Indian smartphone market stabilized in 2023, eyeing growth in 2024

8 February 2024

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Cloud, fueled by FedRAMP’s restructure and Executive Order 14028, will drive federal IT market growth in 2024. We predict that the growing federal IT budget, combined with the momentum surrounding cloud, will result in the federal channel opportunity reaching a record-high US$60.1 billion in 2024.

For the US federal IT market, cloud and cybersecurity have been the major drivers of growth over the last five years. This was accelerated by the issuance of Executive Order 14028 – “Improving the Nation’s Cybersecurity” – which obligates government departments to modernize their IT infrastructure with an emphasis on shifting to secure cloud, adopting zero-trust architecture and implementing security tools, such as multifactor authentication and encryption. Despite US$10.9 billion of the 2023 federal IT budget being designated specifically to cybersecurity, many US government departments remain below the minimum standards outlined in EO 14028. This is of particular concern as the deadline to meet standards is the end of fiscal 2024, but it represents a tremendous opportunity for the cybersecurity vendor community and its partners.

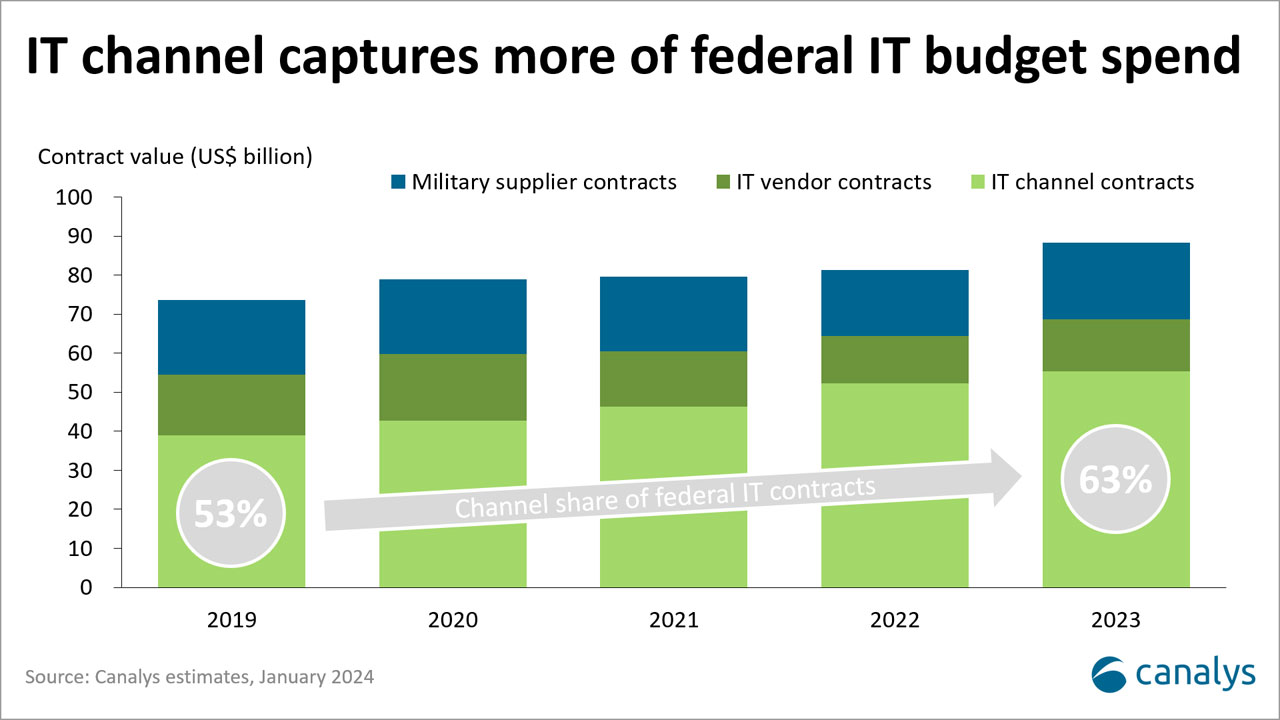

Historically, the federal market has lagged behind the wider IT market when it comes to sourcing from channel partners, but there has been a clear shift over the past five years. Since 2019, the value of contracts owned by channel partners has risen 29.5% from US$39.1 billion to US$55.4 billion in 2023. The share of the channel’s contracts compared with direct business has also grown from a channel market share of 53.1% in 2019 to 62.8% in 2023. This growth is being driven by the federal civilian IT budget, set to reach US$74.0 billion in 2024, up 11.6% from last year and up 29.0% from 2020. Approximately 83% of the federal IT budget goes to contractors.

The federal channel has been growing rapidly over the last two years, driven by increased demand for services and a federal push for cloud adoption and cybersecurity improvements.

In 2023, the Canalys federal top 50 generated US$55.4 billion in IT contracts out of the estimated US$88.3 billion that went to contractors out of the federal civilian and defense IT budgets. Some 35 of the top 50 federal channel companies grew their IT contracts from 2022 to 2023, with 21 of these partners growing their contract obligations by more than 10%. From 2018 to 2023, channel contracts increased by an average of US$4.0 billion per year and total IT contracts (including vendors’) increased by an average of US$3.6 billion per year. The channel’s five-year average growth outpaces the federal market’s five-year average growth. This data shows that not only is the federal government’s dependence on IT contractors growing over time, so is its dependence on partners.

The federal market is also growing as a share of the overall US market: Canalys IT opportunity data reveals that the federal market has outpaced the overall US market in four out of the last five years. The total US IT opportunity in 2023 was US$1.6 trillion, with a growth rate of 2.7%. While the federal IT opportunity was only 3.2% of that total in 2023, its growth of 5.7% that year outpaced that of the overall market.

