Sequential growth forecast in Western European PC market for remainder of 2023

Thursday, 7 September 2023

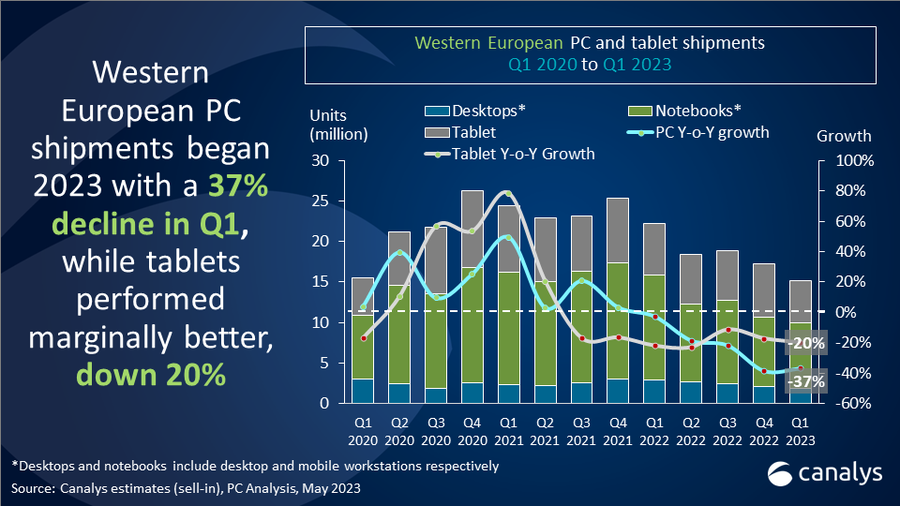

The latest Canalys research shows Western European PC shipments (desktops, notebooks and workstations) fell 17% year-on-year to 10.5 million units in Q2 2023. That was an improvement from the previous quarter when shipments fell 37%. The latest Canalys PC market forecast shows the market is on the road to recovery and expected to see sequential growth for the remainder of 2023 and stronger gains in 2024.

Notebook shipments declined 12% to 8.6 million units in Q2 2023, performing better than desktops which underwent a steep 33% decline to 1.9 million units. Meanwhile, Western Europe’s tablet market contracted significantly as shipments fell by 31% to 4.4 million units. Canalys forecasts full-year 2023 Western Europe PC shipments will fall 13%, and tablets by 14%.

.jpg)

“After a tough first half to 2023, Western Europe’s PC market is now showing signs of recovery,” said Canalys Research Analyst Kieren Jessop. “The market has reached an inflection point; high inventory levels have mostly been digested and the decline in demand has stabilized over the past 18 months. The remainder of 2023 is poised for minimal, but consistent, sequential growth.”

“While consumer confidence levels are showing signs of improvement, the consumer wallet is focused on other areas of discretionary spending. The commercial market is forecast to outperform the consumer segment in 2023, falling only 9% year-on-year compared to 21%. SMB and enterprise PC shipments are expected to have a stronger second half of the year, growing 16% compared to H2 2022. The biggest short-term opportunities will come from markets with a large entry- to mid-level segment and diverse omnichannel landscape. Markets such as Spain, Portugal and Greece should be a focus for vendors looking for pockets of growth. Markets with a larger high-end segment, such as Germany, France and Switzerland will see a partial recovery in early 2024. The trend will accelerate in the second half of next year as economic pressures ease.”

Fujitsu announced its exit from the European PC market, leaving the region with 2.5% market share in desktops. Fujitsu’s withdrawal leaves a vacuum for commercial PC demand, especially in its stronger markets including Germany and Austria, where it holds market share of 12% and 11% respectively among large enterprises.

