Half a billion PCs and tablets shipped worldwide in 2021

Shanghai (China), Bengaluru (India), Singapore, Reading (UK) and Portland (US) – Thursday, 3 February 2022

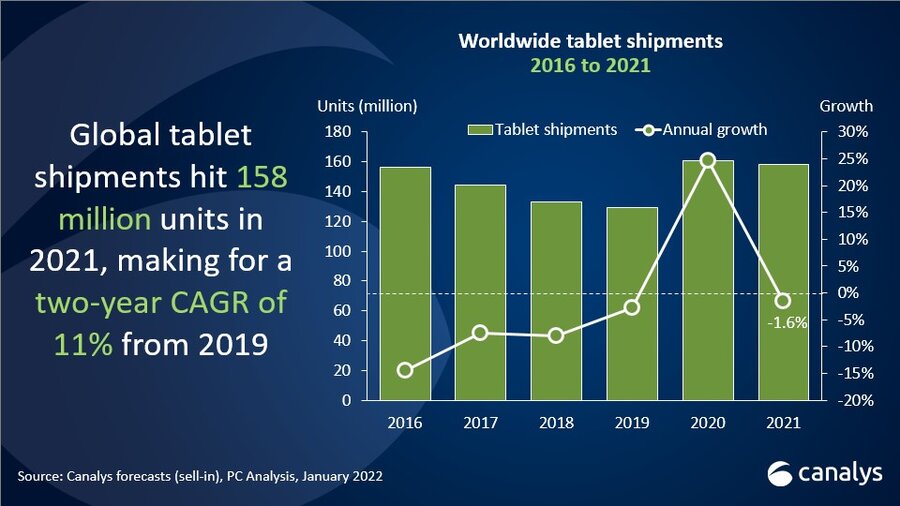

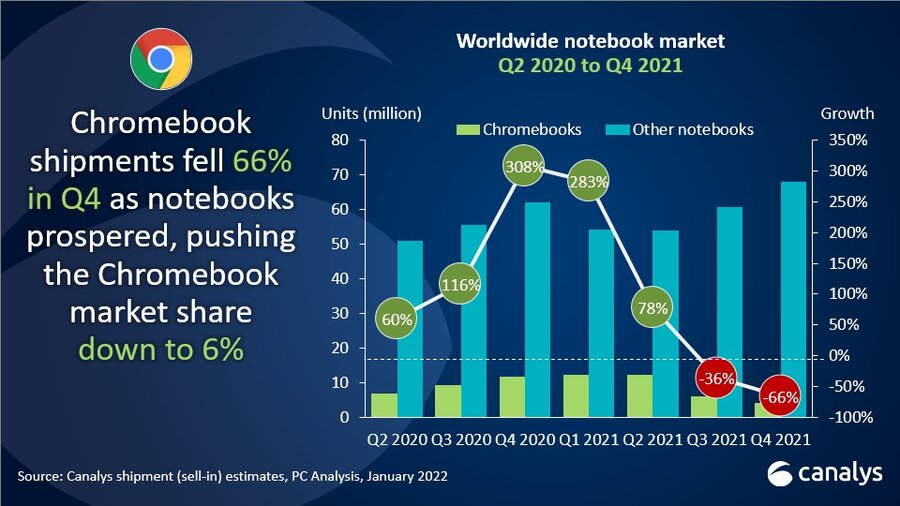

The latest Canalys data shows that worldwide PC (including tablet) shipments fell 7% year on year in Q4 2021, to 133.7 million units. Despite this drop-off, 2021 was a bumper year for PCs and tablets, as total shipments for the year grew 9% to just under half a billion. Chromebooks and tablets, which had been growth engines during the pandemic, both saw shipments suffer steep yet expected annual declines in Q4 2021, primarily due to high saturation in the consumer and education segments. Tablet shipments fell 21% year on year to 41.9 million units, while Chromebook shipments dropped 66.3% to 4.0 million units. For full-year 2021, Chromebook shipments grew 10% while tablet shipments were almost flat, down by 1.6%.

