Canalys: Apple grows 40% to take the crown in China smartphone market in Q4 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Friday, 28 January 2022

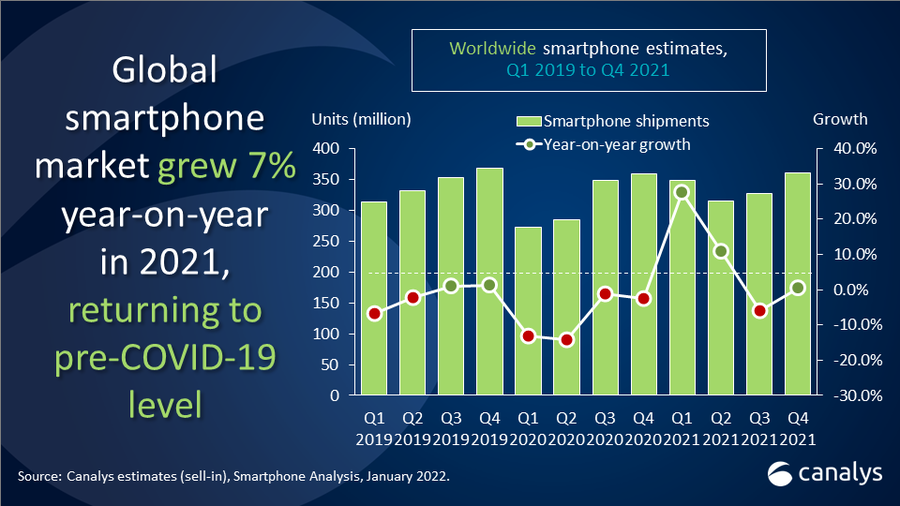

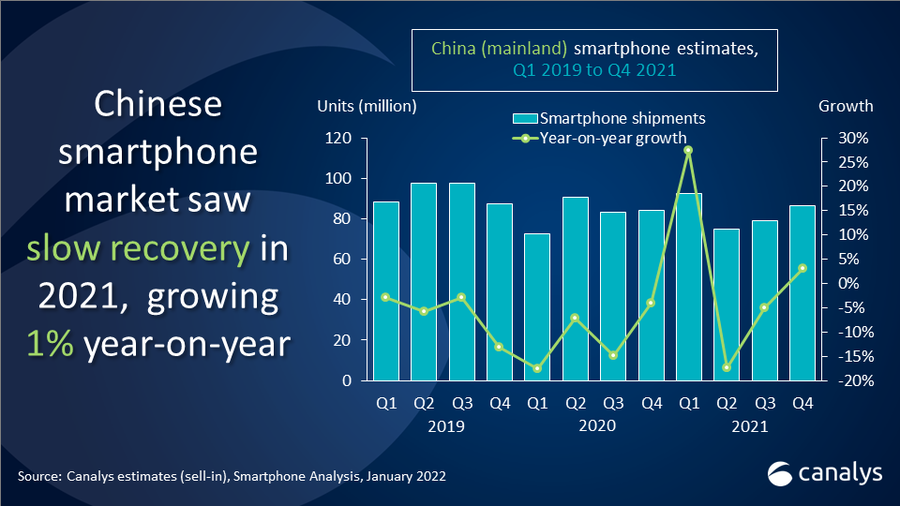

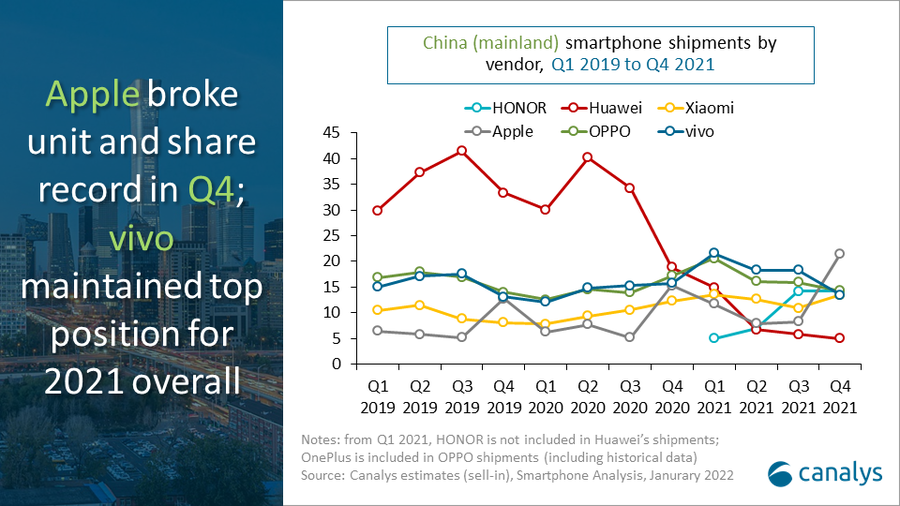

2021 was a rollercoaster ride for the smartphone market in Mainland China. Vendors opened the year with overly aggressive Q1 launches followed by a subdued Q2 and Q3 due to market adjustments and supply constraints. The smartphone market in China in Q4 2021 closed with 86.6 million units shipped, a slight year-on-year growth of 3%. For the full year, 2021 saw nearly 333 million units shipped, a year-on-year increase of 1%, still more than 10% below the pre-COVID-19 level in 2019.