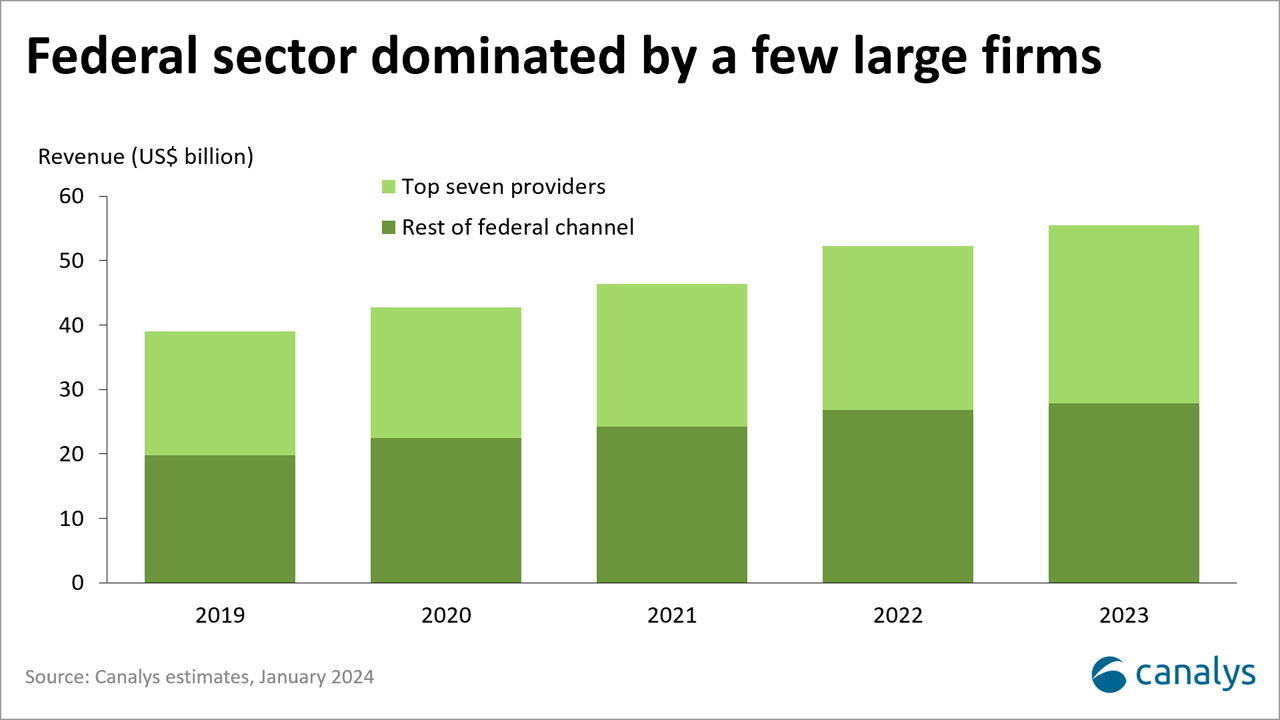

The federal government prefers to work with companies that either do business exclusively or primarily in the federal sector. As an illustration of this preference, seven of the top 10 federal channel partners count the federal government as their largest customer, including business outside of IT. Services have consistently been the main driver of the federal market’s growth over the last five years, with average growth rates exceeding those of all other partner types.

Large companies generated most of the top 50’s 2023 contract obligations, yet only four of the top 10 channel partners’ 2023 IT contracts represented more than 50% of their total revenue in 2023. On average, federal revenue as a share of total revenue was 15.1% for the 50 leading federal IT channel partners. But for 31 of the top 50, federal contract obligations accounted for more than 50% of their total revenue.

Most federal IT contracts are for services, highlighting the government’s need for support for its IT infrastructure. The top seven companies all provide services. The top seven together accounted for 66.2% of the entire top 50’s 2023 growth, and 49.7% of the top 50’s contract obligation total for 2023. The share the top seven has of the top 50 in 2023 is roughly equivalent to what its share was in 2019.

The Federal Risk and Authorization Management Program (FedRAMP) was established in 2011 as the federal government’s tool to assess and authorize cloud services (not providers) for use by federal agencies. Each cloud service that holds federal data must be FedRAMP-certified. It is one of the most rigorous assessments of cloud services in the world. Many FedRAMP services were tailor-made for the federal government due to the level of rigor in the assessment, especially services used in moderate and high-risk environments. As of 30 January, there are 325 FedRAMP-authorized services, of which 290 are SaaS.

