Global smart personal audio market falls 3% in Q3 2023, but TWS, wireless headphones and developing markets grow

Thursday, 14 December 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

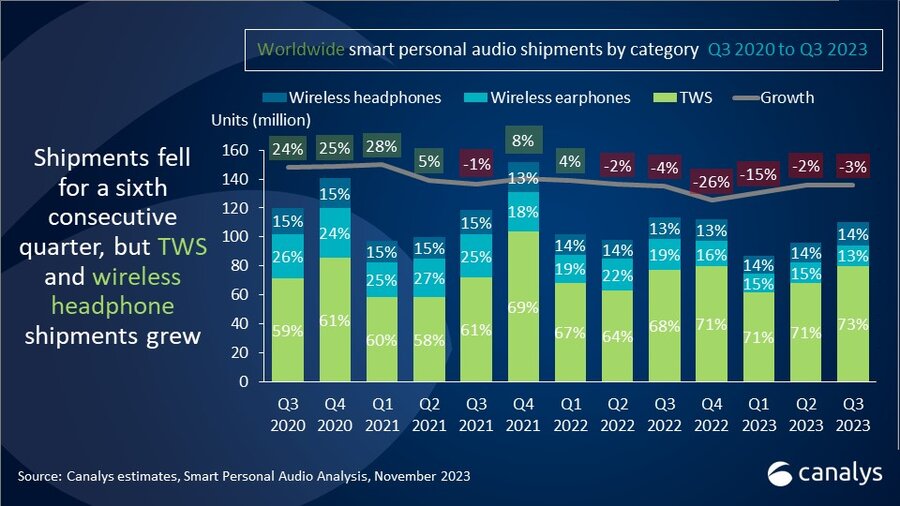

Canalys’ latest research shows that global smart personal audio shipments fell 3% year on year to 110 million units in Q3 2023, with developed regions struggling while emerging regions grew strongly. TWS made up 73% of shipments, as they continue to penetrate affordable mass-market segments. Shipments of wireless headphones surpassed those of wireless earphones for the first time, predominantly due to vendors seeking stronger revenue drivers through wireless headphones and wireless earphones being replaced by TWS. Alternative wearable forms, such as air and bone conduction devices, made up less than 2% of shipments in Q3. Despite being niche, these devices highlight ongoing form factor innovation in search of profit and differentiation in a saturated market.

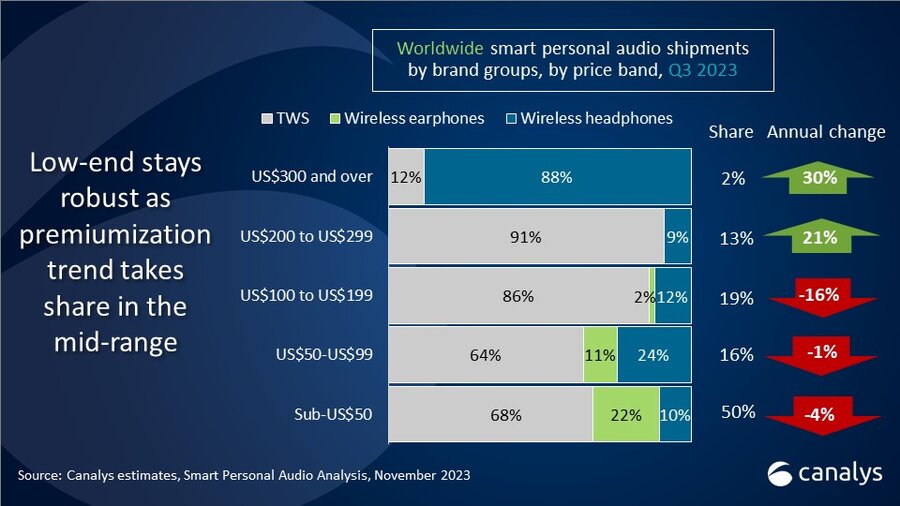

“Demand for smart personal audio devices remains robust despite this quarter’s decline,” said Jack Leathem, Research Analyst at Canalys. “But there were big differences between regions. North America and Western Europe fell 12% and 10%, respectively, reflecting challenging business environments there. These regions currently have strong premium segments alongside robust entry-level segments. The Q3 decline was partly caused by vendors’ strategic decision to skip yearly flagship releases, effectively extending refresh cycles following vendors prioritizing premium models. At the same time, the mid-range segment declined in Q3, lacking clear value-for-money offerings as audio quality and ANC has spread to the low end.”

“Access to good audio quality at lower price points led to a return to growth in China after five quarters of decline,” said Cynthia Chen, Research Manager at Canalys. Vendors are prioritizing lower prices and emerging open-ear form factors to stimulate repeat purchasing in China, where demand is currently poor for consumer electronics. One of the fastest-growing players was Huawei, which leveraged its strong smartphone growth to cross-sell ecosystem devices, and consequently grew its shipments by 30% compared with Q3 2022. “In the fiercely competitive Chinese market, vendors are responding to the homogenization of TWS by looking for new avenues for growth. The exploration of innovative formats and emphasis on sound quality in entry-level wireless headphones contributed to reinvigorating the Chinese market,” said Chen.

“Emerging regions are booming, with most growing volumes by double digits,” said Chen. “The growth stems from improving economic conditions alongside an influx of attention from Chinese vendors seeking to capture increasing opportunities in growing audio markets. Emerging regions offer the opportunity to vendors to establish entry-level device ecosystems, of which personal audio devices are a key part, fostering future user loyalty. As these regions continue to grow, vendors will aim to build user stickiness with their ecosystems and drive device upgrades.”

“We expect growth to return in Q4, driven by replenishing inventories and holiday shopping season deals”, said Leathem. “Looking to 2024, feature-based innovation will help boost shipments. Vendors will prioritize increased device capabilities, such as spatial audio, hearing enhancements and Bluetooth LE, to match product developments from their competitors. Improving economic conditions and expected flagship portfolio launches from Apple and Samsung should further boost the market in 2024. Canalys estimates that total shipments for 2024 will be 3.3% higher than in 2023. But competition in the market will remain fierce across price segments. In this competitive environment, building brand strength and visibility must be a priority for vendors. Using partnerships, collaborations, special editions and interactive in-store stands are among the tools vendors should use to tempt consumers away from the status quo.

|

Global smart personal audio shipments and annual growth |

|||||||

|

Vendor |

Q3 2023 shipments (million) |

Q3 2023 |

Q3 2022 |

Q3 2022 |

Annual |

||

|

Apple |

23.4 |

21% |

25.3 |

22% |

-7% |

||

|

Samsung |

9.2 |

8% |

10.7 |

9% |

-14% |

||

|

boAt |

6.5 |

6% |

6.6 |

6% |

-1% |

||

|

Sony |

5.2 |

5% |

4.6 |

4% |

+11% |

||

|

Xiaomi |

4.3 |

4% |

3.6 |

3% |

+22% |

||

|

Others |

61.4 |

56% |

62.8 |

55% |

-2% |

||

|

Total |

110.1 |

100% |

113.6 |

100% |

-3% |

||

|

|

|

|

|||||

|

*Apple includes Beats; Samsung includes Harman subsidiaries Note: Percentages may not add up to 100% due to rounding. |

|

||||||

For more information, please contact:

Jack Leathem: jack_leathem@canalys.com

Cynthia Chen: cynthia_chen@canalys.com

Canalys’ Smart Personal Audio Analysis is a service that provides qualitative and quantitative insights into the market for smart personal audio devices. It guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and sell on the appropriate platforms to engage in different markets worldwide.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.