Avoid being a sustainability support outcast

21 December 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

The latest Canalys forecast published 22 November, shows we expect less than 5% of smartphones shipped in 2024 to be AI-capable, but that still means AI-capable smartphones will hit around 60 million shipments in 2024, while there will be 53 million units of AI-capable PCs in the same year.

Though AI on smartphones is not new, we've seen AI running on ISPs and NPUs on-device for nearly a decade, the emergence of LLMs has led us to re-think and re-define the definition of "AI-capable" smartphones powered by generative AI (GenAI). This blog explores this new definition and why smartphones can be essential for vendors to implement on-device GenAI, as well as what on-device AI applications on smartphones will look like in the future.

Unlike PCs, smartphones have embraced AI technology for much longer, making "AI-capable smartphones" a much broader concept to define. Chipset vendors such as Qualcomm, Mediatek, Samsung and Google have focused on improving NPU/TPU performance for years. Smartphone vendors including Apple, Huawei, vivo, and Xiaomi are implementing AIML algorithms locally to improve imaging quality, battery life, and typing experience. However, integrating LLM and other GenAI models on-device will require a different computing platform and software capabilities. Canalys believes an "AI-capable" smartphone should meet the following criteria:

Minimal requirements: A smartphone that meets all the following criteria can be defined as an "AI-capable smartphone".

Optional requirements: An "AI-capable smartphone" may not necessarily meet all the following requirements. However, meeting the optional requirements can enhance the user experience.

Prominent installed base: Smartphones have the most extensive installed base compared to edge computing devices such as PCs. Canalys expects the total installed base of global smartphones to reach five billion in 2023, much larger than the 1.4 billion installed base for laptops and desktops combined. The gap will become more prominent, especially in developing markets and among younger generations, who have jumped over the PC era and spend more time on content consumption and social media using mobile-native apps. AI applications will, therefore, reach a larger audience when integrated into the smartphone form factor.

Portable form factor: Smartphones are portable and can accelerate the penetration of AI app usage. A pocket-sized device enables use cases that more closely align with daily activities, ranging from communication to entertainment. These use cases can complement the productivity use cases of PCs, thus widening the reach of AI in digital life. The availability of different sensors in smartphones further enhances data collection for AI, paving the way for the development of highly personalized AI applications.

Robust app ecosystem: Smartphone's robust app ecosystem will enable a thriving developer community for vendors. Unlike smartwatches, which typically have fewer applications in the marketplace, and focus on specific use cases such as health and workout suggestions, smartphones offer a broader canvas for AI innovation. The strength of the app ecosystem facilitates seamless AI integration across apps and fosters the creation of diverse third-party AI applications under a strong developer community.

