Global cloud services market growth slows to 16% in Q2 2023

Thursday, 10 August 2023

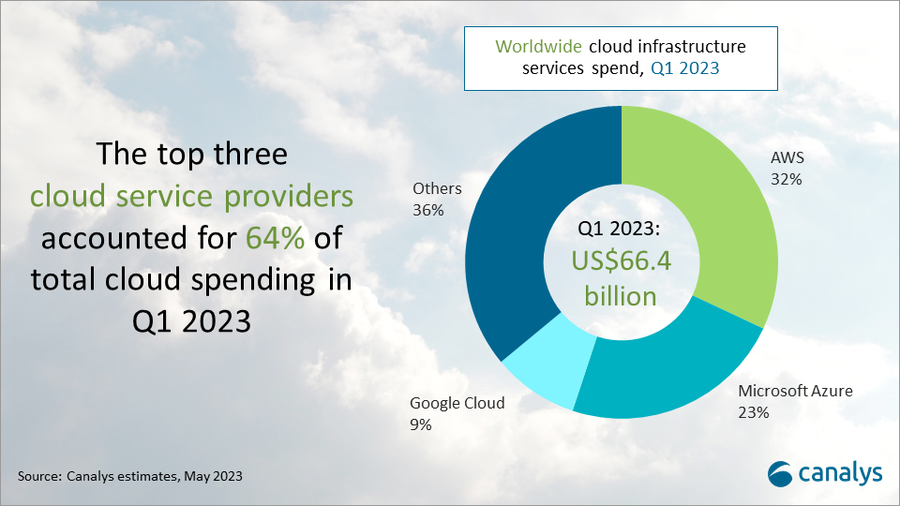

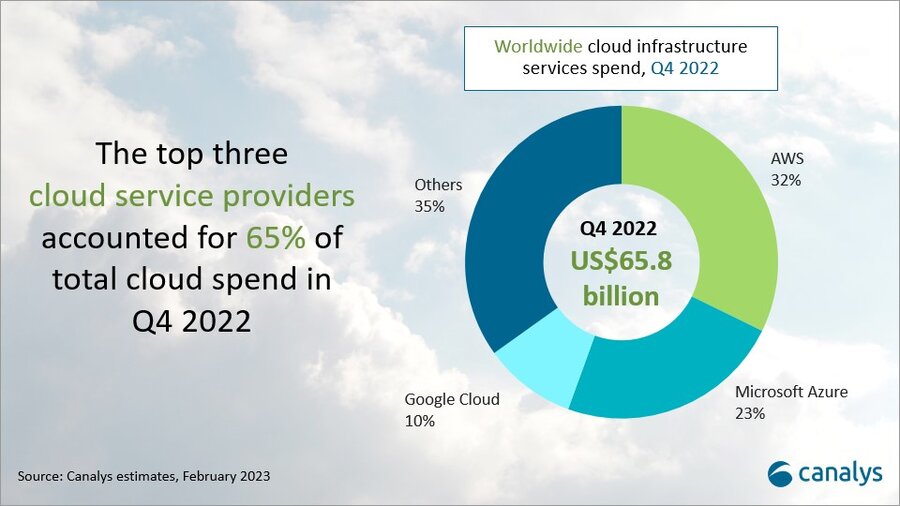

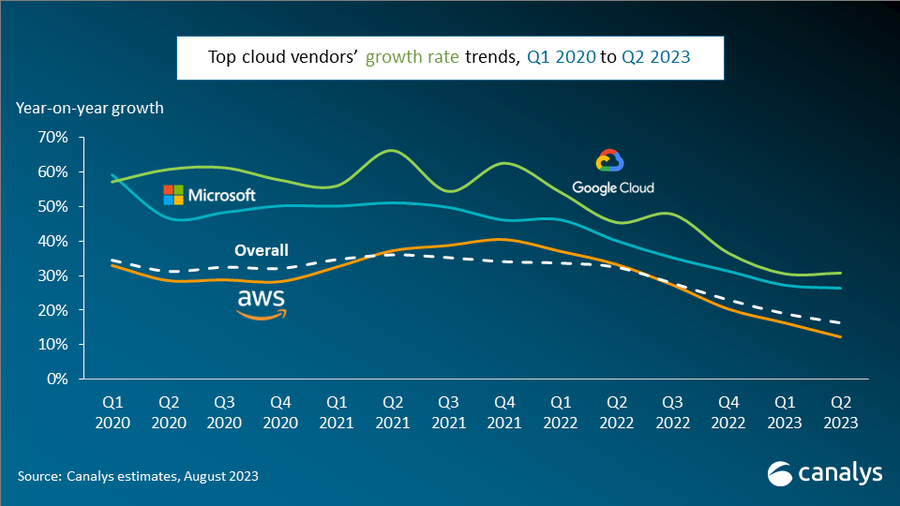

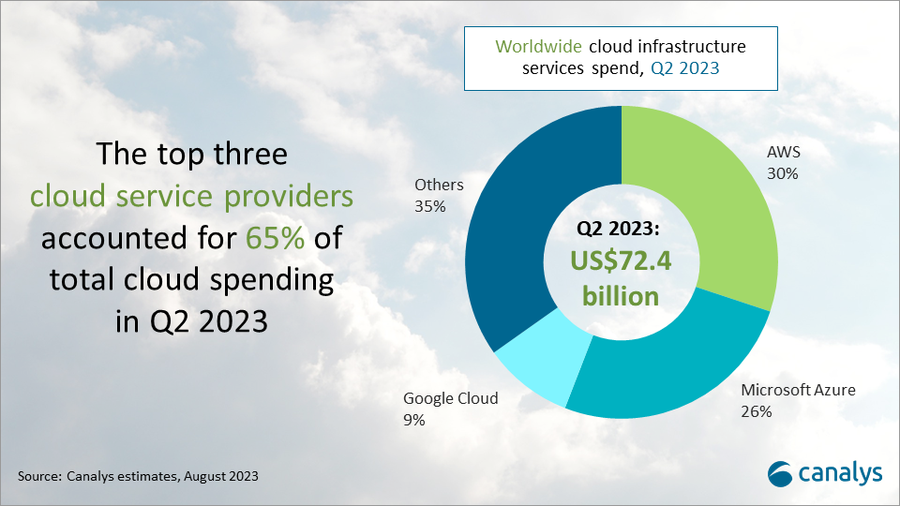

Worldwide cloud infrastructure services spending increased 16% to US$72.4 billion in Q2 2023. This growth rate represents a decline against the previous quarter’s 19%, as the market feels the effect of spending pressures, though slower growth is also a consequence of the market’s greater size. In Q2 2023, the top three vendors, AWS, Microsoft Azure and Google Cloud, collectively grew 20% – down from 22% in Q1 – to account for 65% of total spending. While AWS and Microsoft both saw a deceleration in growth, Google Cloud’s growth rate remained stable compared with the previous quarter, at 31%.

The impact of the strengthening US dollar on hyperscalers is diminishing. But ongoing macroeconomic uncertainties mean customers remain focused on optimizing cloud usage to reduce costs. So far, AI technologies and their integration into existing products are yet to see widespread commercialization, so have not had a meaningful impact on revenue for the cloud providers. But AI represents a major driver of cloud investment in the future, and all the major cloud vendors continue to invest heavily in AI technologies.

In the current business landscape, where emphasis is placed on cost control, cloud vendors must secure a significant influx of new customers and workloads to drive revenue growth. The emergence of AI technology is introducing new cloud workloads and is set to fuel massive demand for computing capacity, creating new opportunities for cloud growth. Notably in this quarter, both AWS and Microsoft launched new AI-oriented partner programs, recognizing the importance of collaborating with partners to drive customers’ use of their AI products.

“The most common collaboration model involves partners contributing their industry expertise, business process knowledge and data analytics experience within relationships,” said Yi Zhang, Research Analyst at Canalys. “Cloud providers, in turn, offer partners early exposure to their emerging technologies and provide technical support.”

“In the meantime, vendors need to separate the wheat from the chaff when it comes to driving their AI strategies through partners,” said Alex Smith, VP at Canalys. “That means focusing on partners that are building service practices around AI, engaging in sales and marketing initiatives that focus on AI, producing original thought leadership and compelling case studies around AI applications, and selling solutions that are embedded with AI capabilities. It’s these partners that will assume a leading role in steering companies toward being leaders in this field.”

