Wearable band market bounces back with 6% growth in Q2 2023 after two quarters of decline

Tuesday, 19 September 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

According to Canalys estimates, vendors shipped 44 million wearable bands worldwide in Q2 2023, representing year-on-year growth of 6%. “The wearables market is coming back to life, driven by increasing consumer demand in various aspects of daily life,” said Jack Leathem, Research Analyst at Canalys. “Demand across different segments is rebounding, leading vendors to address specific consumer needs.”

The basic watch category continued to grow, capturing nearly half the market, mainly thanks to Indian players and major smartphone vendors, such as Huawei, Xiaomi and Huami. In the Indian market, basic watches continued their phenomenal momentum, with shipments up 73%, underscoring the vibrancy of the country’s wearables market.

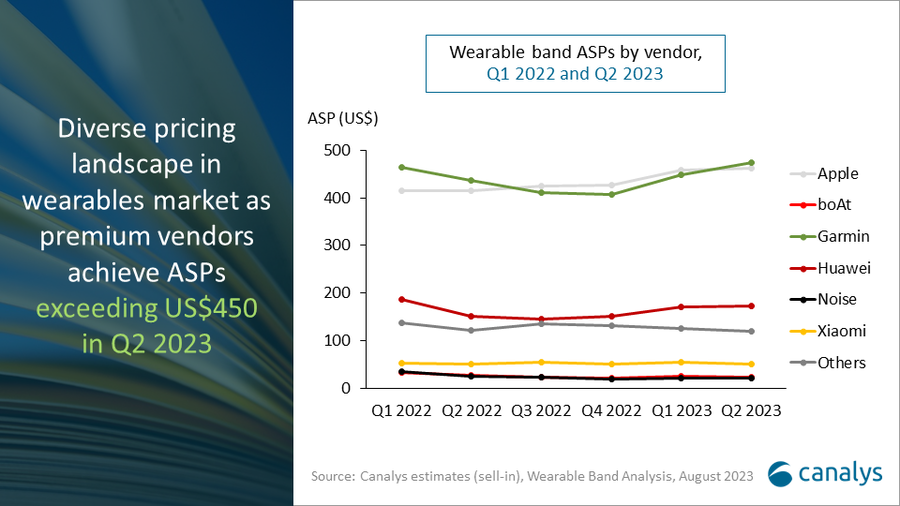

Despite a year-on-year decline, basic bands maintained a stable market share at 19%, thanks to the availability of affordable options and consumers’ cautious attitudes to higher-priced alternatives. The watch category has seen substantial double-digit growth, primarily propelled by competitively priced basic watches. Vendors introduced a slew of new wearables in the second quarter to bolster their market presence. For example, Xiaomi and Huawei launched basic bands and basic watches with enticing prices, appealing to diverse consumer preferences. Indian vendors have followed suit, with brands such as Noise introducing entry-level models while also launching some higher-priced products to cater to other customer segments. Fire-Boltt has further cut prices, offering consumers exceptional value with an average selling price below US$19.

“As the market evolves, clear segmentation trends are emerging among vendors, aiming to boost competitiveness,” added Leathem. “Consumers can now find entry-level products that are not only more affordable but also packed with enhanced features. Advances in screen technology are increasing the reach of smart wearables to a wider audience. Meanwhile, premium vendors are concentrating on enriching features and delivering added value, leading to an uptick in average selling prices. For example, Google saw its average smartwatch selling price jump from US$216 to US$266, thanks to the integration of additional services and value. This strategy reflects a progressive vision that prioritizes value beyond just the hardware, mirroring the rapid progression of the wearables market.”

“In light of current economic challenges, wearables maintain significant long-term prospects,” said Cynthia Chen, Canalys Research Manager. “Though short-term economic factors push consumers to value-driven wearables, their enduring appeal lies in consistent quality and long-term data benefits. Canalys forecasts the wearables market is poised for sustained growth at a CAGR of 4.1% through to 2027, underpinned by shifting consumer needs.”

|

Worldwide wearable band shipments and annual growth |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Apple |

8.1 |

18% |

8.4 |

20% |

-3% |

|

Xiaomi |

4.8 |

11% |

4.8 |

11% |

0% |

|

Huawei |

4.3 |

10% |

3.8 |

9% |

+13% |

|

Noise |

3.5 |

8% |

1.8 |

4% |

+93% |

|

Fire-Boltt |

3.0 |

7% |

1.6 |

4% |

+86% |

|

Others |

20.6 |

47% |

21.3 |

51% |

-3% |

|

Total |

44.2 |

100.0% |

41.7 |

100.0% |

+6% |

|

|

|

|

|||

|

Note: percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Cynthia Chen: cynthia_chen@canalys.com

Jack Leathem: jack_leathem@canalys.com

Canalys’ Wearable Band Analysis service provides qualitative and quantitative insights into the wearable band market and addresses the areas where vendors can improve. Our best-in-class service guides vendors and partners to make the right decisions on value propositions, choose the right channel partners and enhance go-to-market strategies to engage in different markets worldwide. The data has detailed splits, tracking a list of 50+ features around connectivity, components, sensors, chipsets and many other different categories. Model-level information is available for 30+ key markets.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.