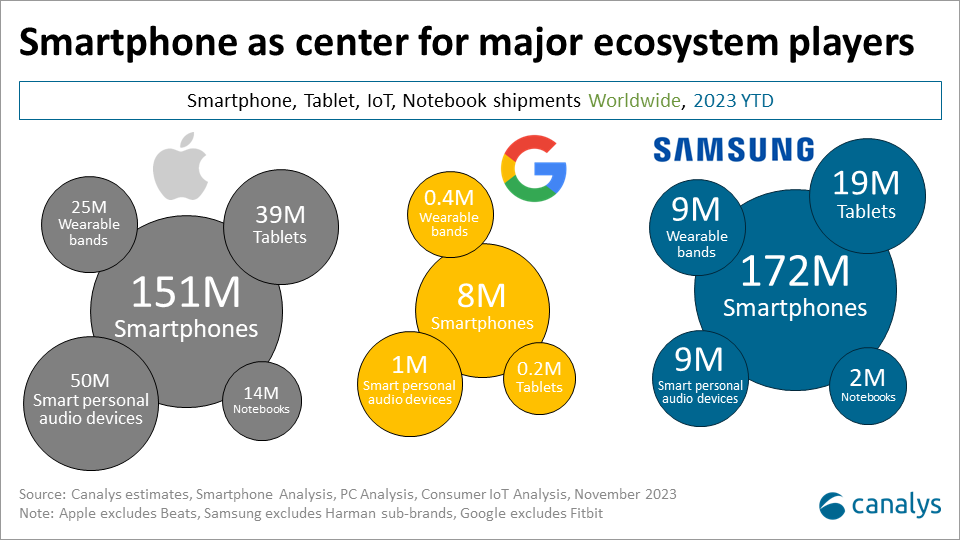

Hub in the smart device ecosystem: A smartphone's connectivity and versatility means it plays a more critical role than other edge devices. Major players in the industry, such as Samsung with its Galaxy Ecosystem and Xiaomi with its smartphone x AIoT strategy, put smartphones at the center of their vast device ecosystems. Integrating AI on-device will further enhance the interconnected experience, empowering smartphone AI to generate personalized actions to control other devices based on user behavior and contextual scenarios.

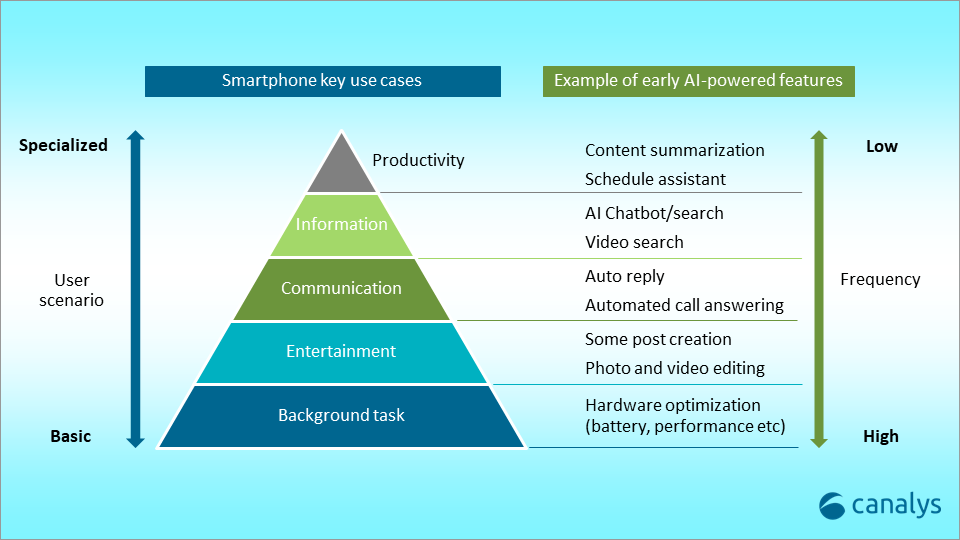

The following chart shows a smartphone's major use cases including Entertainment, Communication, and Information in a pyramid view. We also list some (early) potential AI-powered features for each use case. AI-powered features such as enhanced photo editing and auto-reply, are expected to be used by most users. These high-frequency, AI-powered features will help vendors boost the usage of AI on smartphones and gain more mindshare among consumers.

Smartphones are also a light productivity device for most users compared to PCs. So vendors still need to develop meaningful features in the "productivity" area to attract prosumers in the premium segment. It is worth noting that prosumers expect quality, accuracy, and reliability in Gen AI output. Therefore, establishing credibility and trust in the AI features and their on-device models is essential, providing opportunities for differentiation for vendors that can demonstrate their AI capabilities early on to capture the premium prosumer market.

Some examples of AI features we identified from early AI-capable smartphones which are on the horizon.

Background tasks:

Entertainment:

Communication:

Information:

Productivity:

We must emphasize the importance of building a third-party developer community in smartphone vendors' overall AI strategy and, more importantly, broadening smartphone use cases and creating AI-native apps. TikTok and Uber, mobile-first apps that shape how we use smartphones today, are often made by third-party developers, which will bring out Gen AI-powered apps, leveraging vendors' foundation models. Smartphone vendors must work closely with the developer community to gain future competitive advantage through unique AI features running on their devices. Some vendors have already taken steps, and our previous blog discussed Samsung's roadmap to develop AI leadership by collaborating with developers. Chinese vendors, OPPO, vivo, and Xiaomi, are also proactively fortifying the developer community by rolling out open-source LLMs. Stay tuned for our next blog to dive deeper into the opportunities and challenges for the Chinese vendors in the AI race.