In the fourth quarter, thanks to the release of the iPhone 13 series, Apple shipped 21.5 million smartphones in China and regained top position for the first time since Q1 2015. OPPO (including OnePlus) ranked second with 14.3 million units with a strong focus on its mid-to-high portfolio. HONOR further consolidated its position in the top three with 14.2 million smartphones shipped in Q4. Xiaomi refreshed its flagship lineup and drove shipments up sequentially to 13.5 million units to maintain fourth place. Affected by its launch timeline, vivo ranked fifth with 13.4 million units.

“Apple delivered an outstanding quarter, providing an adequate supply to the Chinese market amid its tight global supply. Apple’s China market share in Q4 2021 was its highest and accounted for a quarter of total market shipments, a record for Apple since it entered in 2009,” commented Canalys Analyst Toby Zhu. “Apple surprised the market with a lower launch price of the iPhone 13 series which greatly stimulated consumer interest, while overall retail consumption was subdued in Q4 in China. Meanwhile the absence of strong Android competitors in the high-end segment also contributed to Apple's stella performance this quarter,” Zhu added. "This also validates the demand of the high-end segment in China, where consumers are less affected by the macro-economic uncertainty. Apple's success will further accelerate Android vendors’ investment in the high-end market, with highly differentiated features and experiences for domestic consumers.”

"Mainland China will remain the world's largest high-end market in 2022, contributing around 30% of smartphone shipments priced above US$500 globally. Gaining a meaningful share in the high-end segment gives vendors early access of innovative technologies and component supply security, as well as negotiating power in channel cooperation,” said Canalys Research Analyst Amber Liu. “Throughout 2021, Chinese vendors have made notable progress in their high-end production lines, such as the OPPO Find X3, Xiaomi Mi 12, vivo X70, and HONOR Magic3. In addition, foldable smartphones have provided a highly differentiated form factor and experience for Android vendors to compete with Apple.”

"Consumer demand remains the main disappointment in the China smartphone market," commented Canalys VP of Mobility Nicole Peng. "Despite the supply shortage, China will remain a high priority for supply allocation given its size and importance. The challenge for vendors is to provide enough differentiations in both hardware technology and experience in this mature product category to accelerate the mid-to-high-end user replacement cycle. Although it is difficult to see China returning to the 400 million units a year level, the Chinese market shipment value and the ASP have been increasing steadily. This will definitely attract strong contenders to challenge Apple’s dominance in the high-end segment this coming year.”

|

People’s Republic of China (mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: Q4 2021 |

|||||

|

Vendor |

Q4 2021 |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual |

|

Apple |

21.5 |

25% |

15.3 |

18% |

40% |

|

OPPO |

14.3 |

16% |

17.7 |

21% |

-19% |

|

HONOR |

14.2 |

16% |

- |

- |

- |

|

Xiaomi |

13.5 |

16% |

12.2 |

15% |

10% |

|

vivo |

13.4 |

15% |

15.7 |

19% |

-14% |

|

Others |

9.7 |

11% |

23.1 |

28% |

-58% |

|

Total |

86.6 |

100% |

84.0 |

100% |

3% |

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; |

|||||

|

People’s Republic of China (mainland) smartphone shipments and annual growth Canalys Smartphone Market Pulse: 2021 |

|||||

|

Vendor |

2021 |

2021 |

2020 |

2020 |

Annual |

|

vivo |

71.5 |

21% |

57.8 |

18% |

24% |

|

OPPO |

68.7 |

21% |

59.6 |

18% |

15% |

|

Xiaomi |

50.5 |

15% |

39.8 |

12% |

27% |

|

Apple |

49.4 |

15% |

34.4 |

10% |

44% |

|

HONOR |

40.2 |

12% |

- |

- |

- |

|

Others |

52.6 |

16% |

138.7 |

42% |

-62% |

|

Total |

332.9 |

100% |

330.3 |

100% |

1% |

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; |

|||||

For more information, please contact:

Toby Zhu: toby_zhu@canalys.com +86 150 2674 3017

Amber Liu: amber_liu@canalys.com +86 136 2177 7745

Nicole Peng: nicole_peng@canalys.com +86 150 2186 8330

Senior Canalys analysts will be attending MWC Barcelona this year and looking forward to meeting press, clients and new contacts in person. Get in touch to arrange a meeting.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.