Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Apple shifts strategy: pivots from EV ambition

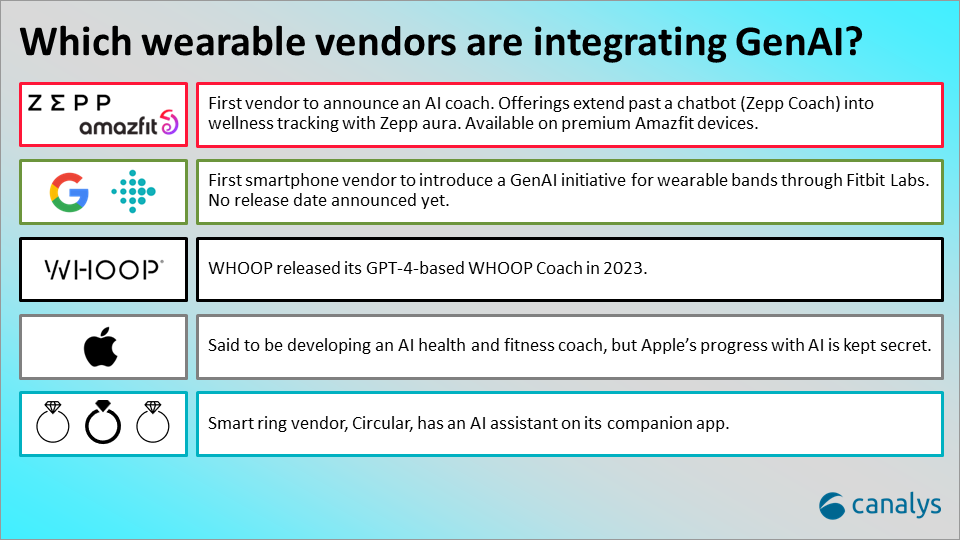

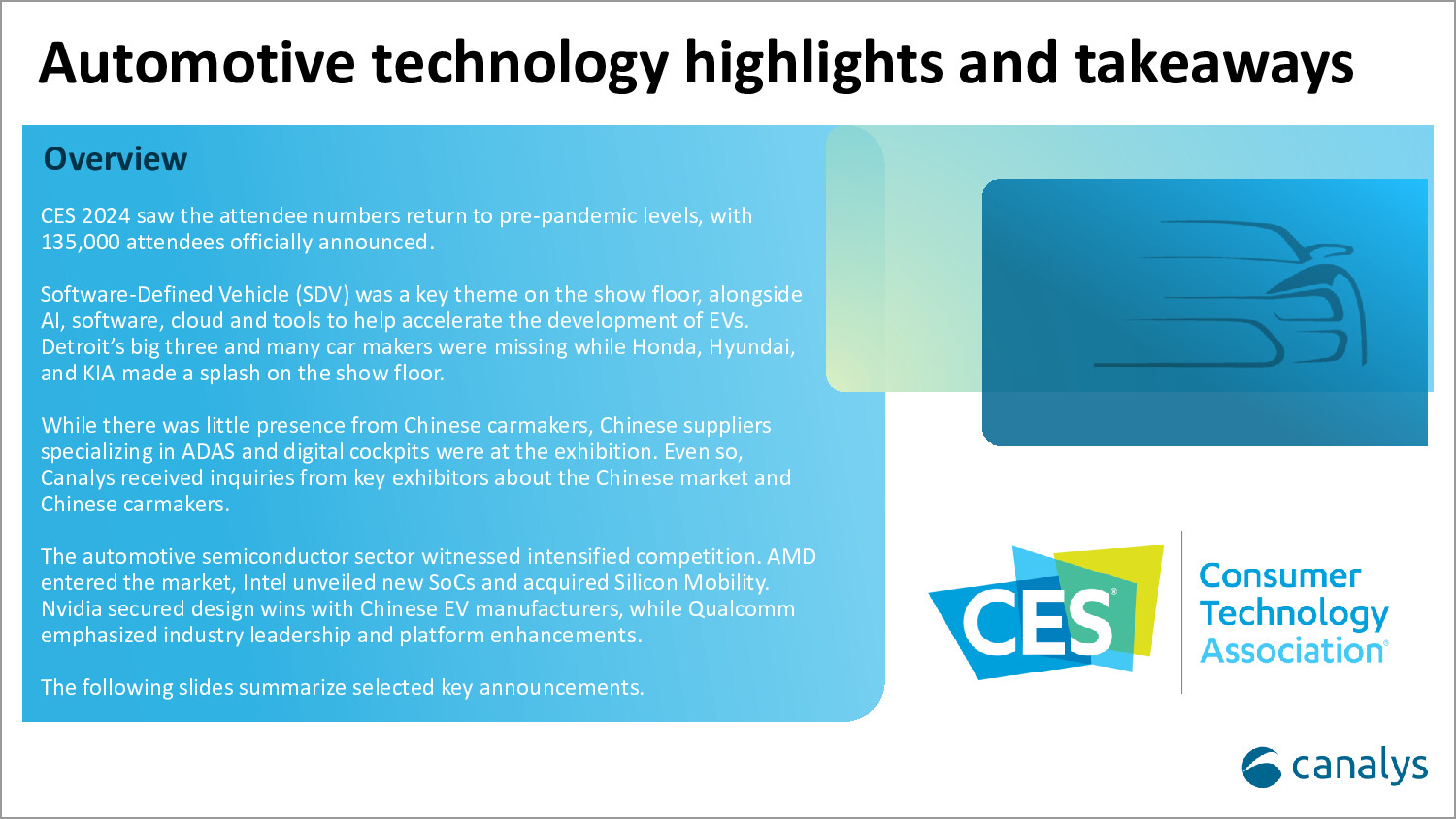

Mainstream media reports indicate Apple’s ambitious electric car project, Project Titan, has hit a roadblock. Despite years of development and a projected 2028 launch, the company has abandoned its plans, shifting its focus to alternative areas, notably generative AI, and mixed-reality technologies. This strategic shift marks a significant change for Apple and raises questions about the future of the EV market and Apple’s role in it.