Despite a 10% sequential increase in shipments during the holiday quarter, the worldwide tablet market plummeted by 21% year on year in Q4 2021. Apple maintained its lead in the rankings with 16.4 million iPads shipped with a 14% annual decline. Samsung held second place with 6.8 million units shipped in Q4 2021, a 31% fall in shipments from a year ago. Lenovo saw tablet shipments decline year on year for the first time in 2021, with 4.7 million units shipped. Amazon and Huawei rounded out the top five, with 4.0 million and 2.2 million devices shipped respectively.

“The tablet space is more diverse now than it was last year, as a host of new players have entered the market, with many more in line to release products,” said Canalys Analyst Himani Mukka. “Though the market saw a year-on-year decline, shipments remained higher than before the pandemic, showing the strength of the tablet revival. The slowdown in Q4 was understandable given the supply constraints stifling growth, as seen in the case of iPads, with delivery lead times for devices stretching to up to two months. Tablets are expected to see subdued growth in coming quarters as the market reverts to its normal seasonality and users who bought tablets in the last 18 months hold onto their current devices. But the postponement of commercial deployments and government tenders in major countries will rebalance the scales for the tablet market.”

Chromebooks experienced a second successive quarter of falling shipments, with a 66% drop as education and consumer demand fell from highs in Q4 2020. Overall, the Chromebook market grew 10% in 2021 despite the last two quarters of negative growth. This has created a massive installed base in the education and consumer markets, which points to future growth potential for the platform.

“Chrome, unsurprisingly, had a second successive quarter of negative growth in Q4,” said Canalys Research Analyst Brian Lynch. “The platform’s dominance in the education segment allowed for astonishing shipment numbers over the past two years, especially as the education industry was thrown into turmoil by the pandemic and had to find innovative ways to continue operations. Chrome has a window of opportunity as developing markets begin to invest in their digital education strategies. Markets such as Brazil and Indonesia are still seeing strong demand and are expected to continue growing well into 2022. While Chrome OS has had decent success outside education, that share of the business remains small, and limited to certain markets only. With businesses able to better plan for the year ahead and the overall component supply situation improving, Chrome will face a decisive year in its battle to gain share against Windows, especially in commercial.”

All major Chromebook vendors struggled in Q4. Acer, with its focus on the less volatile European markets, avoided as steep a decline as other vendors and took the top spot in Q4 with 910,000 units shipped. Second-placed Lenovo, which was a key vendor in Japan’s GIGA education program, saw shipments fall 73% to 749,000 units. HP suffered the largest decline of the top five vendors, with shipments down 87% to 471,000 units. Asus achieved an 18% market share, becoming the third biggest Chromebook vendor. Dell took fourth place with 641,000 units shipped.

In the total PC market (including desktops, notebooks and tablets), Lenovo maintained its dominance, shipping 26.5 million units in Q4 2021. Despite an 8% fall in total shipments, Apple stayed in second place with 24.3 million devices shipped. HP, with 18.6 million units sold in Q4 2021, held onto third place, with a modest 3% year-on-year decrease. Dell, in fourth position, saw a 9% rise in shipments to 17.3 million devices, and just under a 2% increase in market share over the previous year. Samsung shipped 7.9 million devices to complete the top five.

Appendix: Shipment (sell-in) estimates for worldwide PC market, tablet market and Chromebook market, Q4 2021 and full-year 2021

|

Worldwide PC (including tablet) shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q4 2021 |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual growth |

