Canalys unveils first Co-Sell Software Leadership Matrix

13 December 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

AWS held its global customer and partner event, re:Invent, in Las Vegas at the start of December. For partners, the message was a simplified partner program and an increased drive to marketplace. Canalys has summarized the most impactful changes and what they indicate about AWS’s partner strategy moving forward.

AWS held its global customer and partner event, re:Invent, in Las Vegas at the end of November. For partners, the message was a simplified partner program and an increased drive to AWS Marketplace. Canalys has summarized the most impactful changes and what they indicate about AWS’s partner strategy moving forward.

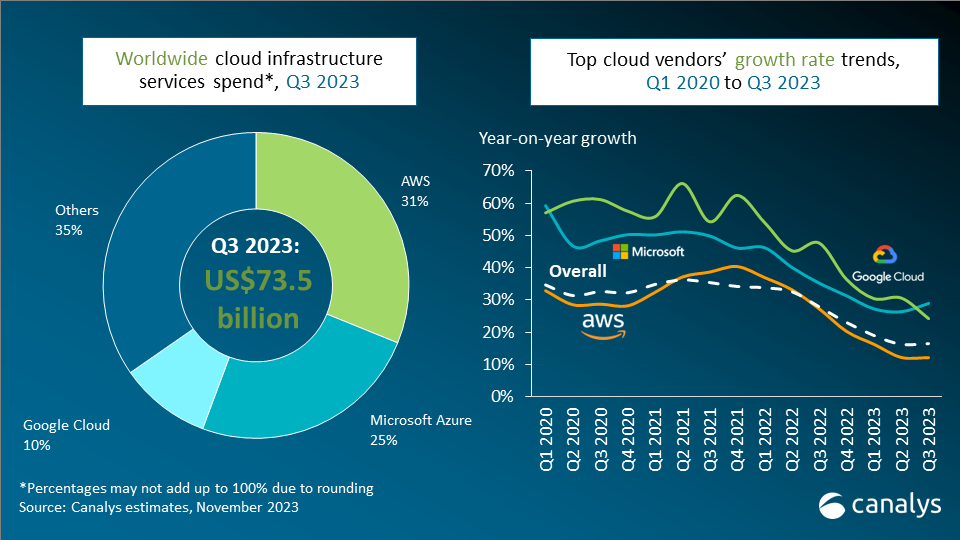

While much of the conversation this event season has been around Generative AI, the partner team at AWS also focused on improving more fundamental elements of their program. AWS’s VP of Worldwide Channels and Alliances, Ruba Borno, used her Partner Keynote session to announce a number of changes and simplifications to the AWS partner program. As AWS’s year-on-year growth rate has lagged behind its major competitors and the overall cloud market since Q3 2022, it will hope these changes will drive an increased adoption rate among target customers.

AWS’s cloud marketplace strategy is becoming a critical component of its broader business model. Over 4,000 ISVs and cybersecurity vendors now offer products on the AWS Marketplace, and billions of dollars of software and cybersecurity are sold through the AWS Marketplace annually. Much of that driven by the scale of AWS’s cloud backlog – the volume of committed customer contracts of more than one year – which had reached over US$130 billion by the end of the first half of 2023. Customers can use up to a quarter of their total committed spend with AWS to buy third party products via the AWS Marketplace, offering an alternative budget stream when core IT budgets face pressures. More and more vendors are rushing to take advantage of this opportunity, while also attracted by AWS’s promise of co-sell and marketing support to help them drive sales momentum and reach new end-customers. For AWS, this creates a self-perpetuating model: most of the ISVs selling via AWS Marketplace also run on AWS, so driving up sales growth also fuels consumption of AWS cloud by the ISVs.

Channel partners play an increasingly important role in this go-to-market model. 52% of partners surveyed by Canalys recognized their customers are either highly likely (23%) or somewhat likely (29%) to buy through a hyperscaler marketplace. Canalys predicted that a third of marketplace transactions will involve channel partners by 2025, and AWS marketplace is already seeing 30% of marketplace transactions involving their partners. Over 2,000 channel partners are now registered to transact Channel Partner Private Offers on the AWS Marketplace. The announcements made at this year’s re:Invent are set to drive this proportion even higher. Programs such as the AWS ISV Accelerate program are already in place to incentivize co-selling partnerships between ISV and services partners within marketplace. The most significant announcement was a reduction of marketplace listing fees for SaaS and data offerings from 13% to 3%. A shift of this magnitude not only brings the AWS marketplace in line with main competitors Microsoft and Google Cloud, but shows a clear strategic shift in viewing the marketplace as a facilitator of consumption and partner revenue, rather than a revenue-generating asset in its own right.