Apple never publicly confirmed it would make an EV, but had taken several steps over the years to suggest it was serious about it. Apple’s entry into the EV space was highly anticipated, potentially attracting new consumers and driving innovation. It began as an electric vehicle that would compete against Tesla and then transformed into a self-driving system to rival Google’s Waymo. Apple’s decision to move away from its EV ambition marks a significant turning point for the company. For years, rumors swirled around Apple’s secretive Project Titan. However, recent media reports indicated Apple has decided to pull the plug after facing numerous challenges and shifting priorities.

Limitations and adverse market conditions led to Apple’s backstep.

With reported investments surpassing US$10 billion over a decade, the ambitious Project Titan encountered uneven progress throughout its life and the unfavorable EV landscape of the United States. Recent trends in the US EV market indicate a slowdown, albeit with a positive growth trajectory compared to the previous year. However, unsold EV inventory has increased among retailers, and automakers are trimming down EV production. Ford and General Motors have reportedly reduced EV production and postponed investments in EVs amid cooling sales. Ford will focus on hybrid vehicles, calling them a “bridge” to the BEV market. Beyond waning consumer demand, factors contributing to this setback include higher interest rates, reduced government subsidies, and intense competition. Tesla responded to market pressures by adopting an aggressive pricing strategy, although this move adversely impacted its earnings in 2023. Additionally, Tesla has altered its plans to establish a new factory in Mexico, originally intended to serve the North American market, citing the burden of high interest rates. Instead, Tesla has announced plans to manufacture a new electric model at its Texas factory in the latter half of 2025.

Differences in political viewpoints among Republicans and Democrats in the US have left electrification in uncertain waters. The present government aims to make EVs more affordable and EV charging accessible with the help of federal subsidies. The Biden administration aims to add 500,000 new chargers by 2026 and set a goal for 50% of new light-duty vehicle sales to be electric by 2030. However, in the blink of an election in 2024, the priorities can change with a change in the winds.

The EV market is fiercely competitive and complex, which might have been deemed a significant risk for Apple. Meeting stringent safety and regulatory standards for autonomous vehicles added further complexity. Developing autonomous systems for vehicles proved to be a significant technical challenge, requiring expertise in areas beyond Apple’s core competencies. According to a few anonymous employees familiar with the project reported in mainstream media, if Apple had successfully ventured into the EV sector, it would have priced up to US$100,000 and still generate slim profit from this business compared to its other products with a large margin that Apple is used to.

The decision to halt the EV project came after exhaustive deliberations among top executives and the board. The latest rumored approach prior to the project cancellation, was delaying a car release until 2028 and reducing self-driving specifications from Level 4 to Level 2+ technology. The project though struggled nearly from the start, with Apple changing the team’s leadership and strategy several times. The self-driving software was hard to profit from and incompatible with Apple’s core business model or consumer ecosystem.

Apple’s decision to move away from the EV project foregoes a potential future revenue stream. Apple has witnessed flattish growth in iPhone shipments for the last two years and the Vision Pro, which recently launched, isn’t expected to contribute to immediate growth, yet it has a history of abandoning projects, and redirecting focus towards burgeoning sectors with better prospects. So it is understandable that Apple intends to redirect its engineers and investments into areas such as artificial intelligence, which could enhance its consumer electronics business.

Opportunities for Apple in the automotive Industry

In navigating the ever-changing landscape of the automotive industry, adaptability and vigilance are paramount as technology advances rapidly and consumer preferences evolve. Apple’s expertise in software and technology could still offer valuable contributions to the automotive sector. Collaborations with incumbent players hold the potential to accelerate advancements in connectivity and in-car entertainment systems.

While Apple may have stepped away from the automotive playing field, its influence in the automotive industry isn’t entirely out of the picture. Apple’s CarPlay enjoys widespread adoption with car manufacturers, and is a dominant force in in-car infotainment systems. Its user-friendly interface and seamless integration with iPhones resonate with a significant portion of car buyers. Apple introduced the next-generation CarPlay in WWDC 2022, with major updates such as deep integration and support for multi-screen. But there have been no CarPlay updates since then. Apple likely requires carmakers provide deep-level access to vehicle data to enable its next-gen CarPlay functionalities which could be a challenge. It may be too aggressive, and carmakers might be careful with this approach. According to Canalys research, over 75% of global light vehicles can mirror smartphones (with integrated Android Auto and Apple CarPlay) and over 86% of new light vehicles sold in 2023 have this functionality.

Ultimately, the future trajectory of EV industries remains dynamic, with Apple’s decision serving as just one of many factors shaping this evolving landscape. The latest Canalys research predicts sales of global light electric vehicles (EVs) will grow 27% and reach 17.5 million units. The North American EV market will grow 26.8% to 2.2 million units, with the EV penetration at 12.5% in 2024.

So while Apple may not be building cars, its technology and user experience expertise positions it to play a significant role in the future of the automotive industry. Through strategic collaborations and the continued development of CarPlay, Apple can remain an important player in shaping the in-car experience and contributing to advancements in the automotive landscape. With the arrival of digital cockpits, Apple needs a strong product strategy to compete with automakers’ proprietary technologies and Google’s Android Automotive, all while catering to the demands of loyal iPhone users seeking seamless integration within the Apple ecosystem in their vehicles.