FedRAMP marked the federal government’s first attempt to legislate cloud, but the program did not gain much traction until 2018. In 2015, only 20 services were FedRAMP-authorized. “Reuse”, as defined by FedRAMP, is the number of times an existing FedRAMP authorization has been reused by another agency, added to the total number of times the service is used by another FedRAMP-authorized service. Total FedRAMP reuses have grown from 1,900 in 2020 to over 6,500 today – a 342% increase in just three years. The vast majority of cloud services used by federal government agencies today were adopted within the last five years, especially in the last three years since President Biden’s cybersecurity EO.

Historically, FedRAMP authorization could take as long as 18 months and could cost businesses hundreds of thousands of dollars. To speed up the authorization process and lower the cost for government and businesses alike, the Office of Management and Budget, one of FedRAMP’s governing bodies, released a memorandum in October overhauling the program’s structure and guidance. FedRAMP’s new structure and guidance is set to go into effect early next year. The restructure is likely to result in hundreds of SaaS solutions obtaining FedRAMP authorization for the first time, creating a large opportunity for the channel.

We predict that the federal channel will grow to US$60.1 billion in 2024, maintaining similar levels of growth to previous years (8.5%) with increased market share. The significant influence of service partners in this market is indicative of the level of support required by government agencies in their transitions to the cloud as well as managing and defending against the growing number of cyber-threats. The most successful partners in this space will be able to leverage long-term service deals that provide substantial continued support to government clients.