|

Lenovo |

26,500 |

19.8% |

28,792 |

20.0% |

-8.0% |

|

Apple |

24,256 |

18.1% |

26,348 |

18.3% |

-7.9% |

|

HP |

18,646 |

13.9% |

19,268 |

13.4% |

-3.2% |

|

Dell |

17,279 |

12.9% |

15,873 |

11.0% |

8.9% |

|

Samsung |

7,855 |

5.9% |

11,631 |

8.1% |

-32.5% |

|

Others |

39,131 |

29.3% |

42,072 |

29.2% |

-7.0% |

|

Total |

133,667 |

100% |

143,984 |

100% |

-7.2% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|

||||

|

Worldwide PC (including tablet) shipments (market share and annual growth) |

|||||

|

Vendor (company) |

2021 |

2021 |

2020 |

2020 |

Annual growth |

|

Lenovo |

99,666 |

20.0% |

86,630 |

18.9% |

15.0% |

|

Apple |

90,004 |

18.0% |

81,349 |

17.7% |

10.6% |

|

HP |

74,140 |

14.8% |

67,812 |

14.8% |

9.3% |

|

Dell |

59,560 |

11.9% |

50,494 |

11.0% |

18.0% |

|

Samsung |

35,631 |

7.1% |

34,645 |

7.6% |

2.8% |

|

Others |

140,368 |

28.1% |

137,541 |

30.0% |

2.1% |

|

Total |

499,369 |

100% |

458,470 |

100% |

8.9% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|

||||

|

Worldwide Chromebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q4 2021 |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual |

|

Acer |

910 |

23.0% |

1,444 |

12.3% |

-37.0% |

|

Lenovo |

749 |

18.9% |

2,808 |

23.9% |

-73.3% |

|

Asus |

722 |

18.3% |

1,281 |

10.9% |

-43.6% |

|

Dell |

641 |

16.2% |

1,559 |

13.3% |

-58.9% |

|

HP |

471 |

11.9% |

3,541 |

30.1% |

-86.7% |

|

Others |

462 |

11.7% |

1,117 |

9.5% |

-58.6% |

|

Total |

3,955 |

100.0% |

11,750 |

100.0% |

-66.3% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2021 |

|

||||

|

Worldwide Chromebook shipments (market share and annual growth) |

|||||

|

Vendor (company) |

2021 |

2021 |

2020 |

2020 |

Annual |

|

HP |

10,250 |

30.1% |

9,374 |

30.4% |

9.4% |

|

Lenovo |

8,200 |

24.1% |

6,771 |

21.9% |

21.1% |

|

Acer |

5,159 |

15.1% |

4,320 |

14.0% |

19.4% |

|

Dell |

3,603 |

10.6% |

4,655 |

15.1% |

-22.6% |

|

Asus |

3,348 |

9.8% |

2,744 |

8.9% |

22.0% |

|

Others |

3,524 |

10.3% |

2,996 |

9.7% |

17.6% |

|

Total |

34,084 |

100.0% |

30,860 |

100.0% |

10.4% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2021 |

|

||||

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

Q4 2021 |

Q4 2021 |

Q4 2020 |

Q4 2020 |

Annual |

|

Apple |

16,443 |

39.2% |

19,186 |

36.2% |

-14.3% |

|

Samsung |

6,892 |

16.4% |

9,916 |

18.7% |

-30.5% |

|

Lenovo |

4,742 |

11.3% |

5,573 |

10.5% |

-14.9% |

|

Amazon |

4,011 |

9.6% |

6,537 |

12.3% |

-38.6% |

|

Huawei |

2,239 |

5.3% |

3,631 |

6.9% |

-38.3% |

|

Others |

7,587 |

18.1% |

8,143 |

15.4% |

-6.8% |

|

Total |

41,914 |

100% |

52,986 |

100% |

-20.9% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|

||||

|

Worldwide tablet shipments (market share and annual growth) |

|||||

|

Vendor (company) |

2021 |

2021 |

2020 |

2020 |

Annual |

|

Apple |

61,043 |

38.6% |

58,775 |

36.5% |

3.9% |

|

Samsung |

30,093 |

19.0% |

30,978 |

19.3% |

-2.9% |

|

Lenovo |

17,467 |

11.0% |

13,985 |

8.7% |

24.9% |

|

Amazon |

13,299 |

8.4% |

15,854 |

9.9% |

-16.1% |

|

Huawei |

9,189 |

5.8% |

16,708 |

10.4% |

-45.0% |

|

Others |

27,208 |

17.2% |

24,557 |

15.3% |

-10.8% |

|

Total |

158,299 |

100% |

160,856 |

100% |

-1.6% |

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding. Source: Canalys PC Analysis (sell-in shipments), February 2022 |

|

||||

Senior Canalys analysts will be attending MWC Barcelona this year and looking forward to meeting press, clients and new contacts in person. Get in touch to arrange a meeting.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

For more information, please contact:

Himani Mukka (Singapore): himani_mukka@canalys.com +65 8223 4730

Brian Lynch (US): brian_lynch@canalys.com +1 503 927 5489

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.