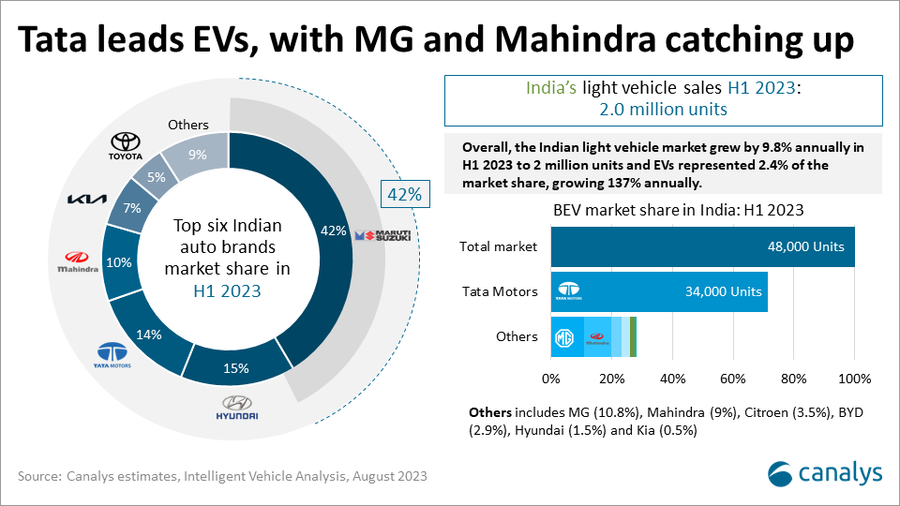

Tata Motors takes 72% share in India's burgeoning EV market

Friday, 11 August 2023

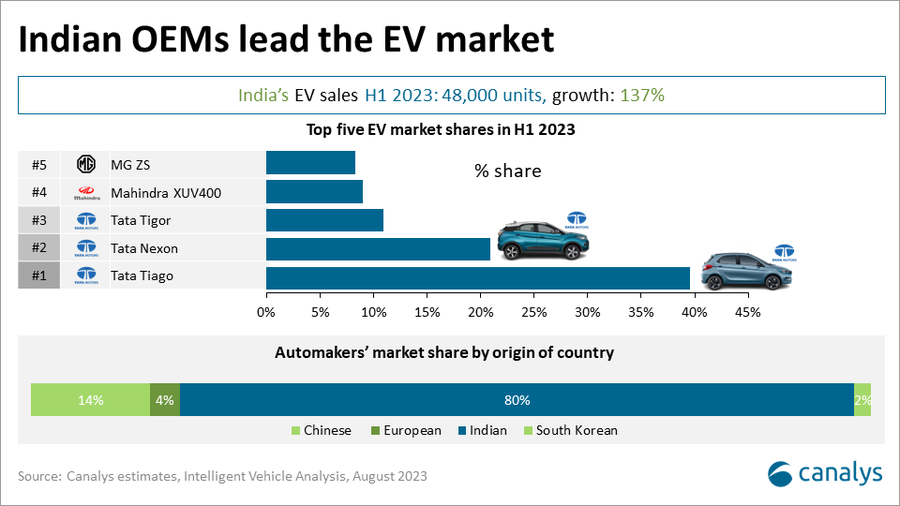

The latest Canalys research reveals that India’s light vehicle market grew by 9.8% in H1 2023 to 2.0 million units, up from 1.8 million in H1 2022. Electric vehicles (EVs) occupied 2.4% of the Indian market share and the market grew by a phenomenal 137% year on year with 48,000 EVs sold.

Ranked as the world’s third-largest automotive market, India showcases significant magnitude. Numerous automotive OEMs are aligning their mobility strategies with the government’s objective of EVs attaining 30% of all vehicles sold by 2030. To achieve this goal, the OEMs will introduce more EV models during the latter half of this decade. Improving EV charging infrastructure in the country will also complement this strategic move.

