North American smartphone shipments to fall 12% in 2023 despite premium segment strength

Tuesday, 12 September 2023

Canalys is part of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

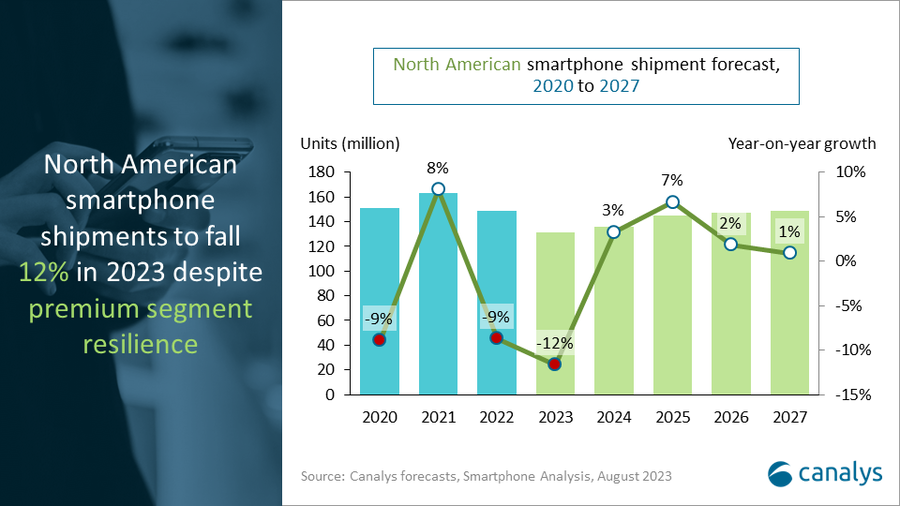

Canalys forecasts North America’s smartphone shipments will fall 12% in 2023, as the region recorded the worst quarterly performance for over a decade in Q2 2023. Macroeconomic challenges, including rising interest rates and persistent inflation, led to a drop in consumer demand. The second half of 2023 will see a marginal uptick in sales as vendors will launch new models in Q3. The premium segment (smartphones costing US$1,000 or more) will remain solid as both vendors and the channel are investing here, leveraging early trade-ins and financing options. Meanwhile, the low end (sub-US$200 models) will continue to struggle as prepaid demand dwindles. Smartphone shipments are expected to recover slightly in 2024, increasing by 3%, but are unlikely to break the 150-million-unit mark any time before 2027.

“The market is highly volatile, as poor economic conditions accelerate key trends in the smartphone industry, such as elongated refresh cycles and declining carrier subsidies, adding to the industry’s sustainability imperatives and the ongoing 5G drive,” said Lindsey Upton, Analyst. “Mobile carriers and smartphone vendors are responding and adapting to the adverse business environment with more targeted approaches to build sustainable business models. For example, major carriers are optimizing their premium plans to drive user and device upgrades as well as higher average revenue per account and customer loyalty. Verizon Wireless recently launched myPlan, which has already brought 70% of customers to the premium option. T-Mobile also introduced the Go5G Next and Plus plans, which allow for more phone upgrade flexibility with extended, no-interest payment plans to drive device upgrade and refresh cycles, particularly for premium devices.”

“Smartphone vendors are banking on the premium segment to navigate uncertainties,” said Upton. “The ASP of North American smartphones increased to US$738 in Q2 2023, up from US$663 in Q2 2022. Apple and Samsung boosted their premium segment shipments with 25% and 23% growth respectively in Q2 2023. This was driven by robust demand for premium devices with advanced features and differentiated form factors. We expect Apple’s iPhone 15 portfolio and Samsung’s Galaxy Fold5 and Flip5 will stimulate premium segment consumer upgrades for carriers. Brands such as Google Pixel and Motorola, which have been keeping up with the premiumization game with their flagship foldable devices this year, will further sweeten the holiday deals that hit the market in November and December.”

“Vendors must be strategic while planning for the mass-market segment, foreseeing a longer road to recovery,” said Upton. “Despite a shorter refresh cycle, the segment is not expected to recover quickly due to an extended period of inflation affecting consumer budgets. The double-digit declines for Samsung, TCL, HMD and OnePlus in the past six months indicate vendors are highly cautious, given inventory levels are still high. More importantly, major carriers have shifted the focus of their resources from prepaid to postpaid and premium segments.”

“In addition to a more targeted approach to bring the right features to the right price segments, vendors will need to use innovative approaches in their retailer, carrier and social media collaborations to convey brand and product messages in a slow year,” said Upton. “It is unlikely that the smartphone upgrade cycle will return to the 2021 or even pre-pandemic level as market players continue to rationalize spending on marketing and promotion, which has been key to driving upgrades. Sustainability regulations will kick in in North America, and industry leaders will emphasize the right to repair and refurbished devices, creating a new dynamic to the existing smartphone business model in the region.”

|

North American smartphone shipments and annual growth

|

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Apple |

14.8 |

54% |

18.5 |

52% |

-20% |

|

Samsung |

6.6 |

24% |

9.0 |

26% |

-27% |

|

Motorola |

2.3 |

8% |

3.1 |

9% |

-25% |

|

TCL |

1.3 |

5% |

1.8 |

5% |

-30% |

|

|

1.2 |

4% |

0.8 |

2% |

59% |

|

Others |

1.2 |

5% |

2.2 |

6% |

-43% |

|

Total |

27.4 |

100% |

35.4 |

100% |

-22% |

|

|

|

|

|||

|

Note: Percentages may not add up to 100% due to rounding. |

|

||||

For more information, please contact:

Lindsey Upton: lindsey_upton@canalys.com

Canalys’ worldwide Smartphone Analysis service provides a comprehensive country-level view of shipment estimates far in advance of our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processors, memory, cameras and many other specs. We combine comprehensive worldwide statistics for all categories with Canalys’ unique data on shipments via tier-one and tier-two channels. The service also offers a unique view of end-user types. At the same time, we deliver regular analysis to give insights into the data, including the assumptions behind our forecast outlooks.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.