Expanded Scale and Leadership in B2B: From R&D to ROI

With a combined permissioned audience of 50+ million professionals, TechTarget and Informa Tech’s digital businesses have come together to offer industry-leading, global solutions that enable vendors in enterprise technology and other key industry markets to accelerate their revenue growth at scale.

US tariffs: the pros and cons for the technology channel

Over the first weekend in February, US president Donald Trump announced sweeping tariffs on Canada (25%), China (10%) and Mexico (25%). Tariffs were due to come into force on 4 February 2025. But after discussions between the countries, a month’s pause has been announced for Canada and Mexico. Tariffs on China came into force on 4 February 2025, with China launching retaliatory tariffs in response. US tariffs (or the threat of) could soon be rolled out to other countries and regions, including the European Union. The introduction of tariffs may have a significant impact on the technology industry

During US President Trump’s first term, tariffs were threatened long before they were implemented in two phases in 2018. These tariffs targeted specific industries and led to some stockpiling of semiconductor components, finished networking products, and PCs and accessories before they took effect, though vendors only had a short time to act. The first two rounds of tariffs resulted in a short-term uplift for many of the Tech Titans in those segments, as deals were pulled forward and organizations committed to investments ahead of tariff-related price rises. Vendors then had to pass on higher supply chain costs via price rises to customers, not only in the US but worldwide. But this uplift was then followed by a period of stagnation as customers delayed making investments until the COVID-19 crisis sparked another wave of growth for the tech industry.

In his second term, President Trump announced tariffs on all imports from Mexico, Canada and China shortly after his inauguration.

The tariff announcement, and resulting counter-tariffs, bring multiple challenges to vendors and partners and are complicated by uncertainty as to when, how long and how far they will go. Vendors have been preparing contingency measures for these latest tariffs for some time, as universal baseline tariffs were threatened during the election campaign, despite the exact details not being clear. Many PC OEMs began to build inventories to help them offset the impact in the short term. Exports from China to the US jumped by more than 15% in December 2024 as firms moved to beat the potential price rises that could come from tariffs being passed onto consumers.

Last-minute agreements were made with Mexico and then Canada shortly before the tariffs took effect, which paused their implementation for a month in return for border-related security commitments. This is likely to be just the start of further trade negotiations, though it does give a small window of opportunity for vendors with supply chains in Mexico to rethink their inventories in the US. But the tariffs on all Chinese imports took effect on 4 February, with de minimis tax loopholes also closed on small packages couriered from China worth US$800 or less.

China doesn’t go as far as the US (yet)

As it stands, China has announced retaliatory tariffs of 10% to 15% on US imports, targeting key sectors such as natural gas, crude oil, raw materials and automobiles.

The new duties, effective from 10 February 2025, include:

- 15% tariffs on coal and liquefied natural gas (LNG).

- 10% tariffs on crude oil, agricultural machinery, large-engine vehicles and pickup trucks.

Beyond tariffs, China has launched an antitrust investigation into Google (among other US companies). Google’s search engine is not available in China, but its Android OS is used by Chinese smartphone vendors internationally. This gives China the option of further action or it could reach an agreement with the US, like Canada and Mexico.

Vendors will scrutinize supply chains further

Supply chain relocation (or at least diversification) will likely accelerate, as it did during Trump’s first term. Significant modifications may need to be made to products to change country of origin status and avoid the tariffs themselves, something that has been common for some time and could be re-ignited. Companies will negotiate harder with their China-based manufacturers to absorb costs. Possible impacts on foreign exchange rates with the US dollar may help mitigate price increases in the short term.

Supply chain costs will also rise as the increased cost of oil and increased demand for freight push costs further. For example, Vietnam is yet to have tariffs applied, but if significant tariffs are implemented there, expect to see relocation or at least some form of supply chain diversification. Equally, vendors that have relocated some of their supply chains to countries such as Guatemala, Peru, Thailand, Costa Rica, India or Puerto Rico may focus on using these bases for the short term.