“Continuing its momentum from 2022, the Indian EV market grew significantly in H1 2023. There is now a good choice of inexpensive and premium EVs, providing an inclusivity-driven expansion during the first half of the year to potential customers,” said Ashwin Amberkar, Analyst at Canalys. “Affordable, feature-loaded EVs are attracting budget-conscious buyers and it has widened the market’s reach across various economic classes this year. Premium EVs with a longer range and features including advanced connectivity, upgradable infotainment and ADAS technology have proved popular with tech-savvy eco-conscious professionals.”

Tata Motors sold 34,000 EVs during H1 2023, capturing 72% market share. Key contributors to this accomplishment included the highly popular Tiago, priced at US$10,000, Nexon and Tigor models. Tata’s plans include introducing four more EVs by 2024.

MG also made a notable impact in 2023. It surpassed 10% market share, largely due to the success of the MG ZS and its new offering, the MG Comet (also known as the MG Air), which gained traction in selected markets.

In a competitive move, Mahindra presented a direct challenge to Tata with its XUV 400, securing a substantial 9% market share. Similarly, Citroen’s eC3 EV achieved a 3.5% market share, reflecting a positive market response to more affordable compact EVs.

BYD, which aims to gain an ambitious 30% EV market share by 2030, commenced deliveries of the Atto 3 in Q1 2023 and gained a 2.8% market share in H1 2023. The Seal model will arrive by the end of 2023, potentially leveraging an early-move advantage over Tesla.

Hyundai launched its second EV, the Ioniq 5, sharing the platform with the Kia EV6. It is a top seller in its segment and the combined Kia/Hyundai market share has risen to over 2% from 0.8% in H1 2022. Hyundai revamped its short and long-term mobility strategy and aims to launch five distinct EV models by 2032.

Maruti Suzuki, India’s leading car manufacturer, will launch its first EV in 2024 and plans to launch six more models by 2030. Maruti is late with EVs, but its scale and ambition give it the potential to dramatically expand the size of the Indian EV market.

“Despite increased competition in 2023, Canalys expects Tata to continue to dominate the market, with the Tiago remaining the most affordable EV in the market,” said Amberkar. “More deliveries will continue in H2 2023, with the potential to increase the market share of EVs to over 3.5%.”

Tesla is in discussions to manufacture EVs in India in the future with an aim to cater to its increasing global demands. Tesla’s best chance of success selling in India will be with a more affordable vehicle based on the next-generation platform. By manufacturing in India, it will benefit from local subsidies. However, the government is committed to promoting local supply to cater to global demands.

Electric scooter manufacturer Ola announced that it will launch its first electric four-wheeler in the latter half of 2024. It aims to compete with Tesla.

The Chinese automotive OEM BYD recently announced its intention to invest US$1 billion in India to establish manufacturing facilities for EVs and batteries. However, it stepped back after its proposal faced scrutiny from the government.

“Developing countries such as India, with a healthy talent pool, favorable government policies and active EV subsidiaries, are attractive markets for global automakers when many developed countries are quashing EV benefits,” said Amberkar. “India offers a good supplier ecosystem to manufacturers. However, there is an immediate need for sufficient EV component suppliers in the country.”

The FAME India Phase II government scheme to promote nationwide rapid adoption of EVs through automakers’ incentives will continue to help establish the market until its expiration on 31 March 2024. Canalys forecasts that the EV market in India will grow to over 300,000 units in 2025, representing over a 6% market share of the total light vehicle market, achieving a CAGR of 59%.

Important definitions:

Light vehicles include passenger cars and light commercial vehicles.

EVs include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs).

For more information, please contact:

Ashwin Amberkar: ashwin_amberkar@canalys.com

Gain detailed insights into the transformation of the global automotive market with Canalys' industry-leading Intelligent Vehicle Analysis service. We focus on critical aspects, from brand analysis to model evaluation. With our specialized research on electric vehicles (EVs), new energy vehicles and intelligent vehicles, Canalys provides insightful data about car connectivity, convenience, driver assistance, and safety features. The Canalys Intelligent Vehicle Analysis Service goes beyond the typical market research product. It is a tailored solution designed to empower businesses with the tools they need to make informed decisions and stay competitive in the rapidly changing automotive landscape.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.