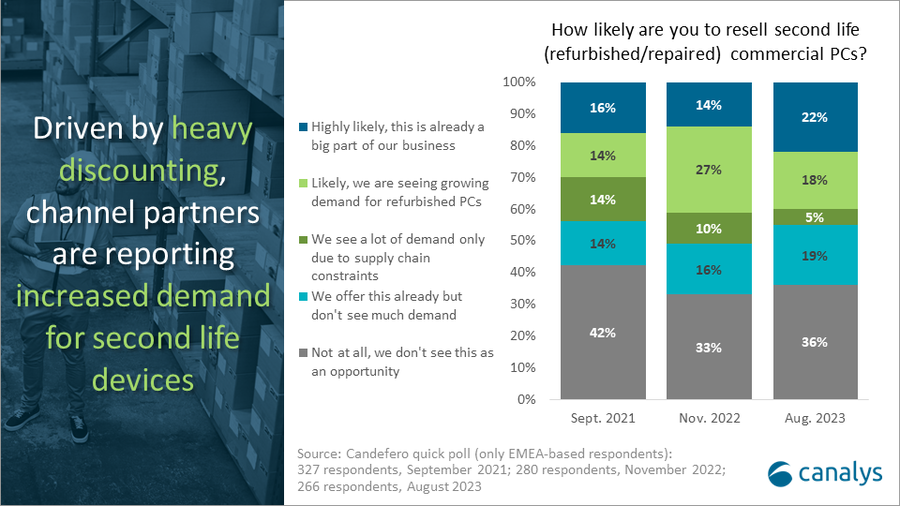

“The current aversion to large hardware outlays in the commercial sector is helping stimulate the refurbished device market,” added Jessop. “A Canalys poll of channel partners in August 2023 found more than two-thirds of EMEA-based respondents offer some refurbished device services. Of those, two-thirds reported growing demand for refurbished PCs, an increase of 10% since the survey was run in late 2021. Vendors should aim to lead in developing sustainability strategies to unlock new revenue opportunities rather than wait for regulations to force their hands. Selling original spare parts, offering own-brand self-refurbished devices, and incentivizing channel partners will help vendors embrace sustainability while remaining profitable in a green economy.”

|

Western Europe desktop, notebook, and workstation shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2023 |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Lenovo |

2,824 |

26.8% |

3,785 |

29.9% |

-25.4% |

|

HP |

2,773 |

26.3% |

3,031 |

23.9% |

-8.5% |

|

Dell |

1,609 |

15.3% |

1,878 |

14.8% |

-14.3% |

|

Apple |

933 |

8.8% |

997 |

7.9% |

-6.4% |

|

Acer |

794 |

7.5% |

1,000 |

7.9% |

-20.7% |

|

Others |

1,621 |

15.4% |

1,973 |

15.6% |

-17.8% |

|

Total |

10,553 |

100.0% |

12,664 |

100.00% |

-16.7% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding |

|

||||

|

Western Europe tablet shipments (market share and annual growth) Canalys PC Market Pulse: Q2 2023 |

|||||

|

Vendor |

Q2 2023 |

Q2 2023 |

Q2 2022 |

Q2 2022 |

Annual |

|

Apple |

1,615 |

36.4% |

2,562 |

40.0% |

-37.0% |

|

Samsung |

1,135 |

25.6% |

1,299 |

20.3% |

-12.7% |

|

Lenovo |

594 |

13.4% |

991 |

15.5% |

-40.1% |

|

Amazon |

345 |

7.8% |

605 |

9.4% |

-42.9% |

|

Microsoft |

138 |

3.1% |

160 |

2.5% |

-13.9% |

|

Others |

610 |

13.7% |

789 |

12.3% |

-22.7% |

|

Total |

4,437 |

100.0% |

6,406 |

100.0% |

-30.8% |

|

|

|

|

|||

|

Note: Unit shipments in thousands. Percentages may not add up to 100% due to rounding |

|

||||

For more information, please contact:

Kieren Jessop: kieren_jessop@canalys.com

Ishan Dutt: ishan_dutt@canalys.com

Canalys' PC Analysis service provides quarterly updated shipment data to help with accurate market sizing, competitive analysis and identifying growth opportunities. Canalys PC shipment data is granular, guided by a strict methodology and broken down by market, vendor and channel, as well as additional splits, such as GPU, CPU, storage and memory. In addition, Canalys also publishes quarterly forecasts to help better understand the future trajectory and changing landscape of the PC industry.

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

To receive media alerts directly, or for more information about our events, services or custom research and consulting capabilities, please contact us. Alternatively, you can email press@canalys.com.

Please click here to unsubscribe

Copyright © Canalys. All rights reserved.