Amazon Web Services (AWS) continued to lead the cloud infrastructure services market in Q2 2023, accounting for 30% of total spend, an increase of 12% year on year. AWS’s growth has more than halved since the same period last year. In the face of subdued revenue growth, AWS is actively increasing its investments in AI. It invested US$100 million in a new generative AI program, which was launched in June 2023. As part of the program, the AWS Generative AI Innovation Center will serve as a hub for free workshops and training and is expected to help enterprises accelerate the development of generative AI-based applications while connecting AWS’ technology with customers and partners. Recent announcements from AWS reveal that thousands of customers are engaging with its new AI service and, concurrently, AWS has established new partnerships with Omnicom and 3M Health Information Systems.

Microsoft Azure accounted for 26% of the market after growing 26% annually, positioning it as the second-largest cloud service provider in Q2 2023. Business performance is expected to remain steady, given the 19% increase in its cloud order backlog, which reached US$224 billion in Q2 2023. It has seen significant momentum in its Azure OpenAI Service, winning noteworthy clients including Ikea, Volvo Group and Zurich Insurance. In light of the projected surge in AI demand, it introduced the Microsoft AI Cloud Partner Program during its global partner event, Microsoft Inspire 2023. This aims to encourage Microsoft’s partner ecosystem to develop solutions that use Microsoft’s AI technology. Microsoft aims to ensure a smooth transition for its existing partners, automatically enrolling them in the new program while retaining their previous benefits and designations.

Google Cloud grew 31% year on year in Q2 2023, the strongest growth of the top three hyperscalers, to capture 9% of the cloud market. Its approach to extending the depreciation period for servers and network equipment helped control operating costs and bolstered Google Cloud’s profitability. Google Cloud’s partner ecosystem continues to provide support in the development of its generative AI applications. Hundreds of ISVs and SaaS providers, including Box, Salesforce and Snorkel, along with GSIs, have committed to training over 150,000 individuals on Google Cloud’s Generative AI. Google Cloud claims to command the allegiance of over 70% of burgeoning tech startups that specialize in generative AI. This roster features standout names such as Cohere, Jasper and Typeface, exemplifying the trust startups place in Google Cloud’s AI capabilities.

Canalys defines cloud infrastructure services as those services that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact:

Alex Smith: alex_smith@canalys.com

Yi Zhang: yi_zhang@canalys.com

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.