices. So, it is likely the popularity of devices will grow as the young generation grows older. At the same time, it provides a new angle for channel players and vendors to connect to younger audiences.

The remaining 85% in Canalys' consumer study stated that they prefer brand-new devices. To attract this audience towards more sustainable options, the focus may have to lie on different credentials than sustainability such as financial benefits, more robust devices with longer lifetimes and "device as a service" subscription models. The specific method might vary between different market segments, but approaching sustainability with more angles than ethics will be key to drive more sustainable decisions from consumers.

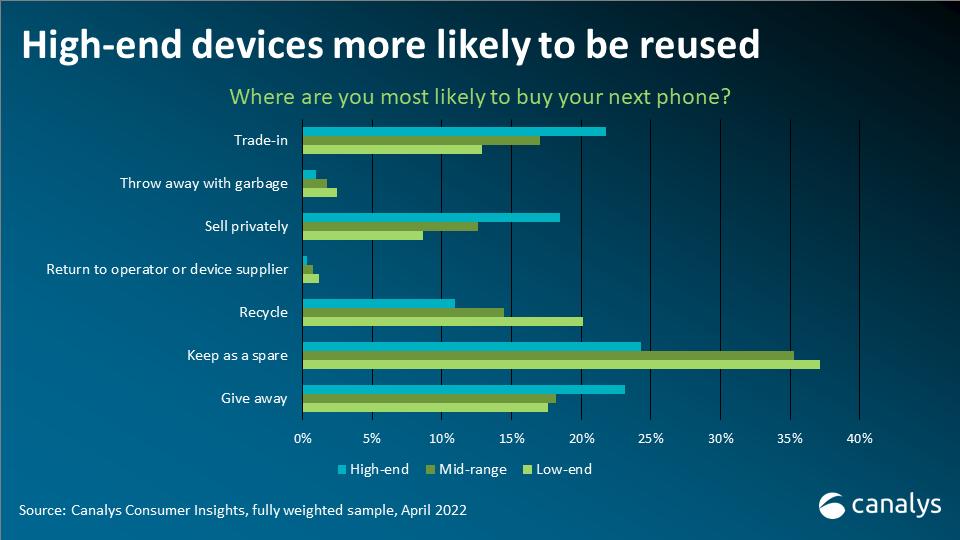

To create a more circular model where devices are reused, there are two sides to the equation. The first relates to the reuse of devices - while the other, relates to sufficient supply of used devices. Here, it is key that devices are returned to be refurbished or recycled. In Canalys’ latest consumer research study, a third of respondents stated they would prefer to trade-in their device when they switch phones next and another third stated they would most likely give it away or sell it to someone else. Thus, the supply of devices into the reused category overwhelmingly surpasses the demand for reused devices. Although supply surplus will result in non-used traded-in devices, it will still allow for used devices to be recycled effectively.

The most popular option in Canalys' consumer study for mid-to-low-range devices, was to keep the old device as a spare.

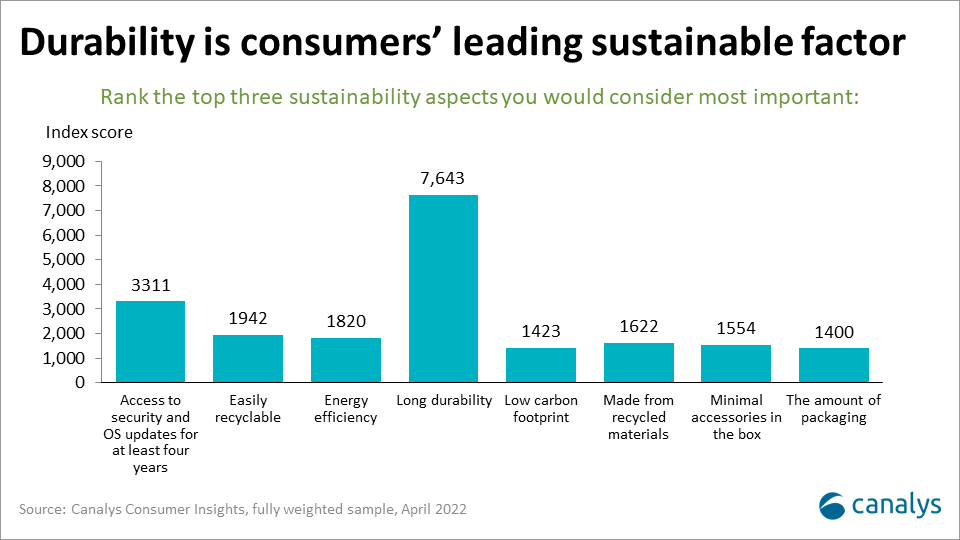

Sustainability awareness among consumers will only grow in the coming years. However, in order to reach the wider, mass market, a different message than an ethical desire to be sustainable will be required. Currently, there is a significant size of the market who takes sustainability factors into their decision-making process, but the majority would still base purchasing decisions on batteries, cameras, and operating systems. For sustainability initiatives to really be impactful and the smartphone industry to take the lead in the sustainability area, addressing the mass audience will be essential. This is where promoting what a sustainable device includes will become important. Here, the focus should be on better batteries, longer upgrade cycles, and perhaps even financial benefits.

In the long-term, more refurbished and secondhand devices, as well as longer upgrade cycles will cause a gradual reduction in the total volume of shipments in the smartphone market. However, instead of considering this as a threat, both smartphone vendors and channel players need to rethink their business models to leverage these new factors. For example, vendors can build more robust, long-lasting devices matching increasing consumer desires, widen their ecosystems to build more physical touchpoints, and even look towards subscription or loyalty programs where they can build stronger connections with the consumer. In all, sustainability will continue to be of leading importance in Western Europe, and smartphone vendors have an excellent opportunity to lead by example and provide a blueprint for other device categories to follow.