This could lead to delays in product launches and delivery. Conversely, increasing production in the US could lead to increased domestic production and job creation. But moving production lines is a lengthy and complex process.

In Trump’s first term, all these countries, except for Puerto Rico, were included on the United States Trade Representative’s (USTR) 12-month and 24-month watch lists, which were used as the basis of reasoning for some of the country-specific tariffs. Currently, 27 countries are listed in the USTR’s 2024 Special 301 Report.

Distribution is back in vogue

Distributors are well-placed to capitalize on the fallout from tariffs. Supply chain logistics will be key and managing this for vendors (and partners) will give distributors a renewed focus. Distributors may choose to hold more stock to account for supply chain disruption and protect against price increases. There is a fine line for distributors as they balance the risk of market demand softening with higher prices with the risk of being left with excess inventory or even being pressured by vendors to absorb costs. Distributors’ core competencies in capital and credit capabilities (especially given the current cost of money) will be vital to support partners. Currency fluctuations, given the uncertainty, also play to distributors’ strengths.

Partners see a short-term boost

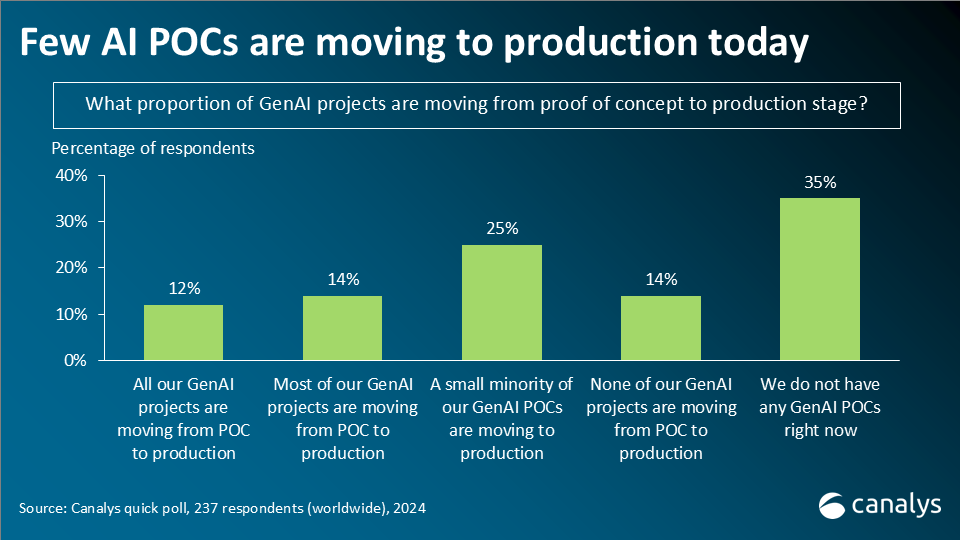

In a recent Canalys quick poll, over 40% of partners stated that they believe tariffs are good news for their businesses. They almost certainly expect to see higher prices leading to higher margins (and potentially a short-term demand boost). This is a short-term impact and risks creating yet another bubble in the technology industry. Sentiment varies regionally, with partners outside of the US being more positive about the impact on their businesses. The feedback from US partners was more polarized: just 18% of partners felt it was good news for their businesses, while 20% saw it as disastrous. US partners are likely more fearful of the potential impacts on business and consumer confidence.

Uncertainty and disruption remain the new norm

Over the last five years, COVID-19, geopolitical crises and economic weakness have contributed to significant uncertainty. The confirmation of tariffs (and ongoing threat) will serve to heighten the risk of further disruption. Predicting the impact of tariffs is difficult as the long-term economic strategy of the US administration is unclear and the impact will vary by industry and country. Both the vendor and partner communities will need to adapt strategies to minimize the impact of tariffs and capitalize on any opportunities they may bring in the short term, and hope for longer-term stability.