The AWS mantra of simplification is also applied to its partner dashboard changes. By creating an increased number of integrations between the APN Customer Engagements program (ACE), AWS Partner Central (the AWS partner dashboard) and marketplace, AWS aims to facilitate better co-selling and marketplace utilization. These integrations will allow partners to create marketplace listings as well as manage their received Private Offers (POs) on a single dashboard in ACE. Partners will also be able to highlight their need for co-sell support on these POs from the same platform. The platform will enable partners to highlight the specific support they need from AWS (or by extension other partners within the AWS ecosystem) in order to close a specific deal.

With these changes, combined with the restructuring and tiering of the fee structure for POs (and by extension Channel Partner Private Offers (CPPOs), AWS will be aiming to increase the size of POs flowing through marketplace, and also encourage partners to work together to increase the size of the overall offerings being sold to the buyer by leveraging these adjusted co-sell motions. The new fees are as follows:

While simplifying many elements, there is an added layer of complication emerging that these changes highlight. Far from shifting IT spending to a zero-tier distribution model, the Marketplace model is increasingly involving not just channel partners but also distributors. This sees the emergence of two and even three-tiered distribution models. This is being driven both by customer demand (from those who want to source products from AWS Marketplace via a trusted partner rather than directly) and vendors selling on the marketplace, who want to manage potential conflict with their existing resellers and distributors, but also use these partners to address some of the challenges that the marketplace model creates. This creates new layers of complexity for vendors, channel partners, and AWS. While the opportunity is significant, partners will have to strategize around the best approaches to co-selling motions, both in the AWS ecosystem and more broadly.

Having unveiled its Partner Profitability Framework at last year’s re:Invent, AWS has made announcements this year to focus on the operational efficiency side of its partners’ profitability. Much of the current inefficiency comes from deeply complex AWS programs, specializations, certifications, and validations and the time and effort required from partners to manage all of this. For example, AWS has added five new specializations, taking the number of specializations to over 100 (including the AWS Resilience Competency, AWS Cyber Insurance Competency and AWS Built-in Competency for ISVs). To help with ease of understanding and simplicity, AWS has brought all of these programs (including what were previously validations) under a single ‘umbrella’, AWS Specializations. This simplicity is critical for partner success, not just from a profitability and efficiency point of view, but from the point of view of winning sales. As new Canalys research highlights, 87% of cloud customers rank vendor specializations as a top three differentiation factor when it comes to selecting new cloud partners. Without an understanding of whether potential partners have the desired specializations, many customers will discount a potential partner entirely. The overhaul of the specializations program will be to simplify both partner and customer experience. This will continue to expand in the AWS marketplace. Having introduced Vendor Insights last year, a functionality within marketplace that allows buyers to accelerate vendor validation while ensuring security compliance, AWS announced expansion of this functionality to include specializations. Starting with the Security and Level1 MSSP competencies, buyers will be able to organize partners by the specializations they hold to accelerate buying decisions. Changes have also been made to the partner management portal, Partner Central, to consolidate management elements such as funding and analytics all in a single frame of reference.

AWS will be hoping that simplifying the partner experience within its ecosystem will drive AWS adoption and growth globally. With AWS growth rates currently at 12.2% according to Canalys’ most recent estimates of the cloud infrastructure market, reliance on driving multiplier revenue and related infrastructure growth will be critical to AWS maintaining its market leading position in the cloud infrastructure market. A Canalys Partner Ecosystem Multiplier study identified a revenue multiplier of up to US$6.40 for every US$1 of AWS infrastructure sold. This means there is a significant amount of additional revenue available to partners adding services on top of AWS infrastructure. With a focus on a services-led approach, there is an additional opportunity for partners and AWS to increase consumption rates of customers. Furthermore, the focus on marketplace and specializations will allow partners to better serve and meet their customers in the customers’ place of preference and remove some of the burden of procurement within the technology market as a whole.